Sustainable growth

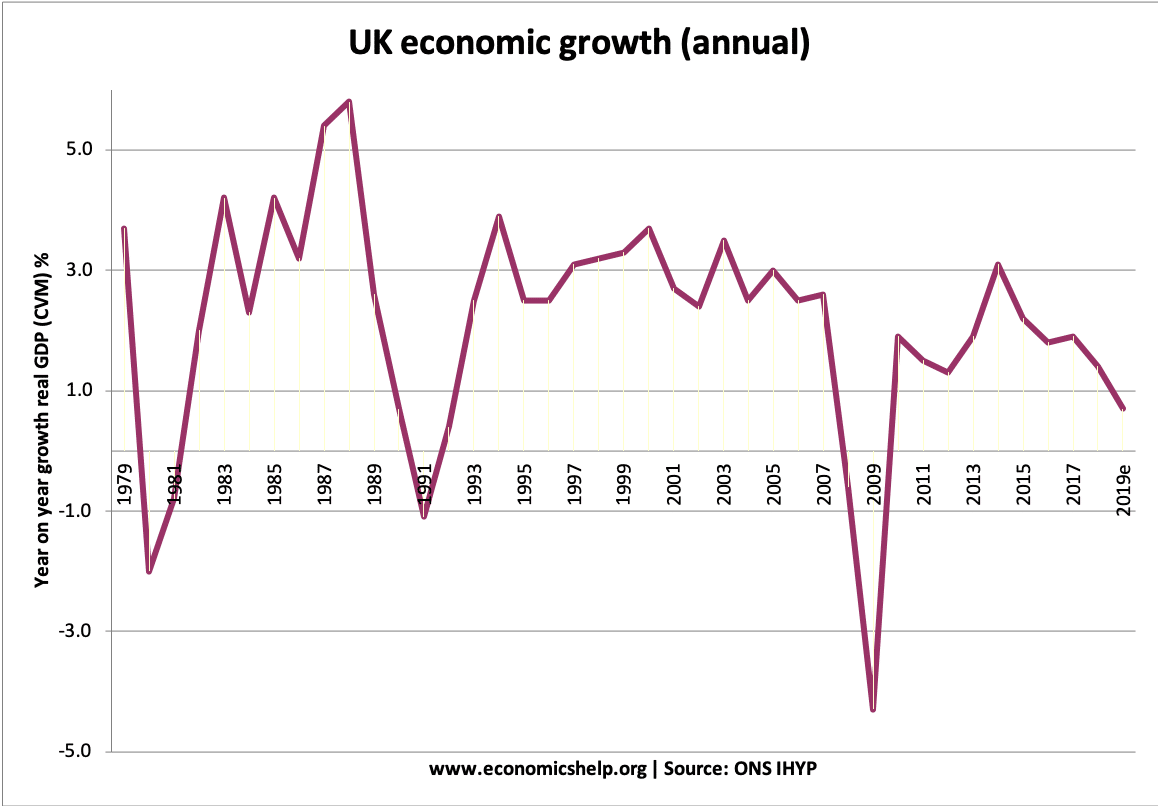

Sustainable economic growth implies that the growth rate can be maintained over the long term. Sustainable growth involves both Environmentally sustainable growth – e.g. not exploiting scarce resources. Sustainable growth in terms of low inflation and a balanced economy. Sustainable economic growth The long-run trend rate of economic growth is the rate of economic growth …