Readers Question: What does the Government spend its money on?

The government spends money for a variety of reasons:

- Reduce inequality (welfare payments like unemployment benefit).

- Provide public goods (fire, police, national defence)

- Provide important public services like education and health (merit goods)

- Debt interest payments.

- Transport

- Military spending

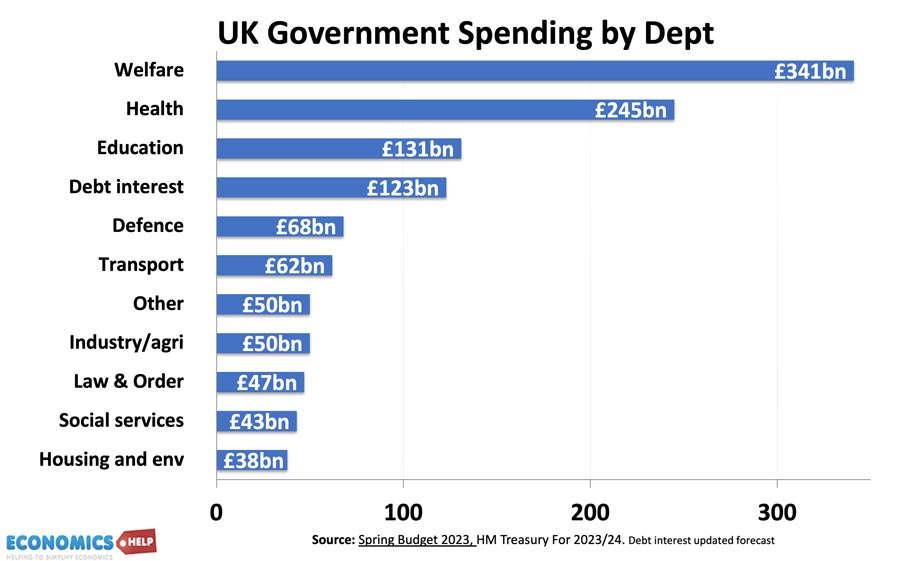

UK public sector spending 2023-24

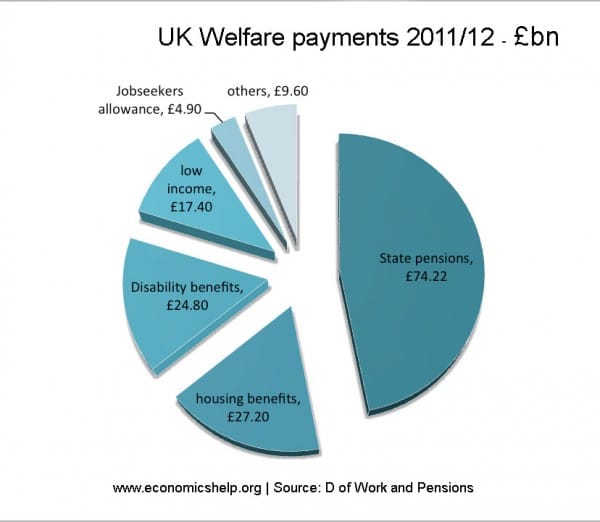

In the UK, the biggest department for public money is social security. This takes almost a quarter of all public spending. It goes on financing a variety of benefits (State pensions, public sector pensions, housing benefits, income support, disability/incapacity benefits, unemployment benefits).

