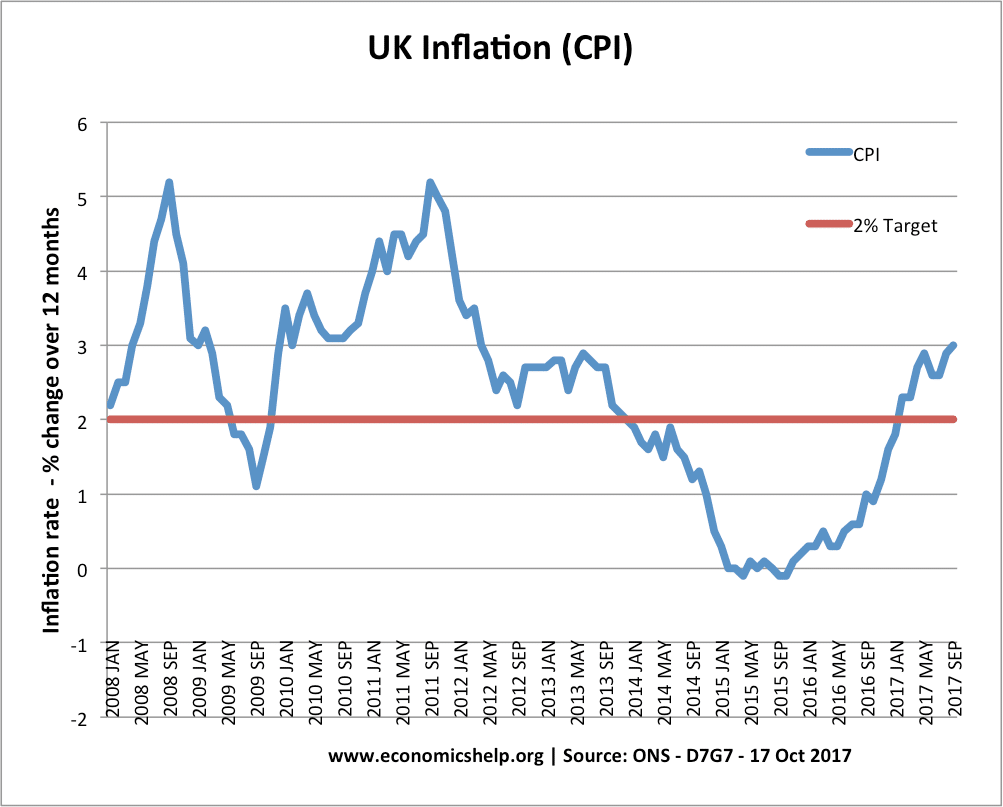

The UK government has given the Bank of England an inflation target of CPI 2 % +/-1. The Bank of England is responsible for using monetary policy (e.g. interest rates) to achieve this goal of low inflation. But, as well as targeting inflation, the Bank of England also has a wider remit of considering objectives such as economic growth.

During 2008 and 2010 the UK had inflation above the target as Bank of England were more concerned about recession

Summary – Should we aim for low inflation as the primary objective?

Since the spikes in inflation during the 1970s and 1980s, many economies have prioritised low inflation as the primary objective of monetary and economic policy. Low inflation has many benefits for an economy; it is seen as a building block for stability and encouraging investment. The hope is that by keeping inflation low, the economy will avoid ‘boom and bust’ economic cycles and provide a framework for economic stability and prosperity. If inflation gets out of hand, the economy will experience various costs of uncertainty, menu costs and loss of international competitiveness.

However, since the crisis of 2008, some economists have become increasingly critical of monetary/economic policy which targets low inflation and ignores other economic objectives such as full employment and economic growth. Critics argue that inflation targets can become too rigid, and recently (especially in Europe) the goal of low inflation has caused unnecessarily high unemployment and a prolonged recession.

Reasons why low inflation is a primary macroeconomic objective

There are many benefits of low inflation. Firstly, if inflation is low and stable, firms will be more confident and optimistic to invest; this will lead to an increase in productive capacity and enable higher rates of economic growth in the future.

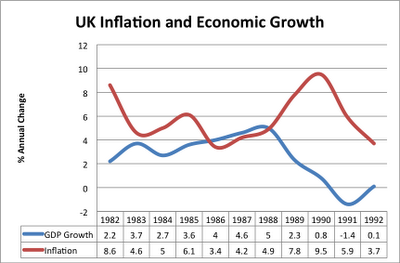

If inflation is allowed to increase because monetary policy is too lax, there could be an economic boom. But if this rate of economic growth is above the long run trend rate of growth, it is likely to be unsustainable, and the boom will be followed by a bust (recession). This occurred in the UK in the late 1980s and 1990s. Economic growth was too fast, causing demand-pull inflation. By the time inflation increased to 10%, it was too late, and the UK needed a rapid increase in interest rates, which caused the recession of 1991/92. Maintaining low inflation will help avoid these cyclical fluctuations in the economy which can cause booms and recessions

If inflation in the UK is higher than other countries, UK goods will become uncompetitive causing a fall in exports and possibly a deterioration in the current account of the balance of payments. This is particularly important if a country is in a single currency or fixed exchange rate because they can’t devalue to restore competitiveness. Keeping inflation low, will help the UK to be competitive. Low inflation will also help to increase the value of the Pound and maintain living standards.

