Impact of economic recession

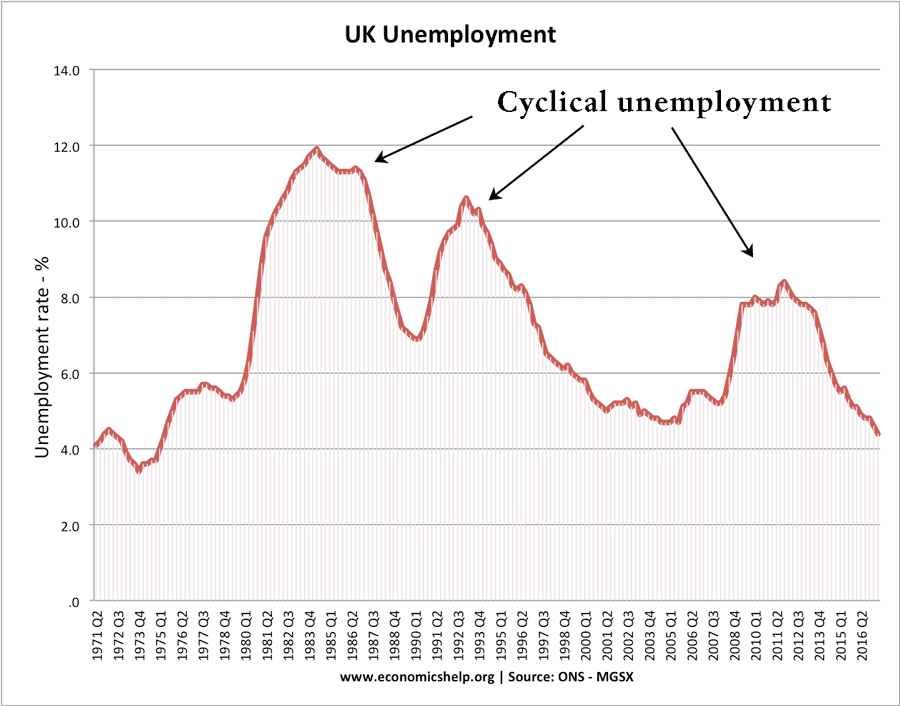

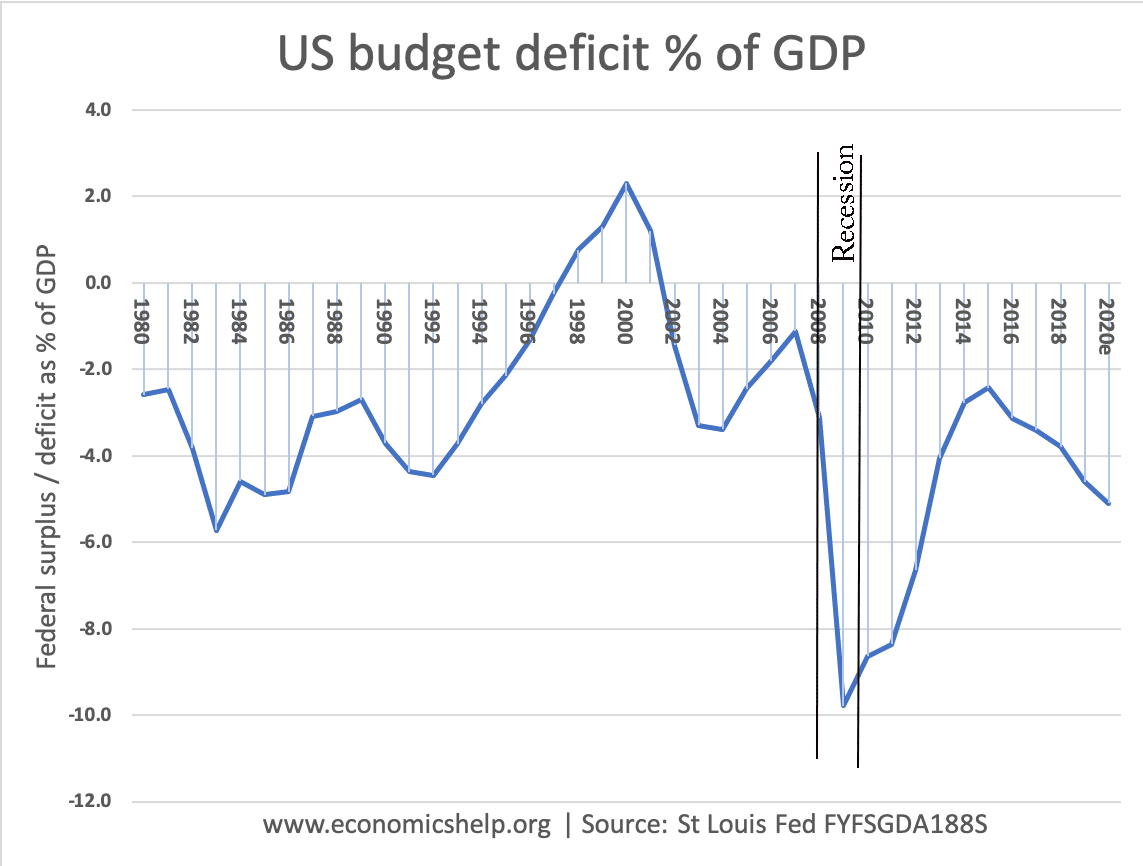

