Some interesting data about large multinationals and the amount of tax they have paid in the UK, compared to their turnover.

If we look at tax as a % of 2011 turnover, we see many paying a small percent.

Source: Guardian data via Duedil

In the past decade there has been a divergence between house prices in different parts of the UK. In particular, house prices in London and surrounding areas has rocketed to unprecedented levels. Source: ONS According to the ONS, average mix-adjusted house prices in September 2015 stood at £299,000 in England, £175,000 in Wales, £199,000 in …

Readers Question: What are the main reasons for the decline of the pound, and what are the costs and benefits of a low pound? The decline of the Pound could be due to Cuts in interest rates Declining economy – causing expectation of lower interest rates ‘Technical positions’ dealers selling Pounds to get rid of …

Some interesting data about large multinationals and the amount of tax they have paid in the UK, compared to their turnover.

If we look at tax as a % of 2011 turnover, we see many paying a small percent.

Source: Guardian data via Duedil

Readers Question: Sorry I’m really confused on how the weak oil prices affects EUR/USD currency. I’ve tried searching for articles but there are really different arguments. For EURO – Weak oil prices worsens Eurozone inflation therefore European bank ,to prevent deflation and boost economy will continue with their negative interest rates and Quantitative easing which …

Readers Question: What are the similarities and differences between the Bank of England and the ECB? Thank you

A carry trade occurs when an investor borrows in one country (at a low interest rate) and invests this money in another country (which has higher interest rates.) If we assume exchange rates are stable, then this carry trade enables an investor to make a profit – and the profit could be even more if …

Currency wars are said to occur when countries seek to devalue their currency to gain a competitive advantage. However, if one country seeks to become more competitive through devaluation, it means other countries become less competitive. Therefore, they may respond by weakening their currency too. Thus, we may get a situation of competitive devaluation where …

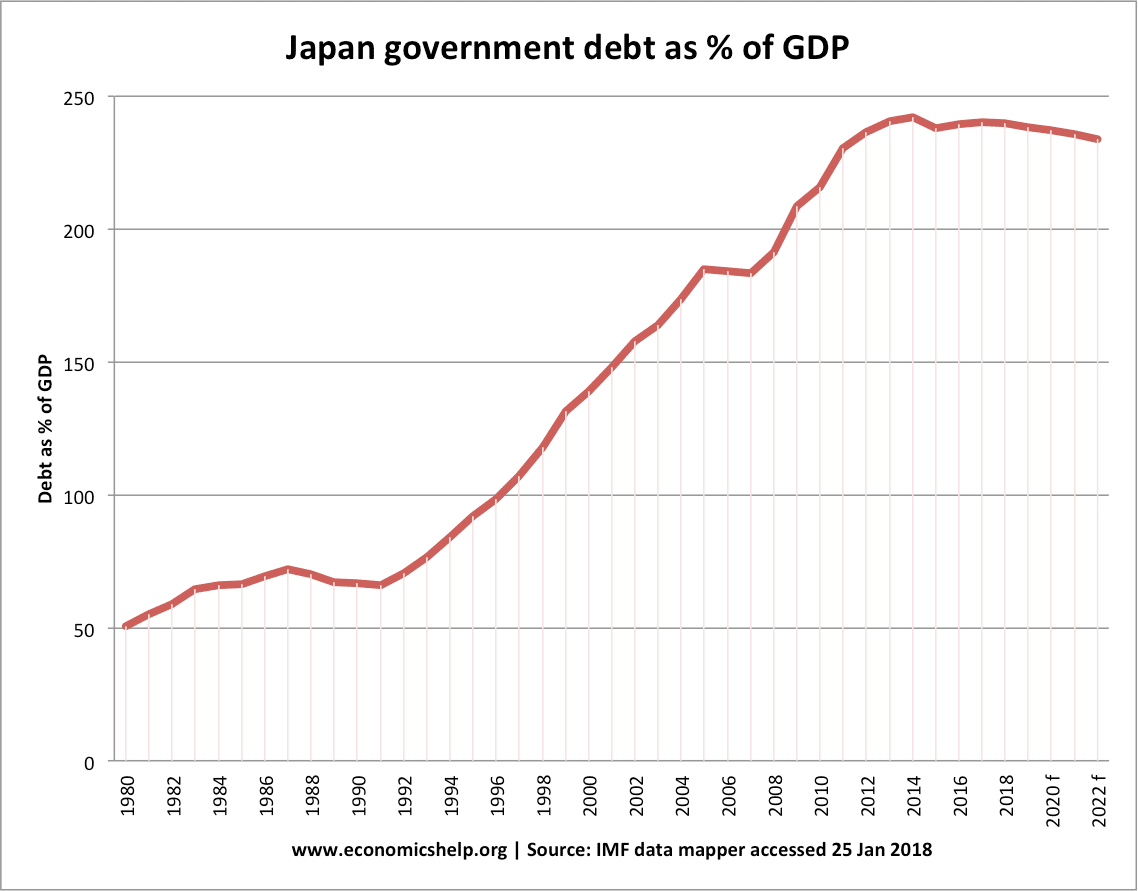

Readers Question: After the insightful post on ‘Italian Economic Decline’, I was particularly captured by the % debt to GDP line graph of the different developed countries. The one thing that really caught my eye was Japan’s huge % debt to GDP and yet their government bond yields are consistently declining. Aren’t the markets worried that Japan may default on their debt someday or is the fact that they have a lender of last resort (no fear of liquidity problems) unlike Italy and their 0% interest rates shielding them from augmenting yields?

It is true that Japanese public sector debt is over 239% of GDP, yet bond yields in Japan remain low. It seems the markets have no current concerns over Japanese repayment. Spain might feel aggrieved that they face rapidly rising bond yields – even though their public sector debt (70% of GDP in 2011) is considerably lower.