Government debt under Labour was a major factor in the elections of 2010 and 2015. But to what extent did the Labour government really plunge the economy into debt during 1997-2007?

Usually, when people say ‘it’s debt that got us into this mess’. They tend to view all types of debt as the same – equating government debt to financial debt incurred from selling sub-prime mortgages in the US. However, this is deeply misleading. The consequence of bad debt defaults in the financial system is very different to government debt financed through selling bonds.

Government debt

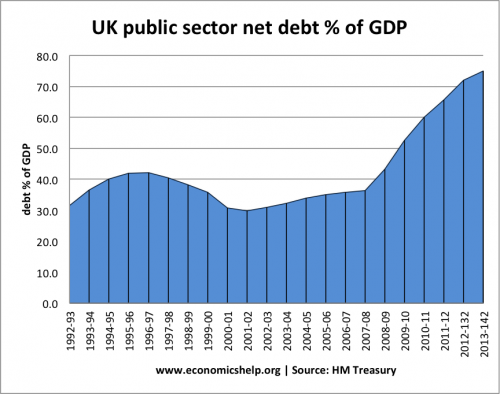

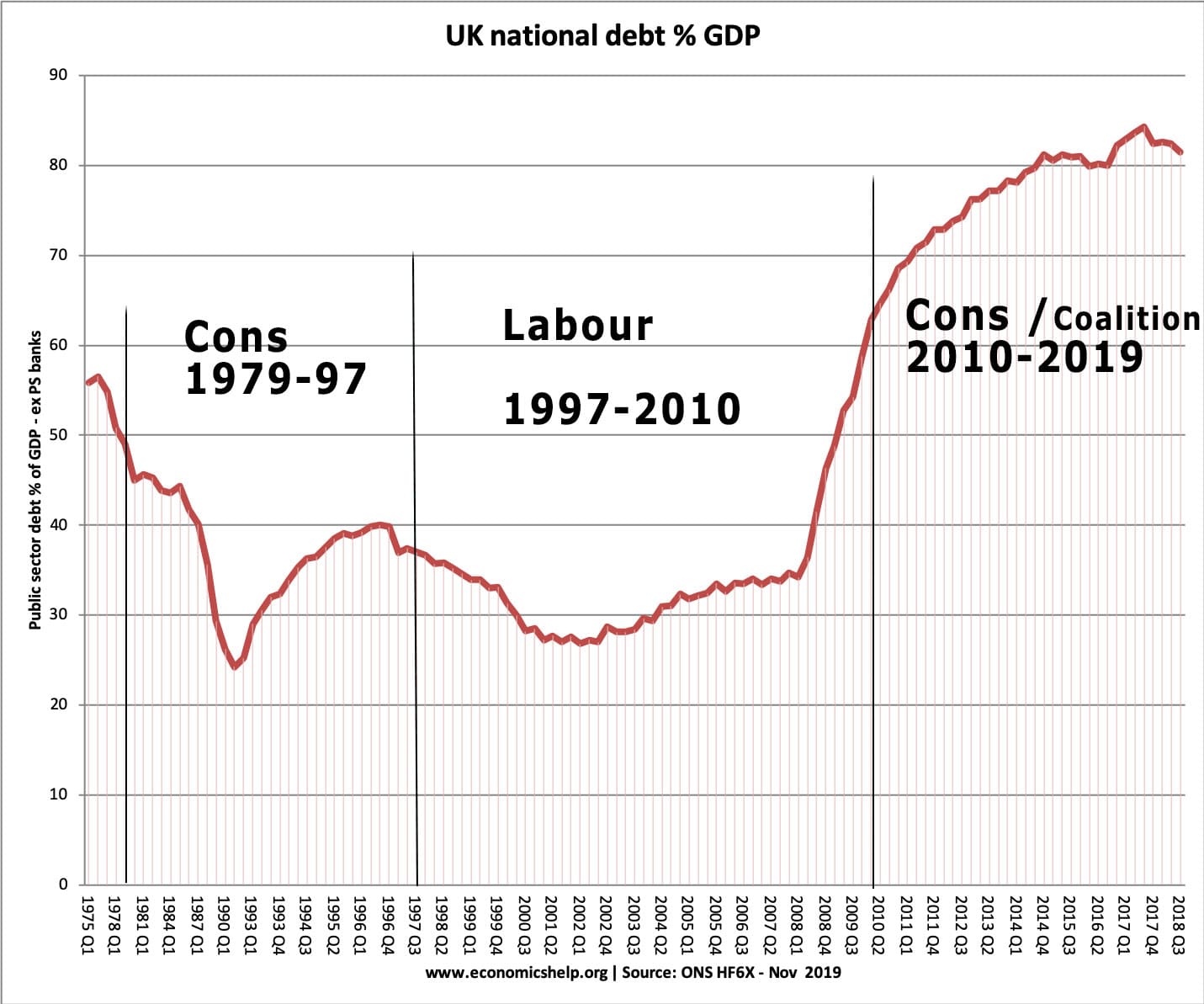

In 1997, public sector debt as % of GDP:

- 1997/98 – 40.4% of GDP

- 2007/08 – 36.4% of GDP

- 2010/11 – 60.0% of GDP.

