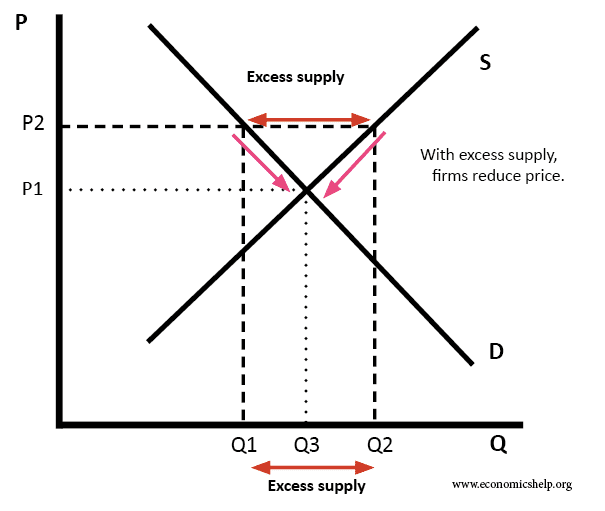

- Expansionary monetary policy aims to increase aggregate demand and economic growth in the economy.

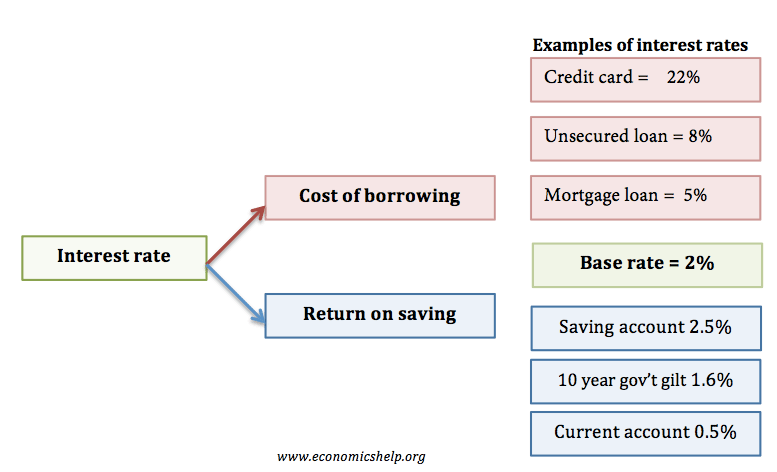

- Expansionary monetary policy involves cutting interest rates or increasing the money supply to boost economic activity.

- It could also be termed a ‘loosening of monetary policy’. It is the opposite of ‘tight’ monetary policy.

When to pursue expansionary monetary policy

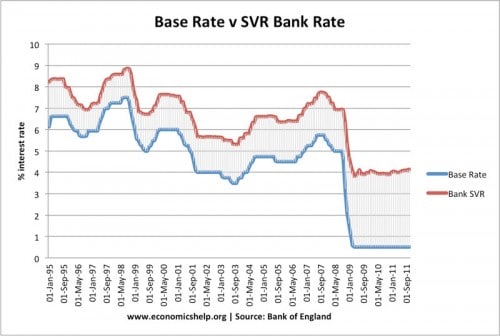

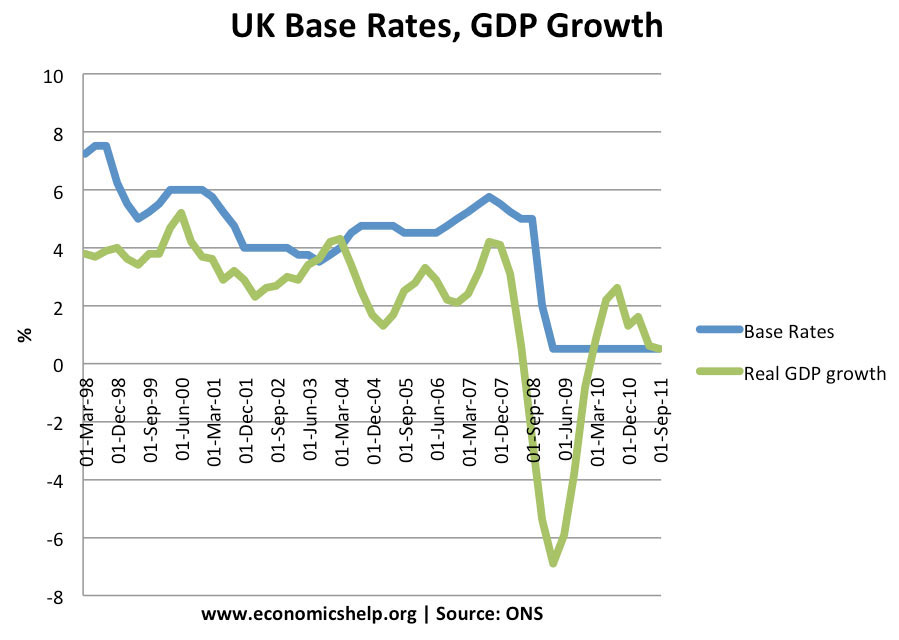

The recession in 2008/09, caused the Bank of England to cut interest rates dramatically to try and boost economic recovery. Interest rates fell from 5% to 0.5% in a few months

