Definition: Monopolistic competition is a market structure which combines elements of monopoly and competitive markets. Essentially a monopolistic competitive market is one with freedom of entry and exit, but firms can differentiate their products. Therefore, they have an inelastic demand curve and so they can set prices. However, because there is freedom of entry, supernormal profits will encourage more firms to enter the market leading to normal profits in the long term.

A monopolistic competitive industry has the following features:

- Many firms.

- Freedom of entry and exit.

- Firms produce differentiated products.

- Firms have price inelastic demand; they are price makers because the good is highly differentiated

- Firms make normal profits in the long run but could make supernormal profits in the short term

- Firms are allocatively and productively inefficient.

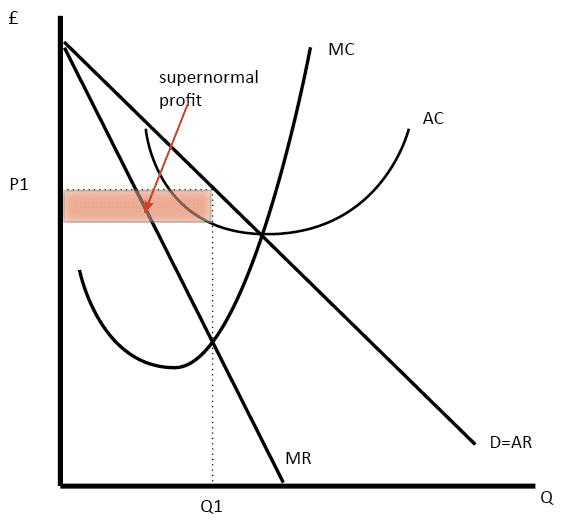

Diagram monopolistic competition short run

The firm maximises profit where MR=MC. This is at output Q1 and price P1, leading to supernormal profit

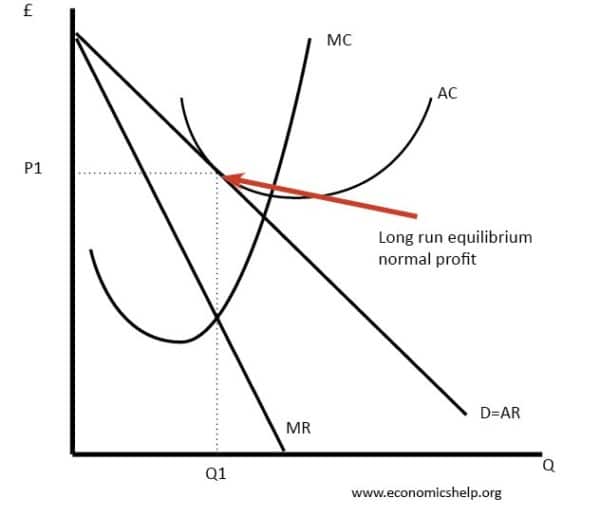

Monopolistic competition long run

In the long-run, supernormal profit encourages new firms to enter. This reduces demand for existing firms and leads to normal profit. I

Efficiency of firms in monopolistic competition

- Allocative inefficient. The above diagrams show a price set above marginal cost

- Productive inefficiency. The above diagram shows a firm not producing on the lowest point of AC curve

- Dynamic efficiency. This is possible as firms have profit to invest in research and development.

- X-efficiency. This is possible as the firm does face competitive pressures to cut cost and provide better products.