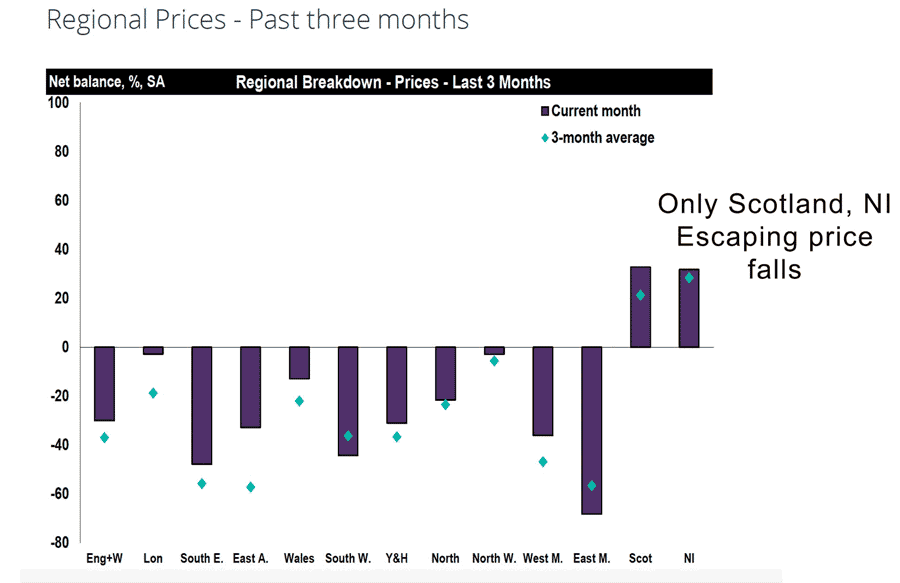

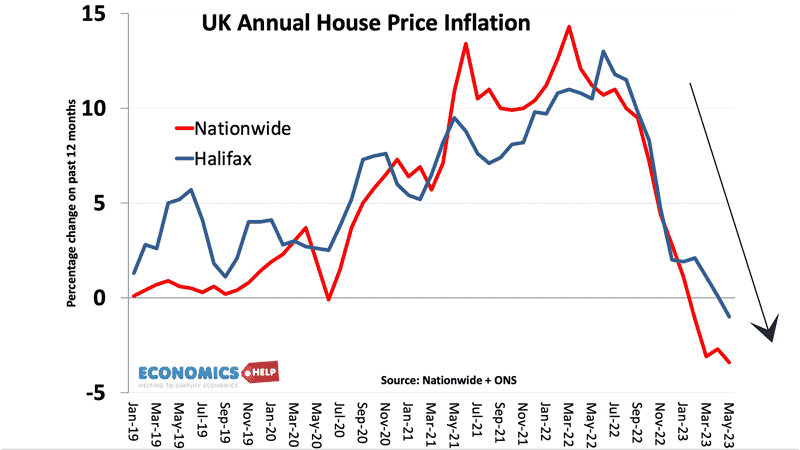

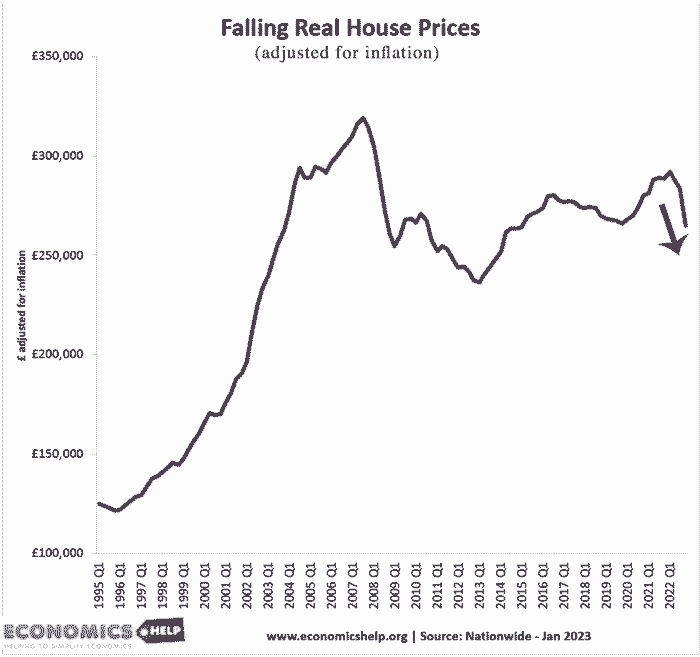

House prices are falling in most parts of the country. With prices around £15,000 lower than last summer.

