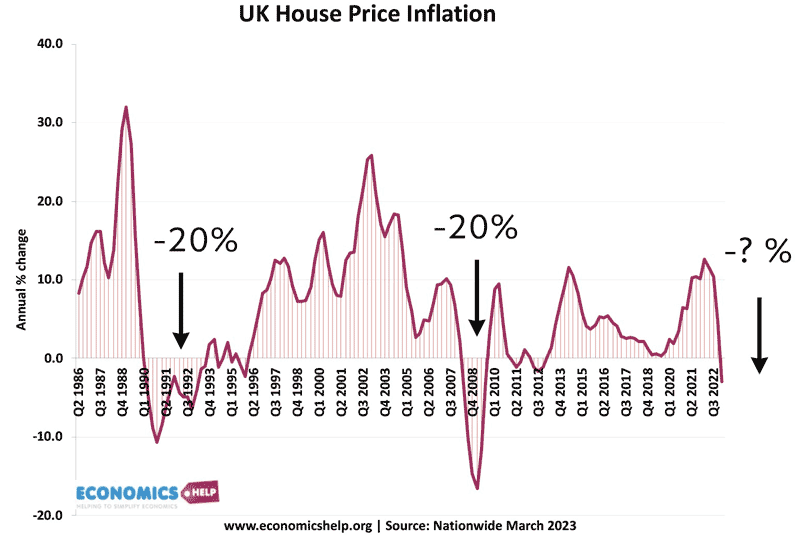

Will the Housing Market become less overvalued?

Last autumn, UK house prices reached record levels – with the highest price to income ratio since the nineteenth century. And just at this moment, the Truss/Kwarteng budget sent mortgage rates soaring – it was a shock to a market heavily reliant on ultra low-rates. This combination of factors was the perfect trigger for a …