EU spending is £14.7bn (2014). Net spending £9.9bn. See more at the cost of EU

See also: Public Spending at UK Gov

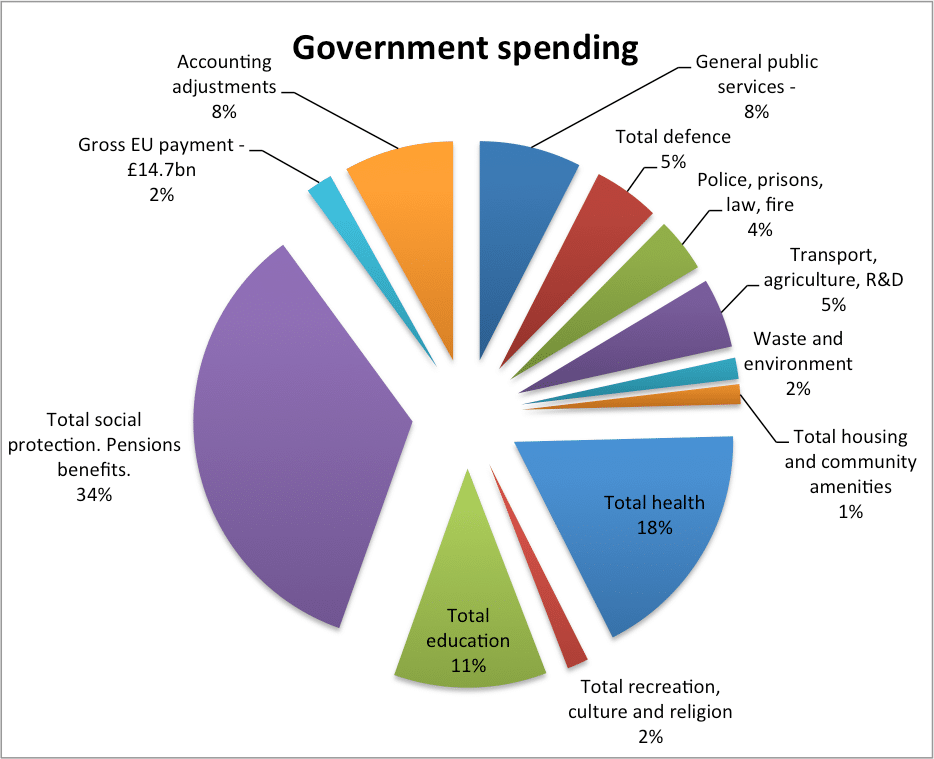

Main areas of Government Spending 2015

- Public Pensions £150 billion

- Sickness and disability £40bn

- Old age pensions £107bn

- National Health Care + £133 billion

- State Education + £90 billion

- Secondary education – £25bn

- University education – £11bn

- local education spending – £48bn

- Defence + £46 billion

- Social Security + £110 billion

- State Protection + £30 billion

- Transport + £20 billion

- Railway – £5.2bn

- Roads – £3bn

- Local transport – £9bn

- General Government + £14 billion

- Executive and legislative – £5.9bn

- Other Public Services + £86 billion

- Social housing – £1.2bn

- Waste management – £9bn

- Public Sector Interest + £52 billion

Cost of EU

- Gross payment to EU – £17.2bn

- Net payment to EU – £8.6bn

- FT – EU cost

Total Spending = £731 billion

- Source: UK Public Spending

Other Notes

- Foreign Aid £7.8 billion or 0.7% of GDP 2011/12 (Cost of Foreign aid)

- Job Seekers allowance £4.9bn (or 0.7% of total spending) 2013/14

The largest area of government spending?

By far the largest area of government spending is social protection. £222bn (2015) 34% of government spending. However, this budget can be split up into different compartments. The biggest single item of government spending is public pensions, with NHS spending in 2nd place.

What percentage of UK spending is on the EU?

If you take gross payments (ignoring EU payments to the UK), in 2014 – £14.7 billion was transferred from the UK to the EU in official payments. This is 2% of government spending.

If you take the £7.1bn net contribution, it works out at 0.9% of public sector spending or £110 per person per year. It is 0.4% of GDP.