After a prolonged boom, the house price inflation rate is turning negative with some of the fastest falls since the last crash. Adjusted for inflation, the real house price fall is 11% lower than last summer.

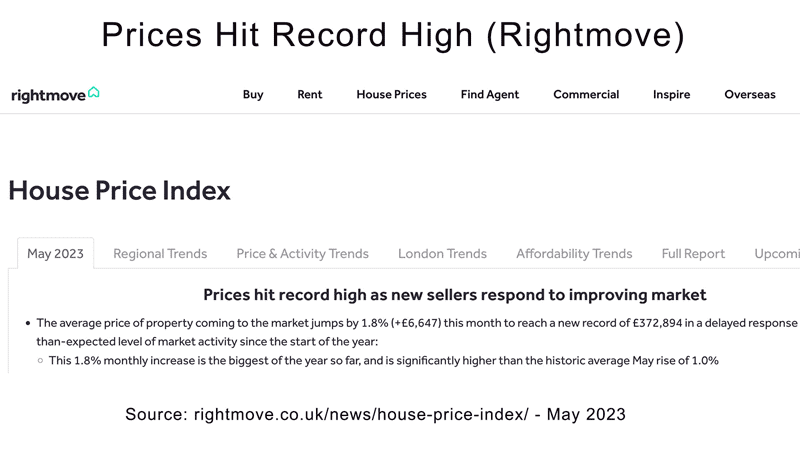

However, there is still some uncertainty about what is actually happening. The latest blog from Rightmove is quite bullish with Rightmove claiming house prices are reaching new record highs.

What explains this contradiction of differing claims, who is right and what might happen next?

Difference between asking price and agreed selling price

The Rightmove figure is somewhat misleading as their index is a measure of asking prices that appear on their website. But, the asking price can be significantly different to the actual agreed selling price. In recent months, there has been a growing gap between the asking and selling price. This is actually quite normal during a housing downturn. Homeowners tend to have an inertia and reluctance to reduce the sale price. If you hear your house is worth £300,000, there is a psychological reluctance to list the house below that figure. However, the pressure of rising interest rates and falling real wages is really putting pressure on potential buyers and increasingly homeowners themselves.