- May 2019 – 82.9% of GDP

At the start of the great recession in 2007, public sector debt had fallen from 40.4% of GDP to 36.4% of GDP. This was despite increased real government spending. After the start of the crisis, public sector debt almost doubled in the space of three years.

If we look at just actual government debt, there is a significant increase.

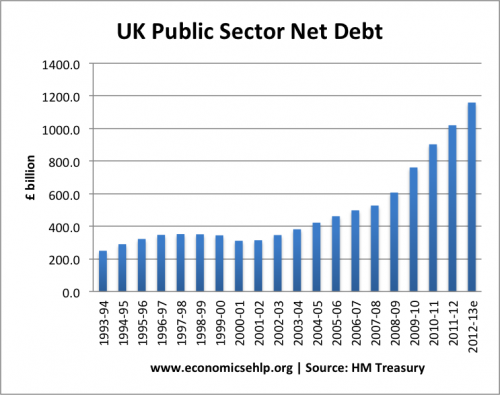

In 1997, the total public sector debt was:

- 1997/98 – £352 bn

- 2007/08 – £527 bn

- 2010/11 – £902 bn

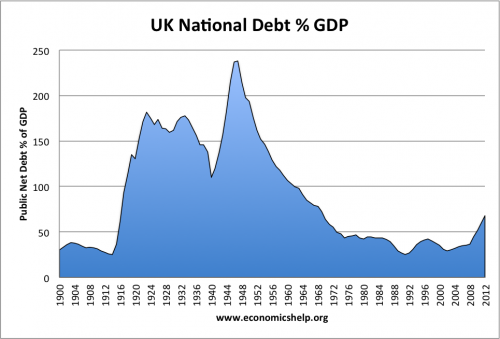

Debt to GDP statistics were helped by the period of strong economic growth – a reminder that economic growth is as important at debt levels. It is also worth bearing in mind UK public sector debt in comparison to the post-war period.

Even public sector debt of 60% of GDP is quite low compared to the historical average of public sector debt in the UK during the twentieth century. The very high period of debt in the 1950s was not a barrier to economic expansion.

Budget Deficit

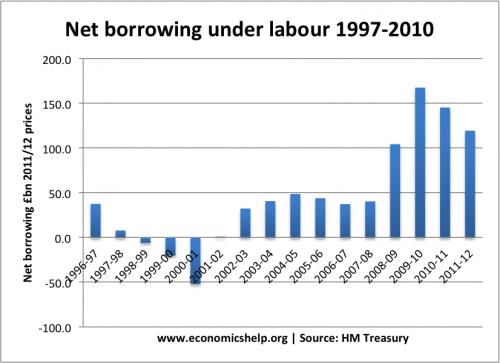

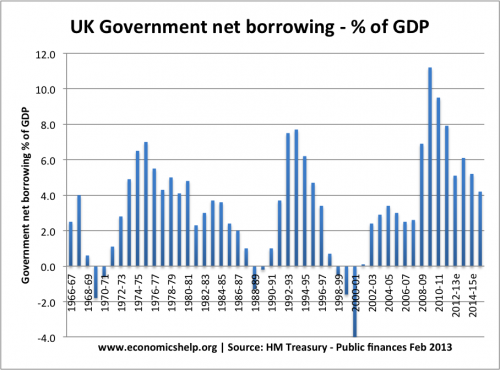

The level of Net government borrowing at 2011/12 prices

- 1997-98 – £ 7.8 bn

- 2007-08 – £ 40.3 bn

- 2010-11 – £ 145.1 bn

Government borrowing as a % of GDP.

Commentary

At the start of 2007, there were few economists expressing concern at government debt running at 36% of GDP. By post-war standards, UK government debt was very low and the government appeared to be meeting its own reasonable fiscal targets.

Given the period of strong economic growth, it is unsurprising that Labour wished to increase spending on health care and education. If the financial crisis hadn’t materialised, we may have looked back on the great moderation with kinder eyes.

However, a critic would point out that we did have a financial crisis and running a budget deficit during an unsustainable economic boom was irresponsible. In retrospect, Labour would have been better reducing the public sector debt further. This would have given the government even more room for manoeuvre during the crisis of 2008-12. Also, with growth strong, this was the best time to reduce the budget deficit. The mantra of Keynesians during the crisis has been – a recession is the wrong time to reduce a budget deficit. Given high growth in the 2000s, it would have been better to be stricter with public spending. Even countercyclical fiscal policy measures such as higher income tax, higher stamp duty may have reduced the housing and financial bubble and made the subsequent crash less dramatic.

