I like this article about the wrong kind of inflation by Roger Bootle

Or as his cleaner said:

“It’s not the inflation they need to sort out, Mr Bootle, it’s the rising prices!”

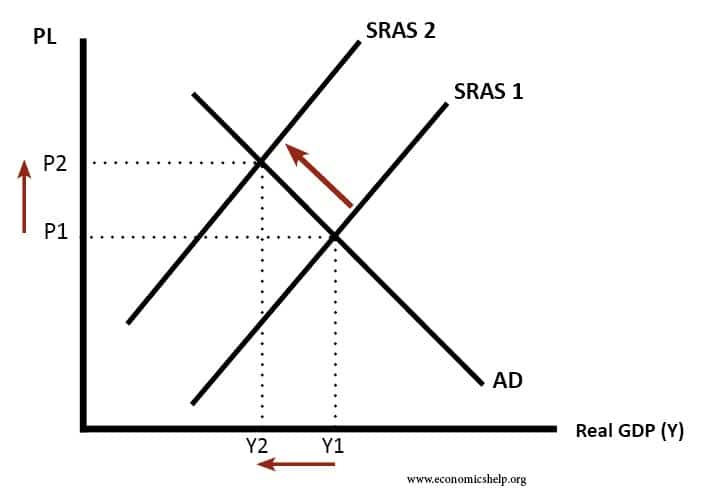

Essentially, the wrong kind of inflation is cost-push inflation. This inflation is due to rising costs of production, such as rising energy prices, rising transport costs, imported inflation and rising food prices. This inflation causes a shift to the left of short run aggregate supply. A simple SRAS / AD diagram shows how this kind of inflation also causes a fall in real GDP.

Cost push inflation, causing rising prices and falling real GDP. (note some textbooks may show SRAS as a straight-line, but the principle is the same)

This wrong kind of inflation leads to a fall in living standards. Since 2008, the UK has seen a fall in real wages. We have had the worst of both worlds – rising prices, but falling incomes (or at least stagnant incomes)

This bad type of inflation doesn’t cause a rise in wages. But, a fall in real wages. We may laugh at Mrs Bootle’s cleaner, but in a way she might be trying to say, inflation isn’t a problem, if money wages keep up. If money wages grow faster than inflation, then we can afford the rising prices. Our income has increased to meet the higher cost of living.

If I was the cleaner for the ECB, I’d be tempted to barge into a meeting and say.

“It’s not the inflation, you need to sort out, its the falling GDP!”

Does that mean there is a ‘Good’ Type of inflation?

Many economists would be nervous about calling it ‘good inflation’, They would still fear the costs of inflation.

Perhaps we could call it ‘normal’ inflation.

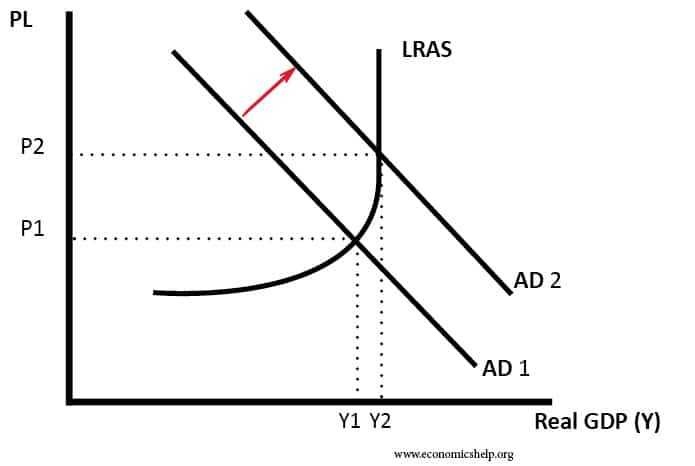

Usually, inflation is caused by rising aggregate demand (demand-pull inflation). Inflation is a sign the economy is approaching full employment. Growth is strong, unemployment low, and the government are receiving strong tax revenues helping to reduce the budget deficit. Inflation may have some costs, but at least we get lower unemployment as a result.

Demand-Pull inflation

This inflation is good because at least policymakers feel it is under their power to reduce it. For example, if the MPC felt the economy was growing too strongly and demand-pull inflation was increasing too quickly, they could put up interest rates to lower the inflation rate. There may be time-lags, it may be difficult to predict when to raise rates. But, this is the kind of inflation, policymakers are used to dealing with. They have an inflation target, and it’s their job to meet it.

The problem is that at the moment, policy makers feel impotent. Inflation is above their target, but they can’t really increase interest rates because the economy is in a recession and unemployment is very high (though the ECB did raise rates in 2011, but that’s another story). Therefore, the MPC has to write lots of letters to the chancellor explaining that this inflation is temporary and doesn’t really reflect underlying inflationary pressures. They have a good point, but after quite a few years of explaining away ‘temporary inflation’, policy makers don’t look so strong.

Policy makers then get criticised on all sides.

- Savers complain that inflation is reducing the value of their savings.

- The unemployed will complain that the monetary authorities are not doing enough to stimulate demand and create positive economic growth

What can we do about bad inflation?

Usually not a lot.

- For example, if we take volatile commodity prices. There isn’t much the government can do to reduce the price of oil or other commodities.

- In the UK, cost-push inflation has been caused by the weakness in the exchange rate, pushing up import prices. But, it wouldn’t make sense to strengthen the exchange rate when we are in a recession and facing a large current account deficit.

Change the Measure of inflation?

One option is to use a different measure of inflation.

CPI inflation is the headline rate, which includes all these volatile, short run factors like energy prices, food prices, import prices and taxes. But, if we have cost-push inflation, CPI will give a very poor guide to the output gap, the amount of spare capacity in the economy.

Arguably, the role of monetary and fiscal policy should not target an arbitrary headline inflation figure but to prevent an inflationary gap or deflationary gap. The inflation rate is useful, but it isn’t necessarily the holy grail. Some economists argue the recent recession shows that inflationary targeting is actually very limited as a guide to macroeconomic policy.

Rather than using CPI as a guide to the level of spare capacity and the situation of the economy, it would be better to use an underlying core-inflation measure, this would place greater emphasis on the underlying inflationary pressures in the economy.

Another option is to use wage inflation. If wage inflation is depressed, this suggests the economy is below full employment. Wage inflation will mean the economy is liable to over-heating.

This can easily be criticised. What is the use of targeting low inflation, if you use a different inflation measure when it is no longer fits your purpose? Policymakers may worry about a loss of confidence in the low inflation credentials. But, policymakers should be equally concerned about their low-unemployment credentials. There’s more to the macroeconomy than keeping CPI at an arbitrary figure of 2%.

Related

Great post. I have a longstanding fascination with cost-push.

Cracking article, very helpful, thanks

“This inflation is good because at least policy makers feel it is under their power to reduce it.”

The most flawed sentence in this analysis.