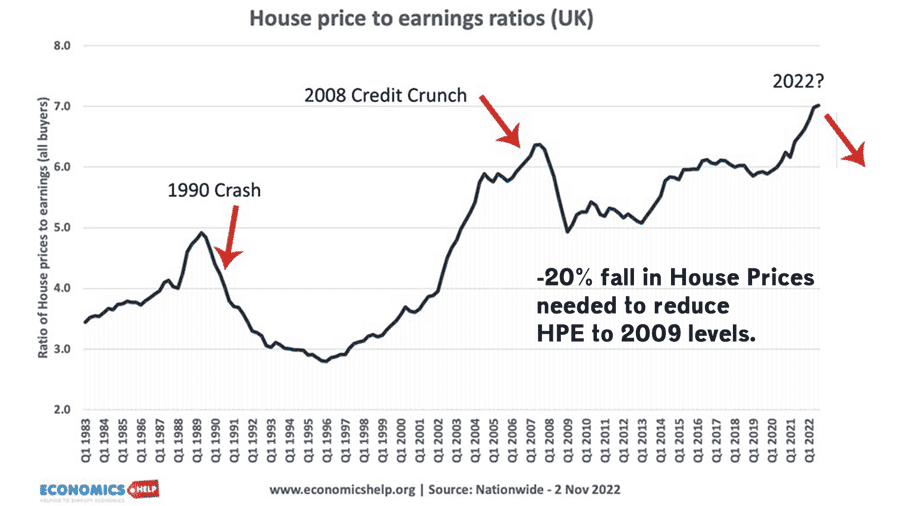

Last summer I made my first video about a UK house price crash. “This time is different”. It was based on the economic fundamentals of a deeply overvalued UK housing market, combined with the shock of rising interest rates after a unique 15-year period of ultra-low rates. Last year House prices to earnings reached record levels and have only narrowly declined, indicating there may be more pain to come. It is still higher than at the peak of the last 2009 crash. Since last summer, house prices have steadily fallen. But what I didn’t predict was Liz Truss’s crazy experiment which sent interest rates soaring towards 6/7%. It meant households could be paying up to 40-45% of income on mortgages – a level not seen since 2007 and 1992. It was a recipe for a big crash in house prices. However, the arrival of Rishi Sunak and the reversal of Truss’s economics brought a degree of stability back to the market, at least temporarily.