This is a fair point. It was a mistake to be running budget deficits of 3% of GDP towards the end of the boom. However, the mistake is relatively minor. The boom was in finance and housing; inflation was running low (unlike say the 1980s boom) Most of the economic profession never saw the extent of the forthcoming recession. From a macro perspective, it didn’t look like a classic boom and bust (high growth and inflation)

Of course, it is easier to be wise after the event. If we were more aware of the dangers inherent in the financial system, we should have exercised much more caution. But, when looking at the causes of the great recession – government spending levels and budget deficits of the preceding years bear little if any cause.

It is also worth noting that when the recession hit, the government did initially pursue expansionary fiscal policy – there was no panic in the bond market. Bond yields have fallen throughout the crisis. Although debt increased rapidly, there was no danger of a fiscal cliff, like say Greece.

The switch towards austerity post-2010 was largely a self-created panic. Part of the motive for austerity was the desire to paint a grim picture of public finances. The problem is that economic pessimism can become self-fulfilling. A more balanced view of the overall state of public finances in 2010 would have led to less rash policy.

Debt under Conservative government 2010-19

More detail at Debt under Conservative government 2010-19

Related

Rubbish. Labour halved our manufacture and invested in bankers. These were lean years for many a small business and Brown ran a deficit from the second election on. This meant pro-cyclical rather than counter cyclical budget deficits. Inflation was hidden by a move to CPI rather than RPI, and a yawning trade gap with cheap foreign imports. There was no real net growth after 2005 because it was all built on increased public and private borrowing. Brown borrowed into the future too, expecting receipts to continue rising. This is partly why public spending has increased so much since – we still have an overbloated public sector with record pay levels, growing debt and deficit, and NO economic growth. Brown created the illusion of prosperity but by ditching manufacture, he ensured we will not recover for a long long time. Had we gone the Balls route, our debts and deficits would be even greater.

You just cannot accept labour are better managing the economy than tories , history prove it the tories always run higher debt !

Levels of debt, on their own, are not a very good way to evaluate economic performance. Public sector debt (including debt to GDP) under the Conservatives government 2010-16 is significantly higher than the previous Labour government, but on its own this means very little.

Well said, the Tory PR machine did a really good job in persuading the public that Labour were bad at economics. The evidence shows otherwise.

How on earth is having the biggest ever national borrowing debt better at running the economy?

Are you just blind to the figures?

Because that borrowing is the result of what has gone before you.

The only thing you have control over as a government is the direction of the deficit. The Tories have always managed the deficit more sensibly than Labour.

There is nothing wrong with a deficit, nor its size – what matters are these points in the context of the economic cycle. The Tories are always fixing a problem, whereas Labour are always creating it by overspending during expansions as well as recessions.

There’s evidence here that you’re wrong. Since WW2, either in original prices, or adjusted to 2014 price, Labour paid back more national debt more often than the Tories did, despite being in power for 28 vs 42 years:

http://www.taxresearch.org.uk/Blog/2016/03/13/the-conservatives-have-been-the-biggest-borrowers-over-the-last-70-years/

We are discussing debt not deficit. Cameron was ticked off for this deliberate obfuscation by the UK Statistics Authority.

that’s just not true, the deficit has tripled under the Tories.

Is that why Labour was last government with a surplus

It is nowhere near the biggest debt ever its quite low compared to just after world war two.The economy has been handled with incompetence since the coalition in 2010 shrinking the state has made the debt worse economies do not work like a household budget that is a myth. Economy’s should be run like a business you speculate to accumulate to grow the economy create jobs and create more income into the treasury to erase the deficit and pay back the debt.

This comment is a cynical over simplification. Government spending in certain verticals protects the health of the capitalist economy, in other areas it undermines it, so the detail is important. Simply expanding government spending does not automatically lead to a healthy, vibrant capitalist economy.

A historical comparison with our economy recovering after a world war is rather ostrich like. A better comparison is with the rest of the world. We have the biggest national debt in the world other than the USA. In the mid 80’s we were not in the top 10. Tories like to blame labour overspending. Labour like to blame the financial crash. The blame lies part way between, but I felt at the time we were dealing with the financial crisis badly. The government purse was left with far too much of the bill. I don’t believe Tory policy would have been significantly better. They always protect the financial sector more than other areas of the economy, it’s the part of the economy they tend to be personally tied to. If you look at household income v decile group over time, the brunt of the financial burden from the crash has hit lower earners more than higher earners. The data is on both the ONS and the equality trusts websites.

History also shows how labour closed twice as many coal mines than Mrs Thatcher

From 1945 to 2015

The conservatives closed more collieries than labour.

585 + to 370 +.

McMillan closed more collieries than any other prime minister in one term.

45 years in government.

