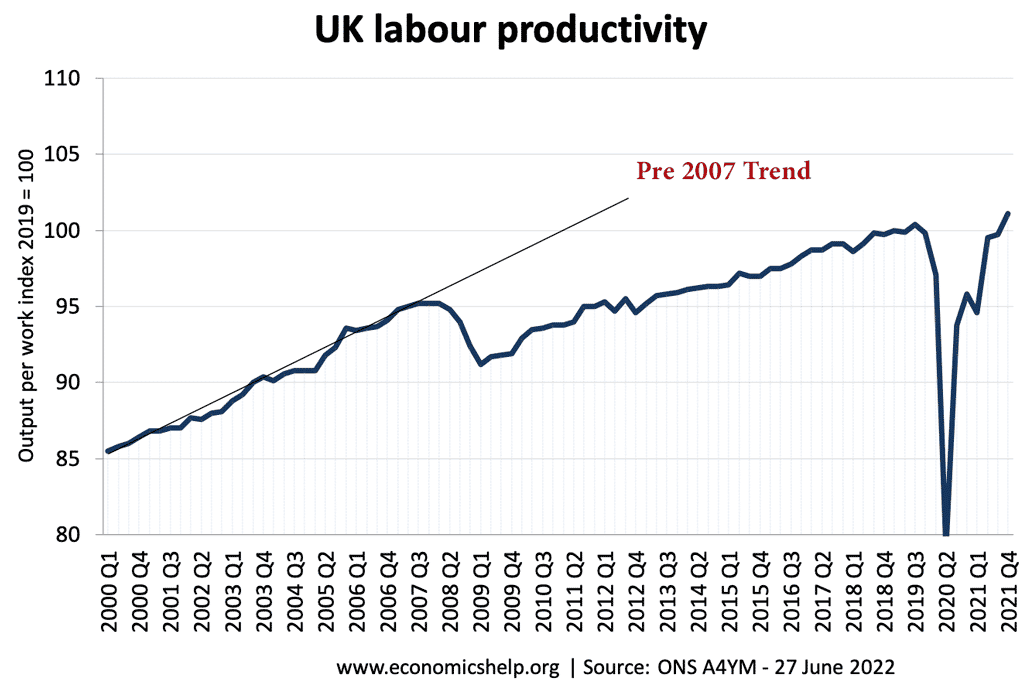

UK Labour Productivity

Labour productivity measures the output per worker in a period of time. Labour productivity is an important factor in determining the long-run trend rate of economic growth; tax revenues, inflation and real wages. Since the start of the great recession in early 2008, UK labour productivity growth has remained very low – well below the …