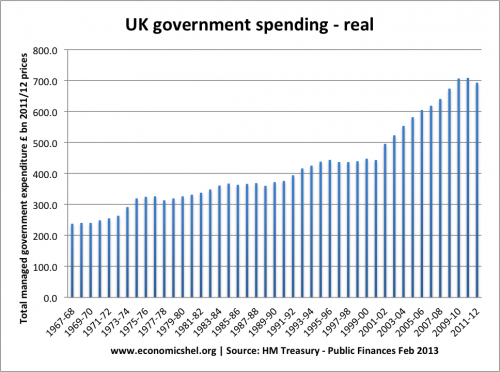

Total Government Spending

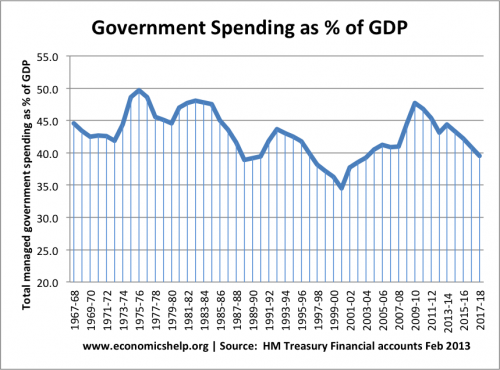

Government Spending as % of GDP

In 2010, the government embarked on tough spending cuts to try and reduce the budget deficit. However, spending on debt interest payments rose to £48bn. Also, spending on welfare benefits rose because of the increase in unemployment. Overall the government plan to keep spending static in real terms (adjusted for inflation)

See also: Total UK government spending

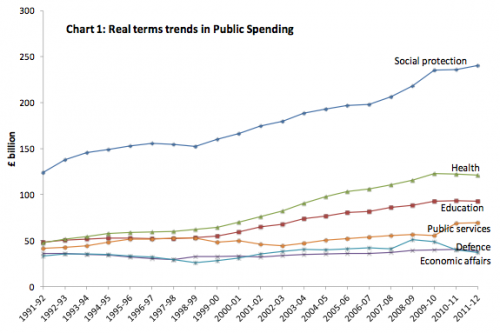

Changes in UK government spending

source: HM Treasury

In the past 20 years, in real terms, the biggest increase in government spending has been in the area of health care.

Welfare Payments

Welfare benefits (billion, bn)

- Housing benefit £16.94 bn

- Disability allowance £12.57 bn

- pensions credit +MIG £8.11 bn

- Income support £6.92 bn

- Rent rebates £5.45 bn

- Attendance allowance £5.30bn

- Incapacity £5.30 bn

- Jobseekers allowance £4.90 bn(0.7% of total spending)

- Council tax benefit £4.80 bn

- employment + Support £3.58bn

- Sick + maternity pay £2.55 bn

- Social fund £2.37 bn

- carers allowance £1.73 bn

- financial assistance £1.24 bn

- See more on UK social security payments

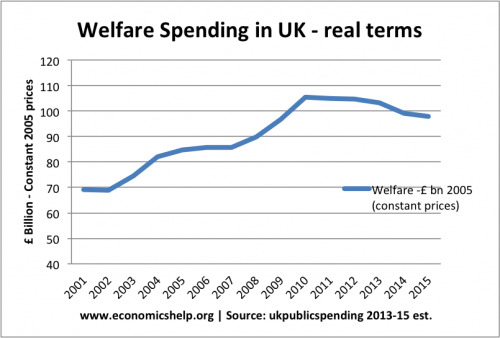

The welfare budget includes spending on unemployment, income support (universal credit), housing benefit and disability allowances. It increased to £105bn in 2011-12

As a percentage of GDP, welfare spending is just over 7% of GDP.

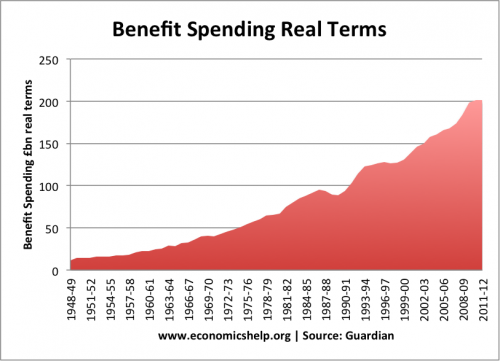

Total Benefit Spending

Total benefit spending includes the welfare budget, plus also the total spending on pensions. The total benefits bill for the UK was £200bn in 2012. See growing size of welfare state