41 PSNB budget deficits. creating £1.1 trillion debt.

Collieries that were not making any money and could not stand on their own without government support. Essentially a (no pun intended) black hole of taxpayers money.

Thatcher was trying to “break” all manner of unions at the time, the collieries were profitable but were forced to close because to function properly they needed a 3year contract to produce coal. Thatcher offered 1 year contracts knowing the mines could not budget and invest in new machinery under this new deal . The miners were striking because their wages for such a dangerous, filthy, life shortening job had fallen behind. Pits were closed and coal for our aging power stations was imported from Poland and South Africa. ding, dong, the witch is …………

This is the socialist myth. Many coal mines were not profitable because they could no longer compete with other countries either on cost or efficiency. This was exactly the same reason we lost our steel industry. It’s easy to criticise when you don’t have to deliver anything, and Labour rarely do because they rarely win elections.

History shows that the Conservatives closed more cosl mines than Labour since 1945

Yet , fewer than the Tories, overall, since the Attlee govt. came to power.

We can all be selective with our stats.

Reality says otherwise.

New labour Have spent 13 years running up

gigantic debts in the NHS , amounting to hundreds of Billions of pounds of outstanding PFI debts ,as well as the debts inside HM Treasury.

PFI was an expensive scam but it achieve what was intended just at HS2 prices 😉

Labour did not halve manufacture.

Perhaps, but the Labour leader Blair lied, took the country to war and caused so many British service people to die

More manufacturing jobs were lost under the last Labour government than the Tory one which preceded it.

Its seems given everything I’ve read here from both ‘Google Economics’ and every one else who has their own opinion ….I’m still really none the wiser. Its seems that depending on ‘who you vote for’…..Idea’s and facts change considerable…..But then that’s politics for you….’its not the truth that’s important, it’s who and what you believe!…sadly!

I couldn’t agree with you more. I came here looking for answers and I too am none the wiser!

in my opinion labor governments always squandered income, We finished paying off our war debts to America & Canada in 2006. What did Ed Balls do with the £53 million yearly saving this generated throughout the labor Governments time in office. On leaving he was the one that left the note to the incoming government ” Sorry nothing left to spend”

That was MP Liam Byrne, and it was considered a running joke for any outgoing government. Until the Tories decided to use the quote as being something it wasn’t to manipulate the population into accepting austerity. Think before you post untruths

Reading this stream of comments you can see a clear sign that Tory supporting commentators write utterly outrageous trash and lies in exactly the same way their Tory MP’s and Ministers do. It is a myth that the Tories run the economy well and Labour screws up. It is the exact opposite of the truth – stated with all the Aplomb of Alan Bustard – Rick Mayall would be rolling in his grave. From Frank Salmon’s assertion that Labour ditched Manufacturing; sorry Frank Maggie and Geoffrey Howe destroyed British Manufacturing in the eighties with glee and ushered in the Service economy we have now anyone alive and of an age to notice could tell you that you poxy liar/idiot take your choice

Any possible credibility your statements had are lost in that futile tirade of insults. The minute you resort to personal attack and deformation you show yourself as unable to close an intelligent argument. The facts are that as said by a previous comment politics is not about the truth and numbers can be reported in ways to make something bad look ok and something good look poor, people see what they want and having an open mind is key to read between the lines and see the overall picture then the question is answered. There is also discrepancy in who reports what that needs to be taken into account but now I’m probably confusing you.

It was Liam Byrne and “I’m afraid there is no money.” May 2010.

Were you not around in the eighties? The Thatcher policy was to break the unions by reducing the industries where they were prevalent and move us to a non manufacturing, financial services economy. As an engineer I saw big reductions in manufacturing. Major’s term continued this. Skilled apprenticeships became consigned to the swarfe bin. Stock and commodity traders were in the ascendancy, which was good news for builders (remember “Loads o Money”). Labours first term from 1997 started to redress things but was too slow. I find it funny that the Tories have been claiming apprenticeships as an innovation. The eighties legacy was found out in the crash. No plan B or underlying manufacturing. Small start ups are not the same as British Steel, BMC, ship building, aircraft manufacturing, train & locomotive. I’m stopping now, it depresses me. Basically you’re so wrong.

Were you not around in the 70s, when the unions just about destroyed the manufacturing industry? Some industries just needed updating:

Jack Dash – took the dockers on strike, replaced by containers.

Newspapers – Print chapels replaced by desk top publishing

British car industry, destroyed by the likes of Red Robbo, Longbridge, Hailwood , Dagenham , Vauxhall, all gone as we know it, and replaced by overseas manufacturers.

Steel industry overpriced and lost out to cheaper suppliers.

Coal industry destroyed by Gormley and Scargill

Most of this was even before Thatcher came to power.

Do you enjoy a weekend away from work every week? I ask because the Church got you Sunday off and Unions got you Saturday off, Oh and you know how safe your workplace is now? Well that’s the unions too.