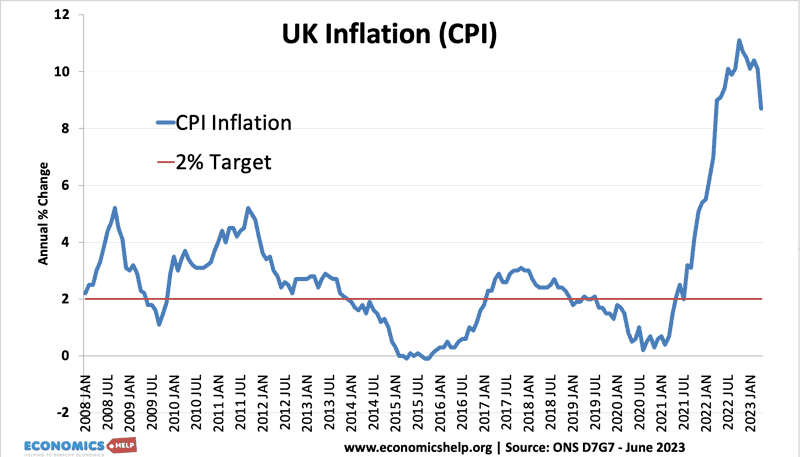

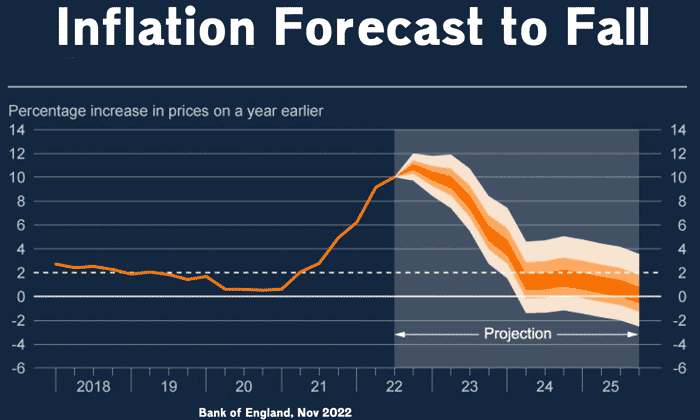

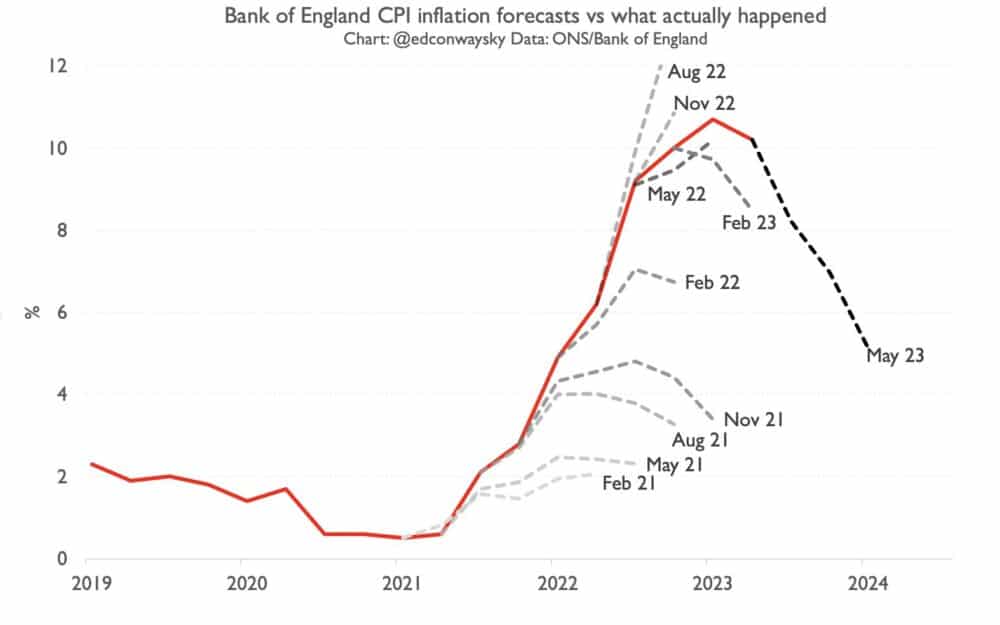

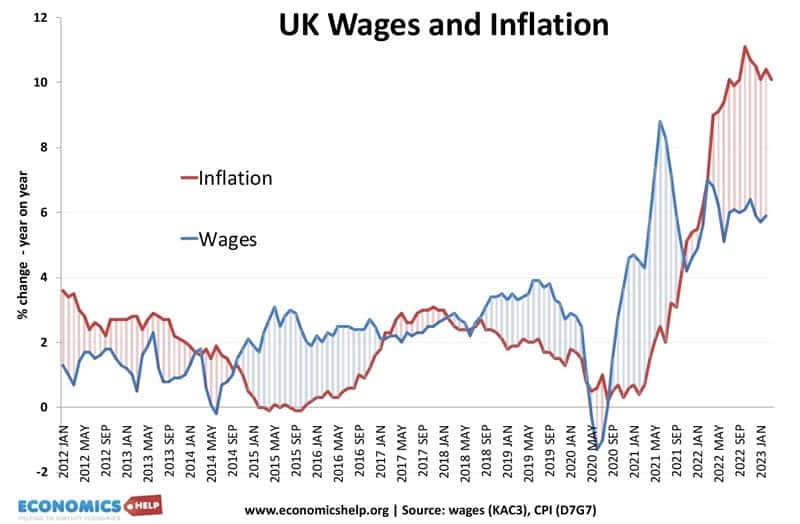

However, last month’s inflation data was very bad news. Despite the headline rate falling from 10% to 8.7%, it worried markets because the fall was much less than expected. And the inflation figures also showed that underlying core inflation, which ignores all the volatile energy prices was creeping up. It means that the UK’s temporary inflation has morphed into more permanent inflation as workers gain nominal wage rises (though not enough to exceed inflation). It is more bad news for the housing market because the hope of a rapid fall in inflation now appears more unlikely. At the start of the year, forecasters were confident inflation would be 2% by the end of the year. But, a persistent pattern of the past two years is that inflation forecasts have been wrong in underestimating inflation.

This is the Bank of England’s forecasts compared to the actual inflation. And the Bank of England admits its inflation model has failed to keep up with recent events.

The result is that mortgage rates have climbed sharply. During Covid, the Bank of England’s effective interest rate was 1.5% today it is 4.5%, but with expectations it will rise further. This shows current fixed rate deals and the revert to rate – which is what you end up paying if you don’t choose a particular deal, an indication of turmoil in the mortgage markets. First time buyers face the prospect of significantly higher interest rates than the past decade. To understand the change in conditions. In 2021, with effective interest rates 1.5% a £270,000 30 year mortgage was costing £932 a month. In the summer of 2023, this could potentially reach £1,533. An extra £600. Now not everyone will see this kind of jump, fixed rate mortgages are more common than in the last financial crash. Though the majority of fixed rate deals are just 2 years and in the next few weeks over 1.1 million will see the end of the very cheap mortgage deals they got 2 years ago.

The problem is that it is not just higher mortgage rates but the UK has experienced an unprecedented decline in real wages with average incomes struggling to regain the pre-covid peak. A combination of rising energy and food prices have left many struggling to pay the bills. The interest rate rises on top will be a difficult situation to deal with.