fact is that currently the uk government is overspending with a £122 billion deficit and nearly £50 billion a year spent on interest payments alone.this is unsustainable and if our interest payments go up then we are in trouble. the solution as I see it is to index government revenue against goverment spending as a covenant with the uk people enshrined in law to avoid the populist flaw in the democratic system. For example income tax should equal social protection, governments should not be allowed to spend more than is contributed from this revenue section. national insurance should be realigned and indexed against Heath spend, again governments should not be allowed to spend more than is contributed from NI revenue, currently this would be an overspend of around 25% and this would be brought back in line through indexing. The government would not be held to account if this indexing was enshrined in a social people charter to avoid the inevitable social people unrest. Most people get the idea that you can’t spend more than you have.

I agree with your point about there being a ‘flaw’ in democratic systems which encourages politicians to raise money from borrowing. I think the £43 billion interest bill to be a wasteful use of government revenue and would like to see it greatly reduced. .

However, I am genuinely puzzled by the commonly aired view that current levels of debt are unsustainable. My question would be: what makes the current debt ‘unsustainable’ when historically we appear to have been able to sustain even higher debt levels over long periods of time?

The debt isn’t unsustainable, and debt interest payments as % of GDP are fairly low by historical standards

how much does the government actually spend on “Helping the unemployed and those on benefits back to work?”

Including all the costs for DWP, G4S, A4E,The work programme and the multitude of other government funded schemes.

I think it is not easy to know what government spend money on,it only depends on what we see and whoever is an insider in the government who can know what the government spends her money on.

It’s not the interest to GDP ratio at the moment that the the worry, at the moment our economy is stronger than its been in a long time. BUT and this is a big BUT in these days all the countries monetary systems are wired together electronically in the event of a stock exchange crash or recessions overseas our economy is as vonerable as any to slip back into recession, so reducing what we owe to other countries is a good idea because our level of debt is so high, Much of the equity markets are over inflated mainly due to foreign . Quantative easing (creating electronic money) policy over the last five or so years so the stock exchange is like a bubble ready to burst

jah neh it’s fine ,but there must be an increasing monentory for students

The government are still wasting 1m a month on new control centres for fire service that have been standing empty since 2009 and it seems they will not get use even with top computers . Wasting money in EU Fines as We do not keep by the EU rules 1m in fishing , 150m for not flying the EU flag and may soon be find 300m over Pollution levels.Now Disabled pay a high price over failings ! ! !

Defra fined 175m of subsidies then fined 580m for mishandling of EU financial help to farmers then a 24m for fruit farmers for bad administrating . We keep seeing MP not doing they job right in so many ways and now they get pay rise 11% And still hit into the pore by taking way Tax credits .Bosses will not give us a pay rise . It been 6 year of me as a truck driver with no rise as I see Bosses in Bentley’s cars . Over the last 5 years 10,000 more people have suicide and it going up as this Government hits the pore ! ! ! Food banks in all towns and we all see the people sleeping ruff in the street . Please stop wasting are TAX and help the people ! ! !

Please can you tell me why this site does not like to speak about the money that MP keep getting in FINES by the EU for bad practice . The Fines are ease to see as top news papers show millions and in 2014 close to a Billions in fines . Why not be showing this as it is year on year .

I think the £52 billion debt interest is wrongly classified. Borrowing is simply a way of financing expenditure on e.g. building schools or hospitals, and the cost of the borrowing (i.e. the debt interest) should be classified under health or education. Salaries of teachers and doctors are not separately classified but are shown under education or health.

The separation of debt interest simply provides ammunition for those who think that borrowing is a BAD THING, whereas it is quite proper to borrow to invest and repay over an extended period as the benefits of the investment flow back over the period of the loan and are experience by the users of that service.

Post office billions in debt. Have the people pick up the mail not at a post office but a wear house. 16 hrs. A day 5 days a week,two shifts,no lay offs.save billions.

Question

Is any tax money invested by Government for profit.

I have heard that some Council tax funds are invested for profit and was wondering if this was the case for general taxes also.