China’s Economic Crisis

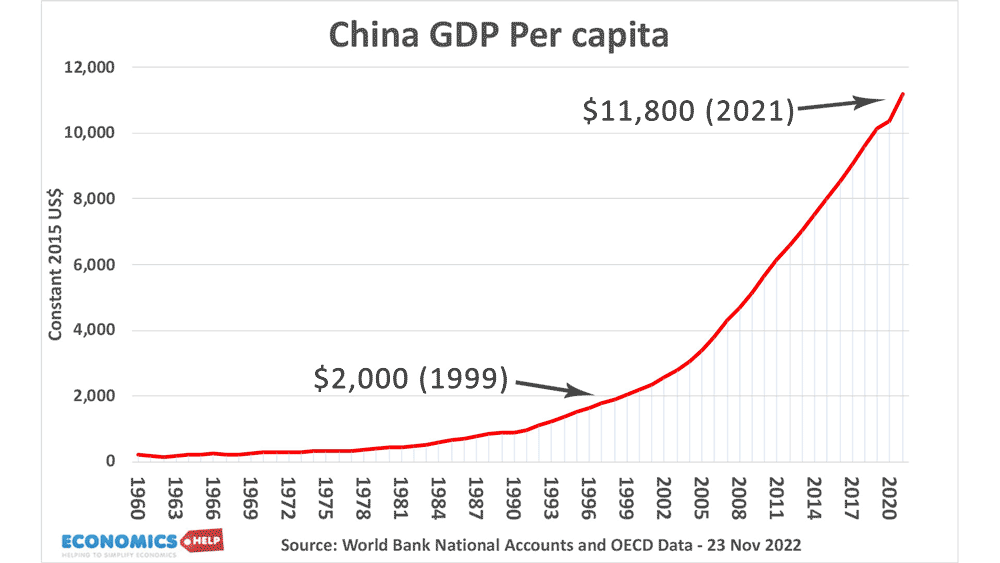

In the past few decades, the Chinese economy has grown at a breakneck speed, allowing living standards to soar with GDP per person growing 500% in the past 21 years. China has become a major force in the global economy with an estimated 20% of global GDP by 2027. Yet, the seemingly unstoppable rise of …