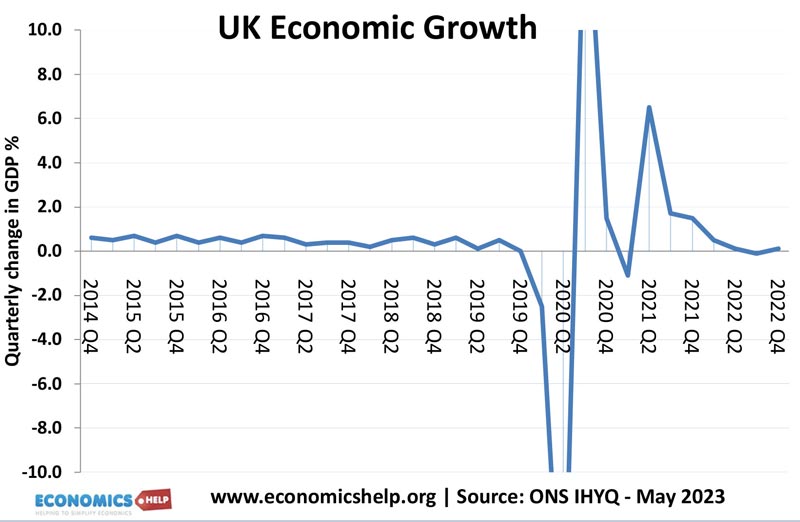

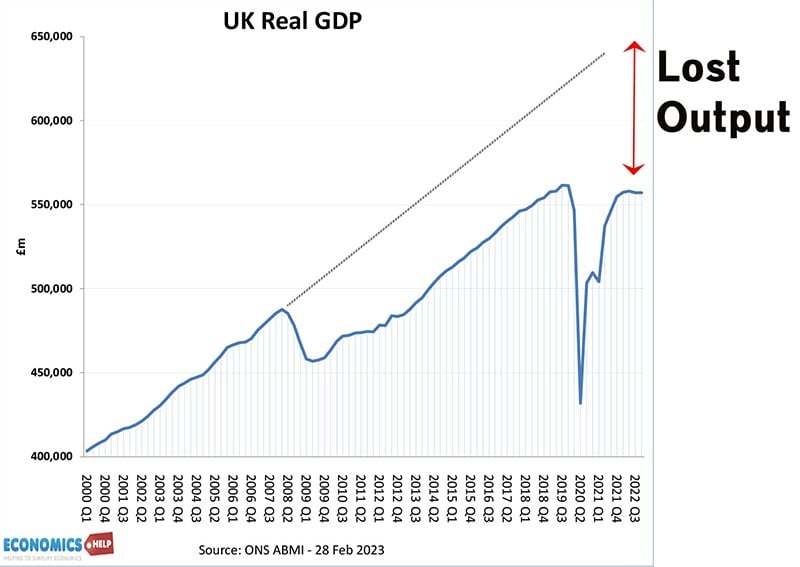

You can hear reports that the UK economic growth is doing better than expected. But, this is slightly misleading as what it really means is the UK has avoided recession, but economic growth is still very low compared to the previous trend growth. Usually, when the economy falls behind, it is easier to catch up lost output, but that is not happening. Growth is still very weak – lower than our main competitors and very significant lost output.

And this is not surprising given the cost of living pressures. A very real concern is that if interest rates rise further on top of all the current headwinds, it will push the economy into recession.

One particular area of weakness in the housing market is the buy to let sector. In recent years, the most attractive element of buy-to-let has been capital growth, with house prices almost doubling since the start of 2009. But now landlords see little if any scope for rising prices and combined with much higher interest rate costs, the profit margin is much less attractive, especially for the amateur buy to let investor.