I’ve been reading all this and i just can’t believe all the finger pointing. British industry went south because it was and is cheaper elsewhere. Ships are cheaper to have built elsewhere. Coal mines were phased out because people were using oil heating then gas.

It stands to reason if you want a commodity and you can get it vastly cheaper elswhere you will.

Labour spends and sod the consequences and conservatives cut back and sod the consequences they’re all as bad as each other. Just vote for whoever you stand by and merry christmas 😁🇬🇧🇬🇧🇬🇧

The ditching of manufacturing and moving towards financial markets was a trend in the UK from Thatcher onwards, I agree that it was a mistake but it’s not a Brown/Labour mistake (if that’s what you’re getting at), it’s a Neoliberalism mistake. Blair and Brown were Thatcherites, and caught up in the “end of history” bubble just as the Conservative Party had been, and still are to some degree.

Good comment, neglecting manufacturing wasn’t a mistake isolated to a single party, but the general trend in UK politics to which both Labour and Conservatives are guilty.

Services rather than manufacturing was already a huge part of the economy, long before Gordon.

Rubbish Brown managed debt after Tory excess in the Thatcher years. They reduced borrowing whilst still investing in Roads, Education, NHS and social engineering. Brown made some mistakes but he was one of the best post war Chancellors this country had.

Why did brown sell our gold for billions less then it was worth

Yes that was a mistake (not selling it for less but making it public knowledge that he would sell), but overall he did well.. You can’t go c.10 years as chancellor and make zero mistakes..

Brown also hit the pension funds, apart from the stupid Brown bottom in gold. He also spent more than the growth in the economy for every year that labour were in power, which was completely irresponsible in view of the bubble that he created, which became the longest period of growth ever experienced in the UK and was boasted about at the Labour party conference. Brown said he had eliminated ‘boom and bust’ but merely created the biggest bust in UK history. And also PFI. Kush, wake up.

Since 1979 the Tories have sold off 10 percent of publicly owned land worth about £420 billion.

They have also sold our water, power, transport companies and various others including Royal Mail and Eurostar This has allowed nearly all of our utilities and transport to be in the hands of foreign owners. The lose of 5bn on our gold reserves was a drop in the ocean compared to this.

That old trope. Even the good old FT didn’t fall for that. Brown deliberately announced the sales, depressed the price and ‘allowed’ a large US bank to make good its massive short position. He had many faults but he wasn’t stupid.

God Mr Salmon have you ever thought about looking at economics through figures rather than party lines. You then might be able to see things more clearly and what you are blaming the pink Tory govt of Blair was down to the terrible economic policies of Jospherds and Bell and Neve etc, Figurehead Thatcher selling off everything we had to keep borrowing and taxation down, absolutely wasting our North Sea Oil especially when you see what Norway has achieved with theirs. The British public are now paying the very very high costs of these shorth sighted policies all in the name of right-wing dogma so they could basically do as they wanted in the British wages market. Which in the 2020s is exactly what they are doing and while destroying our great country,leaving it with no manufacturing base,.Instead of artisans and tradesmen we have spiv-bankers and city spivs producing nothing but money and since these fools took us out of the EU it been showed that any country can do that!.And that great act of foolishness so they can continue to put vest wealth away in off-shore accounts.While the die.Now that is Tory economics.

Perfect and logical reason not to vote Labour.

We can crunch all the figures forever – Nobody knew the boom was going to bust in 2008 – Western governments were massively complacent as were the financial services – Thatcher and Reagan had created the Banking and financial reckless greedy corrupt monsters robbing us of our savings, defrauding us with PPI and numerous other packages and practices and now the west is bankrupt through their rampant reckless capitalism and now millions are suffering as a consequence of the national debts incurred and the economic cuts necessary to service those huge debts. We are now slaves to the bond markets that service those debts – Our democracy is in the hands of corporations and other countries who purchase these bonds – They are essentially dictating our economic policies – Ask Liz Truss

So after 53 years of mostly rampant Tory capitalism we are trillions in national debt and personal debt and up shit creek economically and environmentally- Then there’s house prices/mortgages and personal debt to consider

We are all slaves to them bond markets and national debt now – 14.5 billion in poverty in uk, 3.5 million in destitution and a Vile Tory government destroying our society to protect their wealthy friends and to be a great power in the world – They have extended pension age never talk about work life balance – Just working everyone into the ground to keep economic growth going for them bond markets and keep share holders happy

I love the land in this country and the ordinary people but the aristocracy including Royalty and most of the Tory party have shown themselves to be a utter disgrace and most of the country feel the same

Labour didn’t halve manufacturing. Manufacturing continued to grow in this period

Some reading for Tom

http://www.ft.com/cms/s/0/f32a3392-df7a-11de-98ca-00144feab49a.html#axzz2t2kvD3bo

In 13 years from 1997/8 to 2009/10, the Labour Government increased debt by about £420 billion. In the 5 years from 2010/11 to 2014/2015, the Coalition Government will increase debt by about £600 billion. These are the facts.

