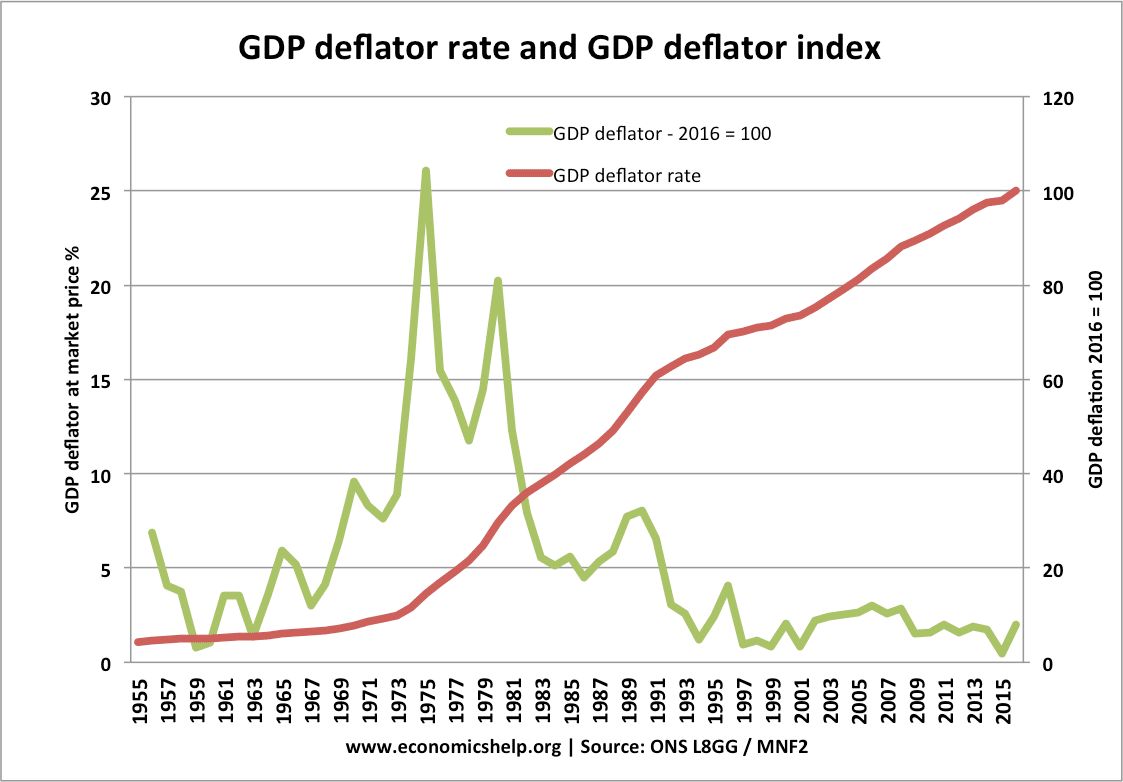

GDP deflator (implicit price deflator for GDP) is a measure of the level of prices of all new, domestic goods and services in an economy. The GDP deflator regularly updates the type of goods and services used to measure the implicit price deflator – depending on which goods are being bought.

e.g.If the price of mobile calls increase relative to landline calls, people will spend less on mobiles so the rise in price becomes less significant.. This is the same principle as a chain weighted measure.

The Consumer price index CPI also tries to measure the average level of prices in an economy. However, it tends to use a more fixed basket of goods. The basket of goods in CPI is often updated less frequently, than the GDP deflator. Even if people stop buying the mobile phones, the price increases will contribute to the CPI.

Use of GDP deflator

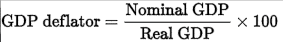

The GDP deflator is used to convert nominal GDP statistics into real GDP.