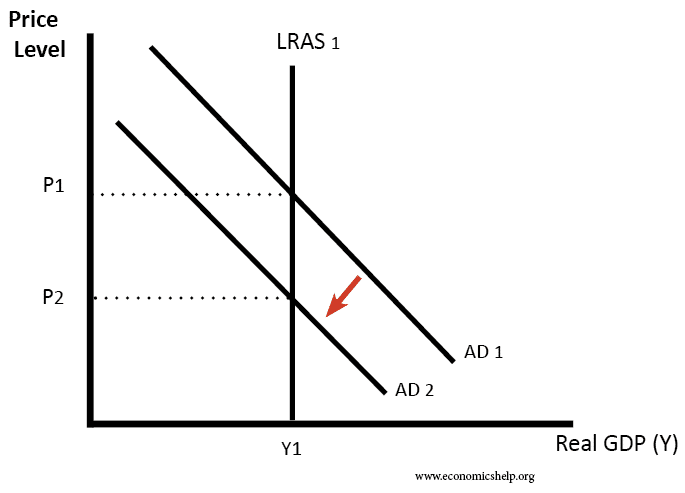

Monetarists believe that inflation can be reduced without conflicting with other macroeconomic objectives. This is because they believe that the LRAS in inelastic, therefore a fall in AD will only cause a temporary fall in Real GDP and after a short period the economy will return to the full employment level of National Output. Therefore the govt should not worry about a temporary rise in unemployment as a result of tight monetary policy because the economy will soon return to equilibrium. (See: is there a trade-off between inflation and unemployment)

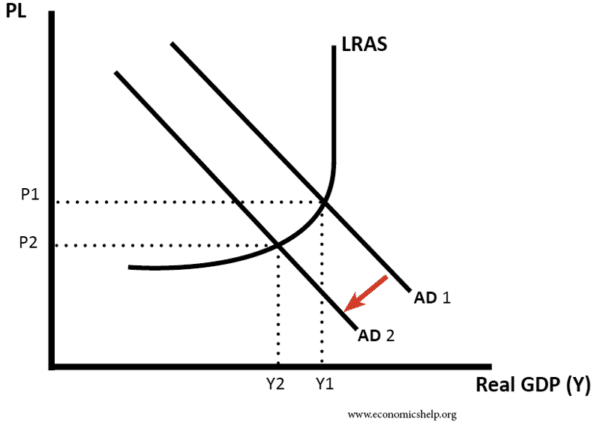

However, this view is not shared by all economists. Keynesians argue that if the economy can be below full capacity for a long time. To keep inflation within its target, it may be necessary to have a significant tightening of monetary policy which could cause a recession and persistent unemployment.

The above diagram shows a fall in inflation as a result of higher interest rates; however, it has caused a fall in AD and lower Real GDP. Keynesians argue that the economy may take a long time to recover because the negative multiplier effect will magnify any fall in AD. Also if confidence is low consumers may be reluctant to spend.

Problems of targeting low inflation

- To target low inflation may conflict with other macroeconomic objectives. To achieve a low inflation target, a Central Bank may need to persist with tight monetary policy, even if this causes low growth and high unemployment. The ECB has been worried about inflation, despite ongoing European recession, and as a result have been reluctant to pursue a looser monetary policy (such as Quantitative easing). This tight monetary policy has caused unemployment in Europe to rise to over 12%, and in southern European economies to even more.

- Some economists argue that a higher inflation target would help overcome problems of a liquidity trap and encourage a rise in nominal GDP. This is essential for promoting economic growth and dealing with high debt to GDP ratios.

- Inflation is more likely to conflict with unemployment if there was a supply-side shock such as lower productivity or an increase in the price of commodities. In this case, to keep inflation low would need a very tight monetary policy and a recession may be quite likely. During 2008, the UK experienced cost-push inflation, which caused inflation to rise to 5%. But, this inflation was misleading to the state of the economy. Demand was also collapsing. The Bank of England ignored the inflation and cut interest rates to target output.

- Unemployment has a greater social cost than inflation. Moderate inflation of 4-5% has only limited economic and social cost. It may cause some savers to see a fall in the real value of their savings, but generally, this is not as devastating as long-term unemployed. Long-term unemployment can be a cause of serious social problems, and social dissatisfaction. Greece with the highest unemployment rate in Europe is facing a growth in political extremism and a break down in many areas of social cohesion.

- A particular problem of low inflation in the Euro. Many countries in the Euro became uncompetitive because of different wage costs. Low inflation makes it difficult for a readjustment of prices within the Eurozone. Keeping overall European inflation low means some countries on the periphery are facing the prospect of deflation or close to deflation. Deflation has many serious costs, such as debt deflation and reduced spending. See: Problems of deflation

Conclusion

In conclusion, low inflation has many benefits which generally help to improve the economic performance of the economy. Also, in normal economic circumstances, it is possible to have low inflation and low unemployment. In this case, there is a good case for targeting low inflation and avoiding a boom and bust economic cycle.

However, in some circumstances keeping inflation low may be unsuitable for the economy. If there was a supply-side shock to the economy, keeping to the inflation target may cause increased unemployment and lower growth which is undesirable. Also, although low inflation can have many benefits, we shouldn’t ignore other objectives, such as economic growth and unemployment. It makes no sense to stick rigidly to low inflation when there is an unemployment crisis. Inflation is an important objective, but it isn’t the only one.

Related