The MPC of the Bank of England has an inflation target of 2% +/-1. They also consider other economic objectives such as economic growth and unemployment. If inflation is forecast to fall below the target, they can consider loosening monetary policy to target higher inflation and enable a higher rate of economic growth.

Also, if the economy is forecast to enter into a recession, they are likely to cut interest rates and try to boost economic growth.

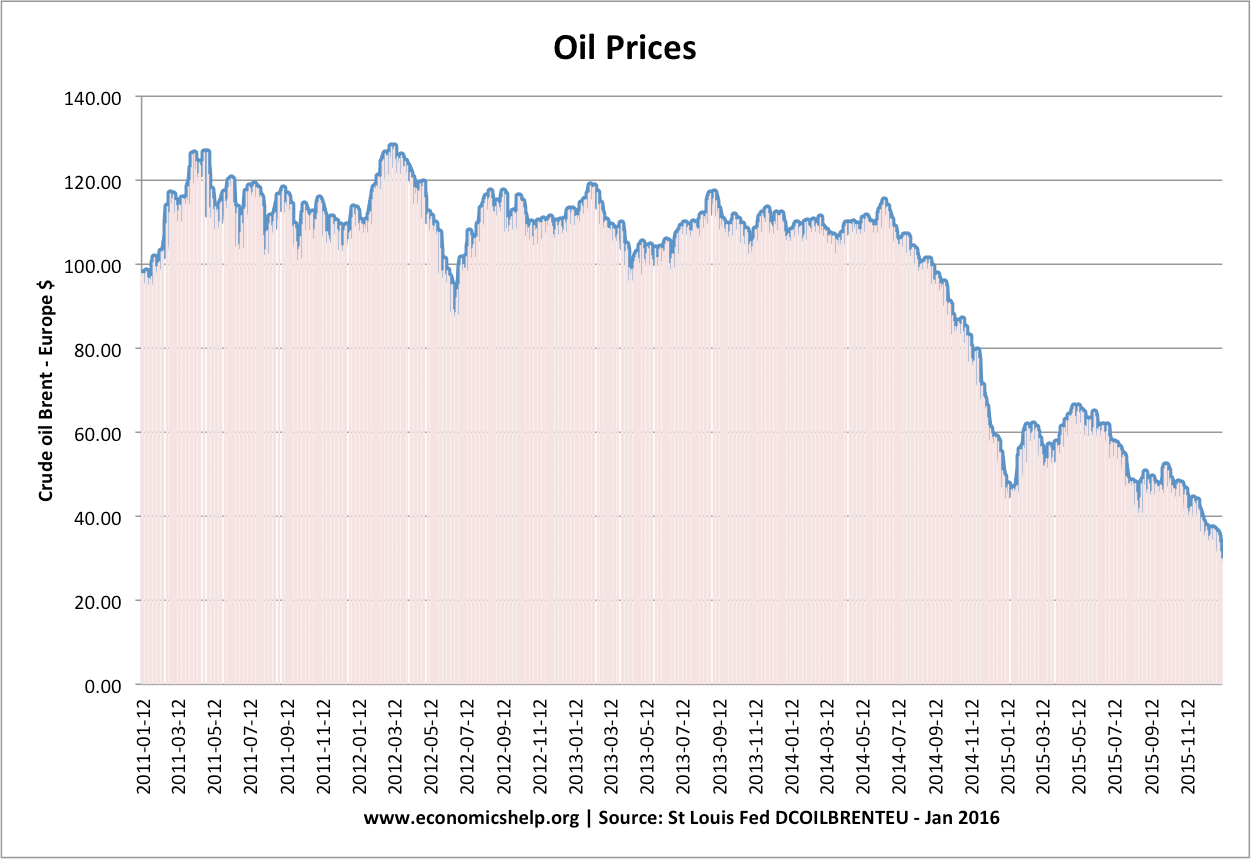

In some cases, they may pursue expansionary monetary policy, even if inflation is above target – if they think inflation is temporary and there is a greater risk of recession. (see: cost-push inflation)