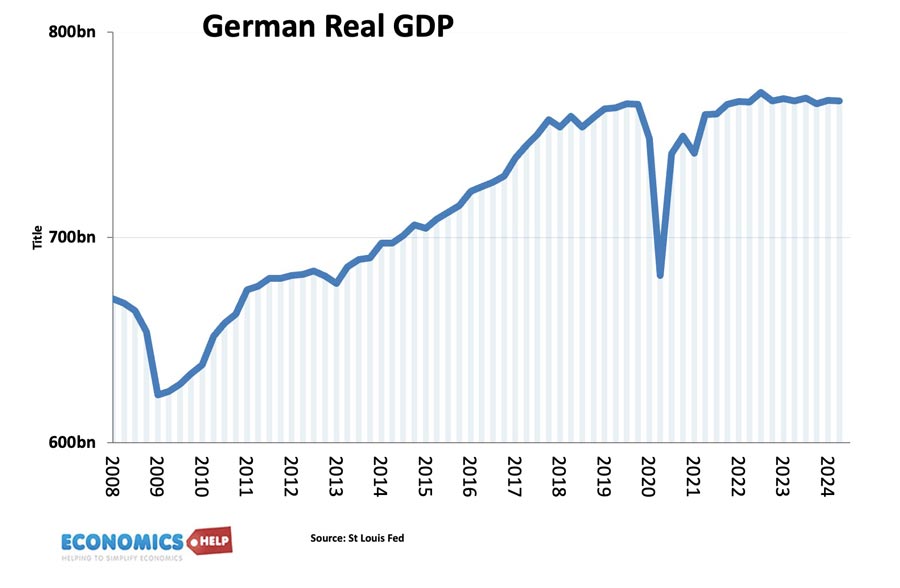

German Economic Crisis Gets Worse

Since 2019, The German economy has gone into an unexpected decline, posting the 2nd worst performance in Europe. GDP is stagnant, the car industry in decline, real wages falling and discontent rising. For many decades, Germany was the powerhouse of the European economy with rapid growth transforming living standards, but this has come to a …