Yes, though I’m always nervous about extracting facts like this.

https://www.economicshelp.org/blog/11874/economics/the-limitation-of-economic-data/

Remember for the first 4-5 years of new government you are committed to previous government spending, the first 4 years of labours government benefitted from Tory plans, similarly Labours spending commitments don’t stop as soon as they left government in 2010.

What about after 6-10 years then? Hammond has said we will be 1950 billion in debt in 2 years time = 90% of GDP.

So Labour were crucified for debt rising from 352billion to 902 billion, under this lot it will rise by more than a trillion.

Tories have bullshitted all of us into believing they know best.

Tories had no choice but to increase national debt to kick start the stagnating economy. They were fiscally prudent general, spending as little as possible, hence austerity. What would you have preferred? Even deeper cuts to publics services to cut the defecit and pay off national debt? The left already claim the cuts were too deep and austerity too harsh. The left can’t have it both ways, claiming cuts were too deep and at the same time complaining about the national debt being too high.

Come on seriously. For the first four or five years of a new government you are committed to the previous governments spending. That’s the full term of the elected government. The new government will detail in its manifesto a costed budget. The new government doesn’t need to adhere to any financial plans that the previous government implemented. There would be little point in winning an election if your full term was dictated by the previous governments financial plan

Exactly! The Tories cut public spending as much as they could (maybe more than a lot of people would have liked), hence austerity. I find it difficult to imagine them cutting public spending any more than they did.

But Labour had a Global Credit Crash which Tories did not have. Tories created the biggest list of millionaires and billionaires in the world while they introduced austerity bringing people to starvation and suicide. Now they are determined to break the NHS to introduce private insurance like USA. No concern to them because they have it already and write it off on expenses which we pay.

The Obesity Time Bomb will break the NHS. There is nothing wrong with an Insurance based Health Service, most developed countries operate this way. Canada, Australia, France, Germany, Ireland we should do the same. Our system is used and abused by too many.

Are you joking. The NHS is one of the greatest institutions ever created in the whole world, it is the very corner stone of this country. No matter what you will, or should, be looked after if you are unfortunate enough to fall ill. Are you honestly in favour of an insurance based health system. The poor and lower social classes in America die. There children die because their parents can’t afford medicine. Why do you think Trump is repealing Obama care. Let me enlighten you. Free health care costs money, money that would no longer go to insurance company’s. The health and welfare of the American people comes second to money. This shower of cruel elitist bastards that we have governing us would happily privatise our health system. The poor would suffer. The rich keep getting richer and the poor suffer.

Insurance based health care is basically saying the poor must pay more or die while the rich pay less in the long term poverty rises, productivity falls, unemployment rises mortality rates rise and crime rises oh and the nhs costs half what US health care costs and god forbid you lose your job or have to change insurance company that’s when you hear an insurance companies favourite words, “pre existing condition” then they send you home to die. source http://www.commonwealthfund.org

Nick shows his true colours

100% in agreement having lived in Germany for almost 20 years with First Class medical facilities. The public wouldn’t notice any change to the way it is paid for. Instead of NI Insurance contributions deducted from pay they would deduct Health ‘Insurance’ payments. No Health Insurance no, apart from emergencies, ‘no go”. No one flies into Germany for Health treatment without expecting to pay for it.

Agreed, I already pay private healthcare and a private healthcare system, more like Australia than Canada should be a good thing.

But if we keep the nhs, let’s stop the free dinner for those that never pay into the system

Not to mention the 30,000 pensioners they let die each year through cold related illnesses. They are literally killing pensioners. A further 30,000 dying needlessly each because the NHS is stretched to breaking point. 20,000 less police and more than double that of our armed services. They have somehow managed to double the national debt while implementing all their cruel cuts. People don’t want to train to be nurses because they have taken away bursaries. There are over 10,000 less fire fighters. The government’s number 1 job is to keep us safe, 3 terrorist attacks in as many months and many many lives lost. They aren’t protecting us, now more than ever we need more police and emergency services. This country is at breaking point. We are standing on the edge of a cliff and I can’t see a safety net at the bottom

governments number 1 job should be making the lives of people better. As for business and economics they should be the means to an end sadly people have not been the priority for this government just a number a human resource nothing more.

Also New labour have given the City of london £425 Billion of Spending power called quantatative easing , which

has made financiers enormous fortunes .

Quantatative easing does not equate to spending power for City of London.. what does comment even mean?

Some of you guys saying labour ran up massive debts,labour last government borrowed approx £700 billion including £500 for bank bailout,conservatives have borrowed approx £9 billion in just 6 years,and cons don’t pay debt back as much as labour has if you compare how much was paid on time in power,Labour’s %s are higher

Informative figures here, I feel: http://www.taxresearch.org.uk/Blog/2016/03/13/the-conservatives-have-been-the-biggest-borrowers-over-the-last-70-years/

The bank bailouts weren’t on the government books. Dolt.

