Readers Question: How reliant is the UK economy on oil?

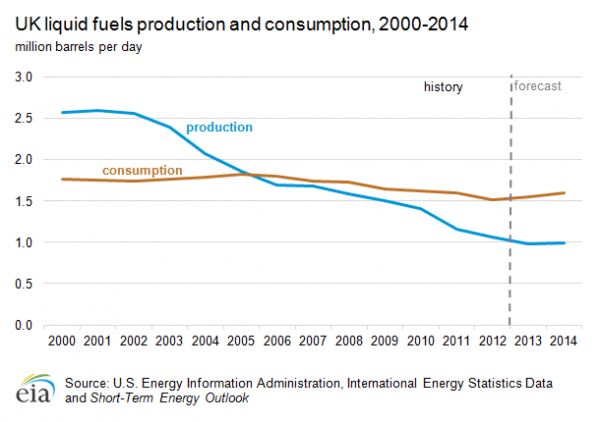

There are two ways of considering this question – the consumption and production of oil.

- Firstly, how much does the UK need to consume oil to maintain economic activity? Could we survive in a post-oil economy?

- Secondly, how important is the UK oil industry and the production of oil?

Consumption of oil

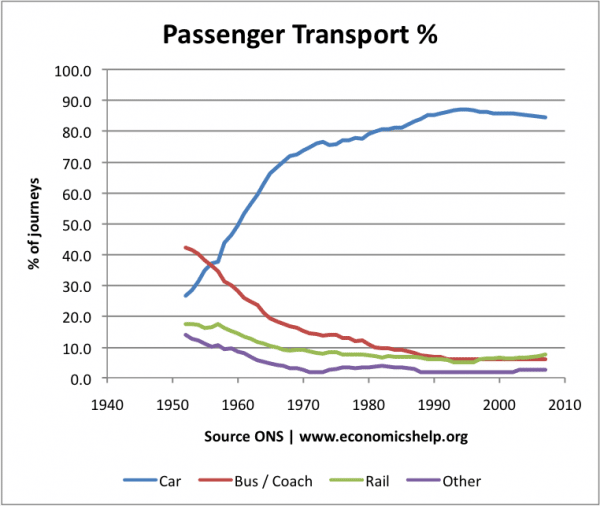

- Transport – cars, lorries e.t.c. mostly rely on petrol / diesel. (In the US transport accounts for 66% of all oil used. I imagine it is a similar statistic in the UK.)

- Production of plastic

- Fertilizers

- Asphalt

- Polyurethanes

- Solvents

- Electrical generation

Reducing dependency on oil consumption

- There have been some attempts to reduce the dependency on oil. In transport, the government have encouraged the consumption of electric cars, with subsidies and encouraging electric car charging points. But, between between 2010 and June 2013 only 5,034 electric cars have been registered. It is a small drop compared to the total number of cars sold.

- According to Calor, there are 160,000 LPG registered cars in the UK, and the number is on the rise.

- Energy efficiency. Cars have become more energy efficient with a high miles per gallon becoming a strong selling point. This has limited the growth in demand for petrol.

- Alternative forms of transport. Some see alternative forms of transport as a way to avoid reliance on oil based fuels. However, despite growth in cycling rates and increased use of trains, cars / lorries still dominate the UK’s mode of transport.

However, the improvements in energy efficiency and attempts to introduce alternative fuel cars are only limiting the growth in demand for oil based fuel.