Readers Question: Can you explain the short-term and long-term effects of Osborne legislating that there must be budget surpluses in any year when growth exceeds 1%, which is almost every year, whilst we have a rather large current account deficit. What will be the effects of this on private sector companies, public investment, households, the current account deficit, pensions and ultimately the banking sector.

Running in a budget surplus means government spending must be lower than total government receipts (primarily tax revenues)

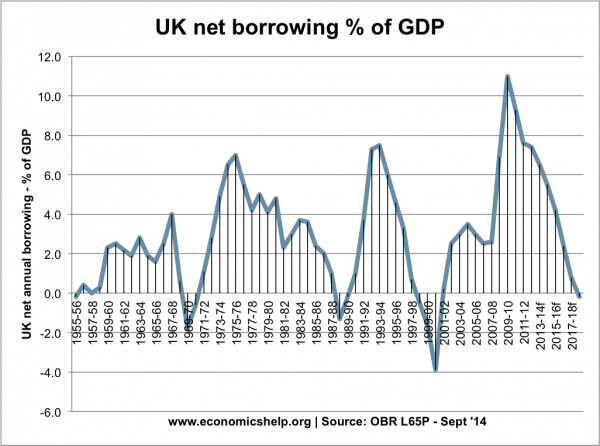

A budget surplus is quite rare for the UK. In the post-war period, budget surpluses have been the exception rather than the norm.

Though it is important to bear in mind, that despite a rare budget surplus, the UK debt as a % of GDP fell from over 200% of GDP to 40% of GDP. (See: UK economic boom post war)

This suggests that the chancellor’s rule of insisting on budget surpluses is unnecessary – if your goal is to stabilise and reduce debt as a % of GDP.

Impact of budget surplus

The impact of a budget surplus will depend on the economic situation and how the budget surplus is achieved. But, these are likely scenarios.

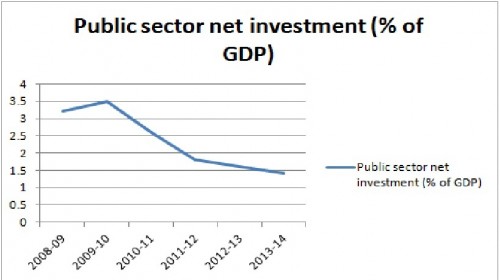

1. Lower public sector investment. When you need to cut spending to meet a fiscal target, the easiest thing to reduce is often public sector investment. Why? Because if you hold back on investment, there are no immediate political losers. There is a cost in the long-term of traffic bottle necks, slower broadband e.t.c. But, it is less politically damaging to delay public investment, than say cut disability benefits or cut pensions.

Source ONS | NTV

From 2002-2007, public sector investment averaged 2.5% of GDP. From 2015, it is forecast to average 1.7% – a relatively low figure, given that the UK’s growing population is putting greater demand on infrastructure and housing.

By contrast, the oppositions fiscal rule allow borrowing to finance public sector investment. This alternative fiscal rule, you would expect to see a higher level of public sector investment.

Evaluation

You could argue government spending is inefficient and the government tends to waste public sector funds on ‘white elephant’ projects with high appeal and limited economic benefit. Critics argue the new HS2 rail-line is expensive for what you get. Therefore, a reduction in public sector investment is not a problem.

However, business organisations and economists tend to see the UK having a great need for public sector investment – investment that will not be carried out by the private sector – e.g. transport, broadband upgrades, renewable energy, housing. Also, another issue is that bond yields on government borrowing are very low – making borrowing very cheap. Insisting on a surplus means the UK is missing a cheap opportunity to invest for the future whilst borrowing costs are very low.

2. Demand side constraints and lower economic growth

The strict fiscal rule implies that the chancellor maybe forced to pursue deflationary fiscal policy – tax rises and or spending cuts to meet the target. This will have an impact on aggregate demand with spending cuts reducing total demand in the economy. Furthermore the uncertainty that taxes may have to rise to meet fiscal rules may also discourage spending and investment.