Debt can’t come down until the deficit is brought under control. Labour massively increased the deficit and thus debt for years to come.

The trouble is many of the blinkered Labour supporters don’t understand that if you are commited to spending more than you earn, you build up the debt. Under Labour we were spending £152 billion more than we were bringing in. Because the coilition and later the Conservatives had these huge commitments of spending, they had to get them under control. They had to reduce public spending, unpopular though it has been the austerity programmes have reduced the difference to £53 billion, even allowing for the interest paid on increased borrowing, a reduction of nearly £100 billion. Even so we are still spending £53 billion more than we earn. At the same time unemployment has fallen drastically, and there is record employment even with the huge imigration that we have endured.

The tories have 1.7 trillons pounds in debt can some explain how that is possible plus dont forget all the cuts cuts !!!!!.

Yes, £1 trillion of that debt was left to us by Labour in 2010. Net borrowing has decreased year on year since, mainly due to careful housekeeping and as you say “the cuts cuts”.

Labour left a national debt of £811 billion after 13 years and bailing out the banks. In 7 years although greatly benefiting from the repayments for that bank bailout, a strategy swiftly followed by the rest of the world the Tories have added well over £900 billion to the national debt. Labour’s debt included what was inherited in 97.

As people have said above, Tories were already committed to spending commitments left to them by Labour (a slightly bloated government), and they were also left with an economy that had shrunk during the global economic crises.

The Tories cut as much as they could. What would you have preferred, even deeper cuts and greater austerity? Because short of raising taxes through the roof (and they did increase top rate of income tax for a few years), that would have been the only way to reduce the reduce the deficit faster.

I really don’t think this the large national debt is Labour’s fault either, no one saw the economic crises coming so why wouldn’t they have made spending commitments and spent generously on public services? It’s unfortunate there was such an economic crises in 2007-2008.. the UK only played a small part in the making of that crises (but the City of London did contribute) but after that happened, a combination of austerity and increased decifit had to happen, because the alternatives would either have been:

a) more austerity to reduce deficit

b) less austerity and even greater defecit and national debt

This ignores the economics of whether austerity is self-defeating in recession. The alternative would have been to pursue expansionary fiscal policy. Also, rather than cutting spending a government could have increased taxes to more European levels.

youur post is obviously satirical

–

in 2014 the OBR reported

the tory unnecessary ” austerity ” policies

an act of gross fiscal incompetence

had stalled the recovery and strangled the economy

cost the uk ££ billions

caused unemployment failed businesses’ and

according to a Glasgow university report had by 2019 been the cause of the deaths of an estimated 330,000 uk citizens

well they said they’d lower the benefit bill.

One Death At A Time

————————————————-

in an act of desperation to stay in power Cameron offered the uk brexit

the total lack of forward planning tells you he didn’t expect the uk to vote

it was disastrous cost the uk £ billions

–

Boris then wasted or spaffed an estimated £100 billion thnx boris

through lamongst other things Lack of thought and due diligence on ppe covi furlough fraud

plus £ billion on his failed trackntrace which he continued to laud even when it failed

Tories have always been carless when it comes to UK money

–

they then gave us the abomination that was truss

4 weeks of utter shambles

costing ££££ billions

–

all their to see if you cared to look

–

–

when the tories took over in 2010

you didnt have to wait weeks to see a gp

didnt wait 2 years or more to have an operation

24 hours for an ambulance or a hospital bed

police actually responded to crime

people on average wages werent having to use foodbanks

Public services though not without problems were able to cope

–

unlike the semi privatised public services doomed for failure from the start at tremendous cost to the tapayer

you werent waiting 6 months to get your pension once claimed

8 months for a pension credit claim as is happening now

6 months for a passport as has been happening

2 years for an asylum application verdict

2 years to see a mental health proffesional

etc etc etc etc

–

They Have However Given Us

increased child poverty

increased homlesness

increased mental health problems

and people seem to think were better off now getting less for more

utterly delusional at best

–

————————————————————————————–

2010-2012

even the OBR office of budget responsibility praised Labours recovery

whilst blaming the tories for stalling the recovery and stagnating the economy

LABOUR came to power with the uk much as it is now

underfunded infrastructure

with Hospitals Schools and Housing ruined by tory underfunding much the same now

with the tories currently refusing to publish a report which outlines schools and hospitals

so bad theyre judged ” a danger to life

–

labour had to implement a school and hospital building and repair programme

built a 100 new hospitals

Cost ££ billions to repair the damage done by the tories

And they didnt have the magic money trees the conservatives seem to have

———————–

ask Steven

Amber Rudd stated that in stevens case the DWP followed policy

——————–

IAN DUNCAN SMITH AND THE LAGHABLY NAMED ” CENTRE FOR SOCIAL JUSTICE ”

