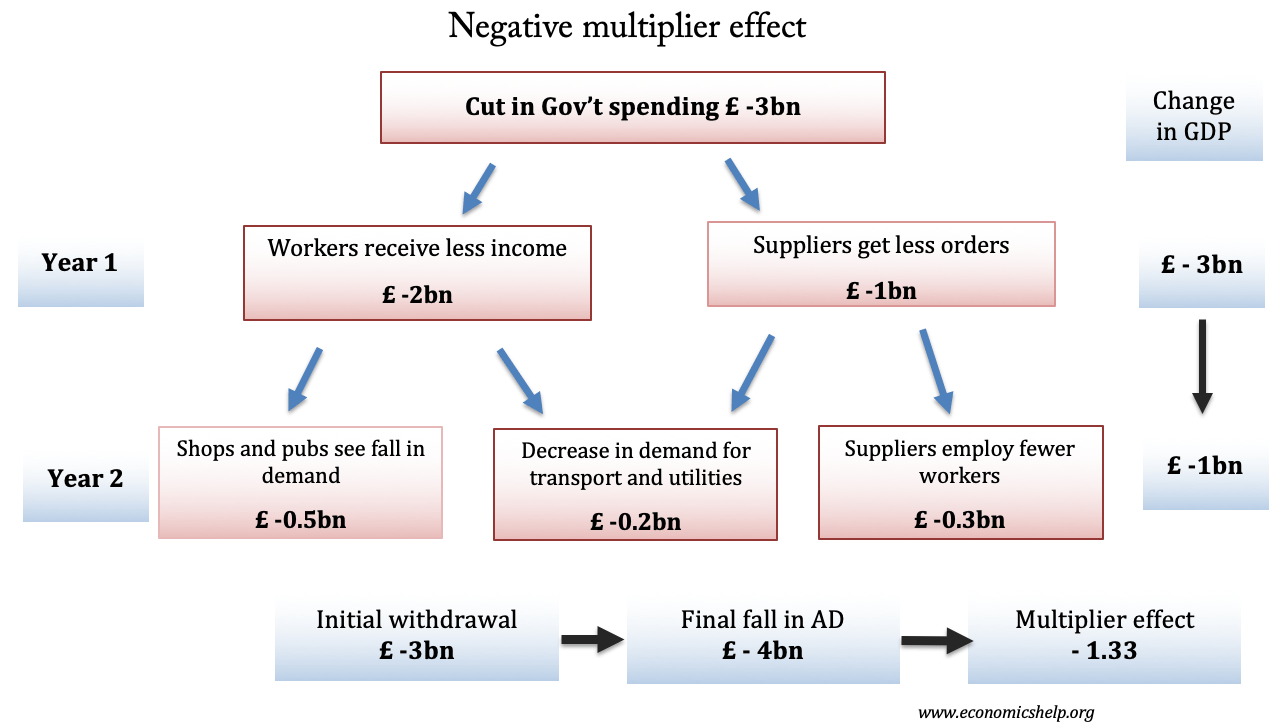

Negative multiplier effect

The negative multiplier effect occurs when an initial withdrawal of spending from the economy leads to knock-on effects and a bigger final fall in real GDP. For example, if the government cut spending by £10bn, this would cause a fall in aggregate demand of £10bn. However, the effect may be greater than the £10bn. If …