If the economy was robust with strong growth in both the UK and rest of the world, the fiscal constraint probably wouldn’t be a problem. It could even be a help in avoiding an economic boom. For example, during normal growth, if the MPC were worried about the impact on aggregate demand of changes to fiscal policy, they could cut interest rates and allow monetary policy to take the slack. However, the concern is that interest rates are already at zero and with disinflation, we are entering a period of a prolonged liquidity trap, deflationary pressures and low growth. In this case, fiscal policy could play a role in maintaining growth in demand and avoiding a stagnant economy. A strict fiscal rule effectively limits a major plank of demand management at a time when monetary policy is already at the limits of what is possible.

Also, with the UK it is important to bear in mind the role of population growth in magnifying the rate of economic growth. Roughly 50% of economic growth is coming from growth in population, but productivity and real GDP per capita is much lower.

Evaluation

You could argue that there is still scope for monetary policy to come to the rescue – e.g. use helicopter money to stimulate demand. But, it is relatively untried and it is uncertain whether it will happen. Expansionary monetary policy of past several years has not broken the period of below trend growth.

3. Benefits of achieving budget surplus. From an economic perspective, the benefits of a budget surplus are not as obvious as politicians assume. Some will argue that a budget surplus will lead to benefits such as

- Lower debt interest payments

- Lower bond yields because less risk of default (though bond yields are already at record lows)

Certainly there was a need to reduce the (recession induced) record level of peace time borrowing. More importantly there are benefits to stabilising the debt to GDP ratio (e.g. some say desirable to reduce from 80% closer to 60%.) But, achieving a budget surplus can be a false dawn. One comparison is the UK in the 1920s, when great efforts were taken to achieve budget surpluses, but this didn’t help the economy at all, and it was a largely a lost decade of low growth, deflationary pressures and even debt to GDP didn’t fall.

How will this rule effect particular goals

To answer the readers question. It is hard to say what effects budget surplus rule will have. It is even harder to say how they will effect certain macro-objectives. The below is merely some possibilities.

- Current account balance of payments. If budget surplus leads to lower demand it may lead to lower spending on imports helping to improve the current account. But, in long-term, less public investment could affect productivity leading to slower growth in exports. Also, growth in Europe is so weak, even a slowdown in UK may be insufficient.

- Households. In short term, squeeze on finances as government ‘austerity’ limits benefits and imposes marginally higher tax. Period of low growth in real incomes likely to continue, though ultra low inflation will help.

- Pensions. In long-term, if chancellors are going to stick to strict fiscal rules, pensions look inevitably a source of reform. Raising of working age is inevitable. This also has to be seen in regard to shift of wealth and living standards from young to old in society.

- Banking sector. I don’t think the banking sector will be too affected by the fiscal rule. Banks and investment trusts may say they prefer governments to run budget surplus, but they also have very high demand for buying government bonds (debt) – which is why bond yields are so low.

Other effects of running budget surplus

See also: effects of budget surplus

I’ve been looking at this through the window of sectoral balances which state that all sectors must add up to zero.

Let’s say in general there’s four sectors in the economy, government, corporations, households, and the rest of the world.

The rest of the world is already running a large surplus. This means there must be an equal and opposite deficit across the other three sectors. At the moment much of this falls on the government sector which is running a deficit of approximately 4% of GDP around the OECD average fiscal position. If via spending cuts and/or tax rises a surplus is forced in the government sector then I can see this cutting our current account deficit some but not completely ( it didn’t switch to a surplus when we ran fiscal surpluses around the year 2000) and so with the government in surplus, and the rest of the world still running a surplus, doesn’t this actually force deficits in the household and corporations sectors?

How long can households and corporations go on spending more than their income to support the twin surpluses in the government and rest of the world sectors? What damage will those deficits do?

Wouldn’t investing to grow GDP be a preferable way to cut the GDP to debt ratio rather than trying to force a surplus at a time when it is likely to be damaging to the domestic economy?