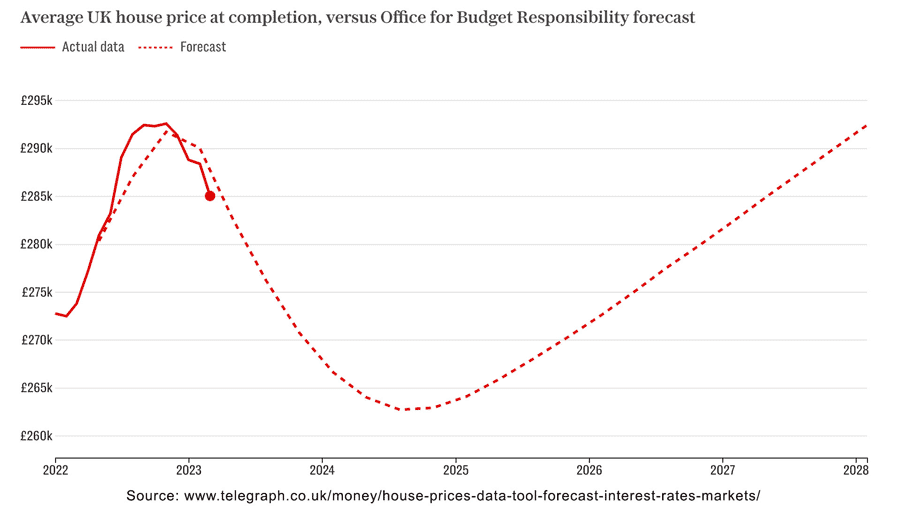

So what about prospects for future house prices? Last year the OBR predicted a 10% fall in nominal house prices and a very slow recovery, and so far this prediction appears on track. Moody’s also predicts a further 10% fall in nominal prices from today’s levels. Yet, even this would do relatively little to reduce historically high house price-to-income ratios – which by the way are the highest since the 1870s. Given the jump in interest rates, surely we would expect a much more significant drop? Well, that is quite possible, but there are a few factors propping up house prices.

What is propping up Prices?

Firstly, demographic factors have increased the number of households – though it is also worth mentioning population growth is starting to be lower than previous expectations. Secondly, the relatively slow growth in homebuilding, made worse by inflation means the UK has a relative shortage of housing at least compared to say Europe. Thirdly, when comparing house price to income ratios of the past, these days it is more common for mortgage applications to have two earners rather than just one in the past. More women are working than in the so called golden post-war period. Fourthly, the alternative to buying, renting has also become increasingly expensive. The result is that there is still demand for first time buyers to try all available means to buy a house – even if it means a 35 or 40 year mortgage terms, borrowing from parents or putting savings on hold. Unless rents start to fall, many young people will still feel like they are between a rock and a hard place. Expensive rents versus overvalued housing market.

Fifthly High inflation will also mean any house price correction will occur partly through the effects of inflation. If we used real house prices the fall would look much more dramatic

There are more factors, such as inherited wealth, overseas buyers, and housing converted to Airbnb, but overall these don’t trump the short-term impact of significantly higher interest rates and the change in market sentiment.

A rapid crash in prices is very unlikely unless there is some kind of banking crisis, which sees 2008-style credit crunch conditions. Usually, house price corrections are less dramatic but take place over a couple of years, as homeowners slowly adjust to the changing market.

My articles/videos from last summer about a potential house price crash hold up pretty well. But, last month I wrote an article – fixed or variable, which was particularly badly timed. I chose variable – partly because I want to overpay the mortgage a lot, but also because I hope rates will be lower in 2 years’ time. But, just three days later, we had this awful inflation data which caused many fixed rate deals to be removed – it was unfortunate timing to say the least. And a reminder economic forecasting is a tricky business. Maybe I should be more careful about taking inflation forecasts from the Bank of England at face value!

Nevertheless, it still has some value because it raises interesting points. One thing I would say is that if rates were to go up to 5.5% to bring down inflation – how sustainable would that be for the economy? Interest rates have a time lag, and towards the end of the year the combination of falling wages, and rising interest rates will cause a perfect storm of negative pressures on the economy. The Chancellor Jeremy Hunt said he would be happy to have a recession to bring inflation down. But, if the economy was to enter a recession, you would see very strong pressures for interest rates to come down. The Bank of England’s own stress tests suggest that if UK rates were to rise to 6% it would cause greater stress than the last financial crisis and would cause GDP to fall to 5% and property prices to fall by 31%.

Now this 2022 prediction from the Bank of England is probably outdated, the economy has been more resilient to higher rates than they predicted last year, but nevertheless, interest rates of 5-6% would be very damaging for the economy, and cause a substantial correction in the housing market. I just doubt how long the Bank could keep interest rates elevated in a recession with rising unemployment.

Recent articles

You are almost the only author worth reading on this subject. Well done and thanks.