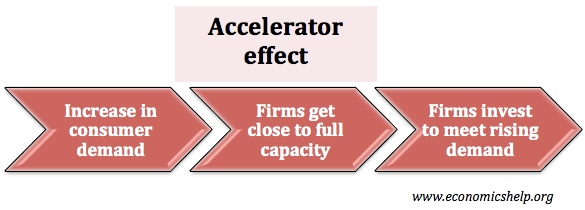

The accelerator effect examines the effect on levels of investment from a change in economic output (or demand for a product).

The simple accelerator model suggests that capital investment is a function of output. If there is an increase in demand and economic output, investment will rise to meet the expected demand.

The simple accelerator model suggests that a fall in the growth rate can lead to lower investment. This suggests the accelerator effect can explain how an economic slowdown leads to a recession.

- A fall in growth rate leads to lower investment. Investment is a component of AD, therefore AD falls further.

The accelerator model suggests the business cycle can be volatile.

Formula for Accelerator Effect

K = f(Y) K = Capital Stock

Y= National Output

f = relationship between capital and output.

Example of Accelerator Effect

- Assume f=2.

- If Y increases by £15bn. Then investment will need to be £30bn (15*2)

- If in the next year Y increases by £5bn, then investment will be only £10bn.

This suggests there will be a fall in the level of net investment. Therefore a fall in the growth rate in the economy can lead to lower investment and further downward pressure on the economy.

Accelerator Effect and Real World

In the real world, there are many other variables that influence investment levels apart from output (and demand). Firms will also take into account interest rates, state of technology, expectations of future, confidence. There are also time lags in investment. Also, it can be difficult to get accurate statistics about the state of demand.

Therefore, a fall in the rate of economic growth doesn’t necessarily lead to a fall in investment. However, empirical evidence suggests the level of investment does tend to be more volatile than the level of economic growth. It is one factor that creates a more volatile business cycle.

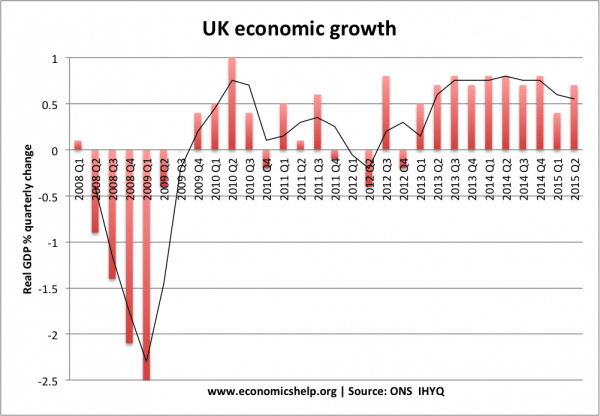

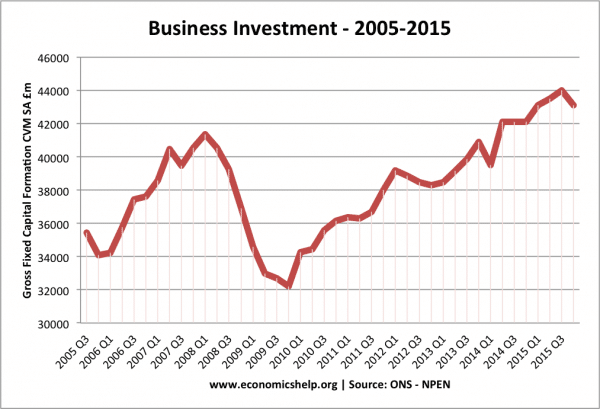

UK economy 2008-15

Business investment. 2005-2015. The slowdown and then fall in economic growth in 2008, led to sharp fall in business investment.

Negative accelerator effect

If there is a fall in the growth of demand, then net investment will fall as firms cut back on starting new investment projects.

Micro Example of Accelerator Effect

A firm will invest depending on demand for its products. The rise in demand for iPads will cause Apple to be investing in increasing capacity to meet future demand. If the iPad drops out of fashion, Apple could be left with a lot of spare capacity and so would cut back investment drastically.

Accelerator Effect and Multiplier Effect

There is some relationship between the two. But, it is important to understand they are different concepts. The multiplier effect states a rise or falls in injections into the economy (for example investment) may cause a bigger final increase (or fall in GDP).

Related

what is the effects of corruption in economic,society and politic of India?

WHAT ARE THE EFFECTS OF A RISE IN INVESTMENT?

I still remember when our professor in economics discussed about money and I just questioned him why not just print money and distribute it to the people so that there will be no poverty. He said that cannot be. Can you guys enlighten me more about it? What will happen if we print money and distribute to everyone so that no one will starve?

Ok… If you ll get money directly distributed by govt will you work hard to earn money…

inflation increases as the value of money decreases.

lets think of a 50 pound note, lets say this 50 pound not was 50 litres of oil, if there is more litres of oil then the price of it will decrease as it decreases as its not a scarce resource anymore so its value will decrease, so if we printed more 50 pound notes, there will be more in the economy and its not a scarce resource anymore and it will lose its value because of inflation

inflation only causes an increase in the internal value of the money not external

Yes, he was right that it cannot be. You must have resources, goods or better to say products equal to that of money printed.

Eg. an economy produces wheat so Gov. can only print money equal to wheat produced that year. Wheat should be worth to that money printed.

Similarly there are other resources e.g oil, rice, crops, money earned by exports etc.

Otherwise the printed money would cause inflation ( value of money decreases )