To find real GDP, you can divide nominal GDP / GDP deflator and times by 100

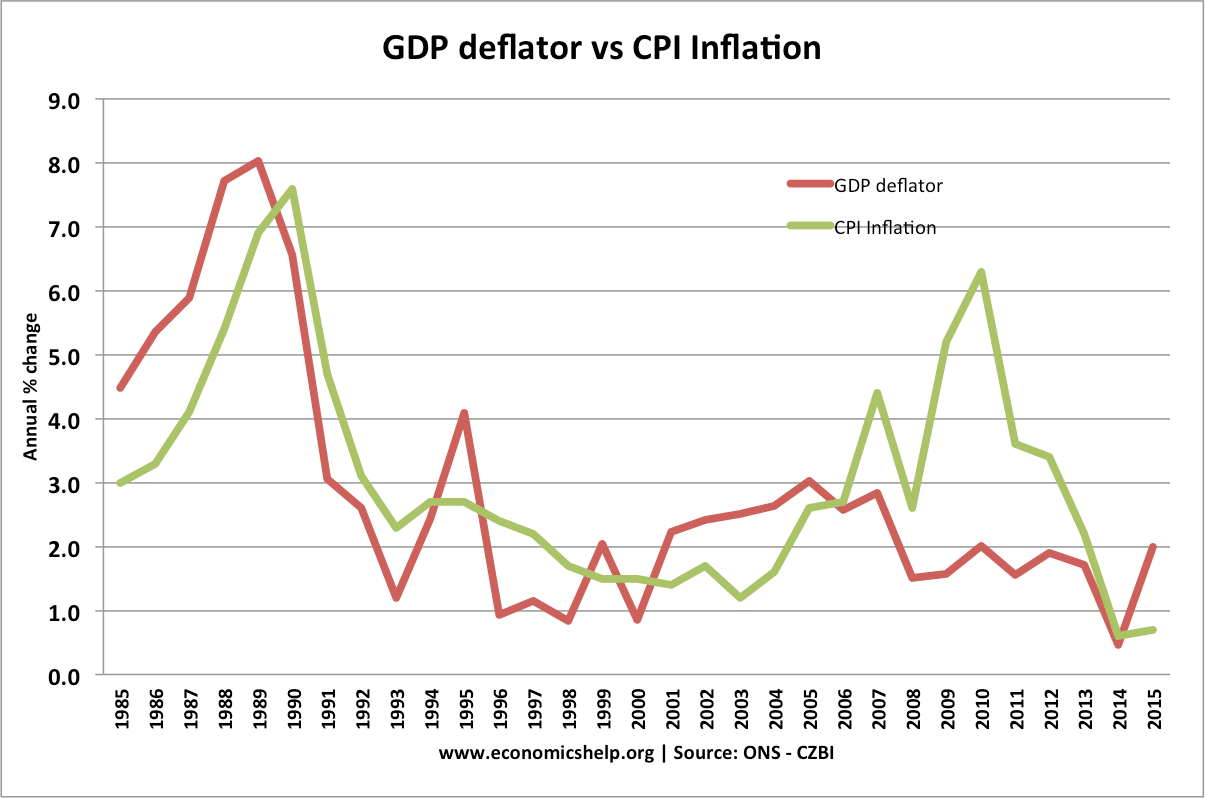

Often GDP deflator and CPI inflation can give a similar figure and similar impression of inflationary pressures. But, in some cases, the GDP deflator can give a more accurate reflection of actual inflation / deflation in the economy. The CPI can lag behind.

UK GDP deflator and CPI

GDP deflator has been less volatile than CPI in recent years. In 2010, CPI inflation was increased by effects of devaluation, higher VAT, rising import prices and higher oil prices.

GDP deflation in China

Between 2003 and 2008, the GDP deflator showed higher inflation than the official CPI measure. However, in recent months, GDP deflator is becoming negative. Thus using GDP deflator, the Chinese economy is not doing as well. Growth is much lower (using GDP deflator, growth is only rather than )

Diana Choyleva, from Lombard Street, said the official Chinese figures show that the economy contracted by 0.2pc in the second quarter, rather than growing 1.7pc (7.5pc year-on-year) as claimed by the government. The discrepancy comes from the inflation assumptions used by Beijing. The government relies on a fixed basket of prices that can flatter the true health of the economy.

A better benchmark is the “GDP deflator”, which uses an evolving measure of prices that better reflect the reality of China’s fast-changing economy. “If you measure it that way, China is much closer to deflation than people realise,”

Deflationary pressures in China are coming from:

- Falling factory gate prices

- Appreciation in currency, leading to higher import prices

- Investment boom coming to an end.

Related

Do you mind if I quote a couple of your articles as long as

I provide credit and sources back to your site?

My blog site is in the exact same area of interest as yours and my users would

certainly benefit from some of the information you provide here.

Please let me know if this alright with you. Thank you!

fine

Hello. Right now i’m doing a research on why the inflation rate in Japan is high in the year 2009 and the lowest in the year of 2010. I tried to search the reasons but i couldn’t find anything. Please help me

hello, i am searching for the GDP deflator of France, that why there is continuous increase in the GDP deflator of France economy?

Can someone please help me?

hy, what are the uses of GDP deflator in national income ststistics