A think tank set up by one ian duncan smith set the policy

–

2023 you notice in todays budget hunt thanked ids and the think tank for setting the new policies for getting the log term sick and disabled back to work

–

pre 2010 if you couldn’t kneel or bend you could get as many as 9 points towards your benefits total which is 15 +

–

The tories removed this the stated reason

“kneeling or bending have no place in todays modern workplace

and they radically altered the majority of descriptors in order to deny benefits to the most vulnerable

expect more deaths

https://www.liverpoolecho.co.uk/news/liverpool-news/money-stephen-smith-wrongly-denied-16164339

——

Debt accumulates exponentially and you only start to pay off debt when you stop running at a deficit and start running at a surplus, labour invested heavily and increased the deficit when we went into a recession (ridiculous thing to do) and left a huge amount of debt which has been accumulating, tories have reduced the deficit massively (hence the public spending cuts) and are close to running at a surplus, at which point they can start to reduce the national debt. Labour policies only look short term and want to turn increase it again and throw our country further into debt, screwing us over for the future.

Is spending more in a recession a stupid thing to do? You could argue that cutting public spending in a recession is more irresponsible. A declining economy is what drives up the deficit and national debt, cutting public spending during a recession only exacerbates the decline.

True but look at the NHS. New Labour overspent on this, increasing staffing levels, awful PFI deals, wasted billions on NHS IT system, but despite the amount they put into the NHS & input increasing dramatically in terms of staffing, output in terms of productivity did not increase in terms of – reducing medication errors, reducing LoS, fewer pressure sores, reducing mortality & morbidity rates etc. Public services has to be efficient otherwise it is like a sponge absorbing more & more money but no change in efficiency. That is what the Tories inherited, so until it really transforms itself in terms of safe, high quality of patient care then it will remain a sponge. You simply just cannot throw money at public services without a radical transformation plan. Public services that are inefficient as will continue to increase the deficit & in turn the national debt, because until you get a surplus in the deficit you cannot possibly begin to pay off the national debt. So yes the debt has increased under Tories, but the legacy debt inherited, & a huge deficit has to be reined in somehow. Reducing deficit has to be tackled first surely to have any hope of paying off Debt!

Who is this Jamie Dow trying to con . The lower social classes in America are not left to die as hospitals are mandated by law to treat everyone . They then attempt , not always successfully , to get paid . Those with insurance are paid for by their policy . The others either don’t pay anything , or the Government covers it . I know because I just spent five years there and saw the system in operation first hand , not through the prism of the BBC or the ” enlightening” Mr. or Mrs. Dow . Obama called people with no policy ” freeloaders ” and it was his major reason for making the ownership of a policy mandatory , penalized by a tax as a percentage of income if no policy was in operation . The only people who are now freeloading are illegal immigrants who tend to work for cash in the black economy . Finally , I found U S health care superb in comparison to the NHS but I did have to pay the Obamafine until I got a policy in my final year there .

It was only in the national news a couple of weeks ago that this government has borrowed more money than every single Labour government of the past,i honestly dont know how these working class people here can ever think they can be a Tory,you will never have the money to be a “Real Tory”

David Cameron when he became PM was advised nicely by the Japanese government,NOT to use austerity they did 11 years before this government and they said they are still paying the price for that mistake.

Compare how John Major brought down the Deficit with Cameron/ May. He did better WITHOUT Austerity and without massively increasing the National Debt.

The reduction of –

UK manufacturing, production, construction, agriculture, mining, fishing capacity, as a % of GDP began in 1970, then increased dramatically from 1979.

A result of the conservative party privatisation agendas;

selling off UK traditional and nationalised industries to

foreign countries, investors, shareholders, corporations subsidising, transferring corporate toxic costs / debts to government debts through corporate welfare.

Increasing UK public debt, hidden debt, PSNB deficit 1979 to 1997.

Failing to provide alternative investment for development for alternative technologies.

Increasing unemployment to 11.9% – 1980’s; 10.6% – 1990’s.

I think we should mention the following: Long-Term Capital Management collapse in 1997; the 1997 Asian financial crisis; the Dot.com of 2000 crash; the cost of the Iraq and Afgan wars.

The 2007 global financial crisis had 2 main causes. The Sup-prime mortgage lending in the US and also the EU zone banks over lending to PIGS countries due to them making much less margin on their Euro zone bond lending (I was in regulatory reporting in an investment bank at this time).

Much of our recent problems have resulted from our GDP not rising. At the start of the 2010’s this was caused by the UK applying the brakes on the economy, initially with higher VAT etc… Everyone involved in Brexit accepted the fact that there would be a hit on growth initially but hinted at higher growth in the future… possibly in 50years.