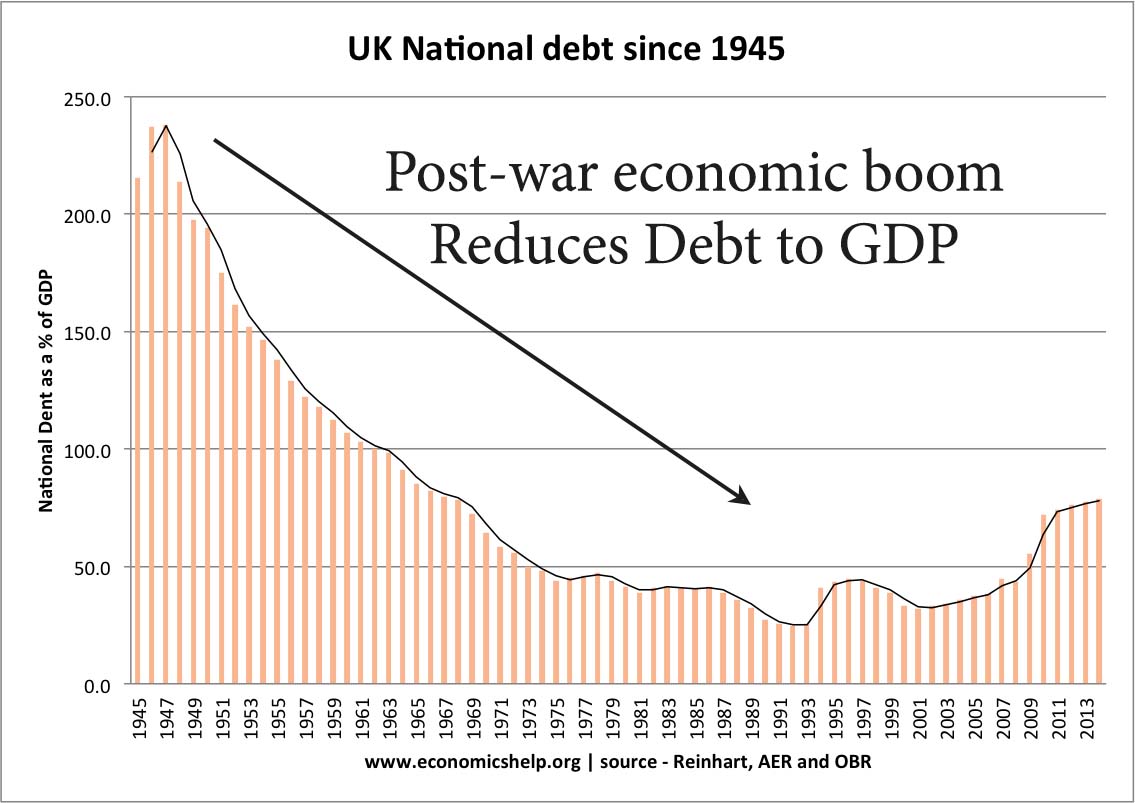

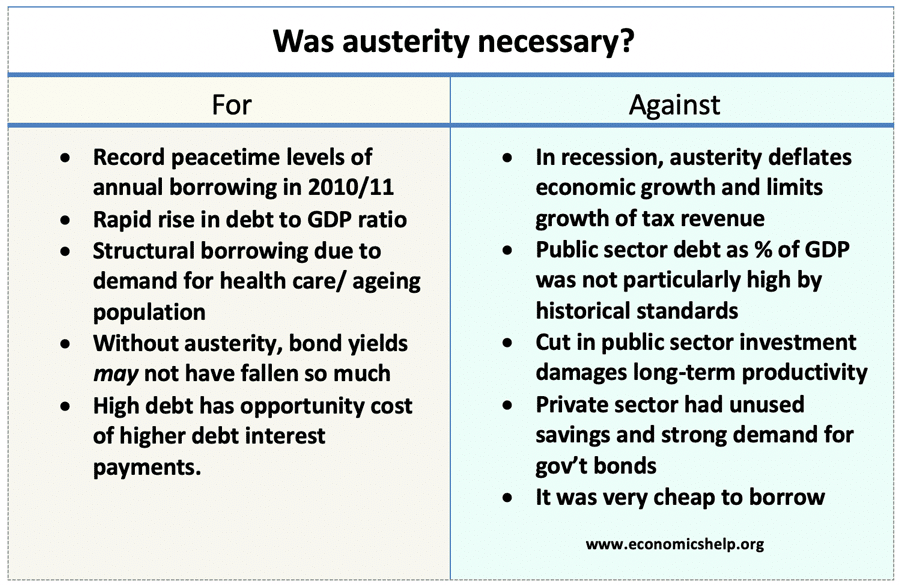

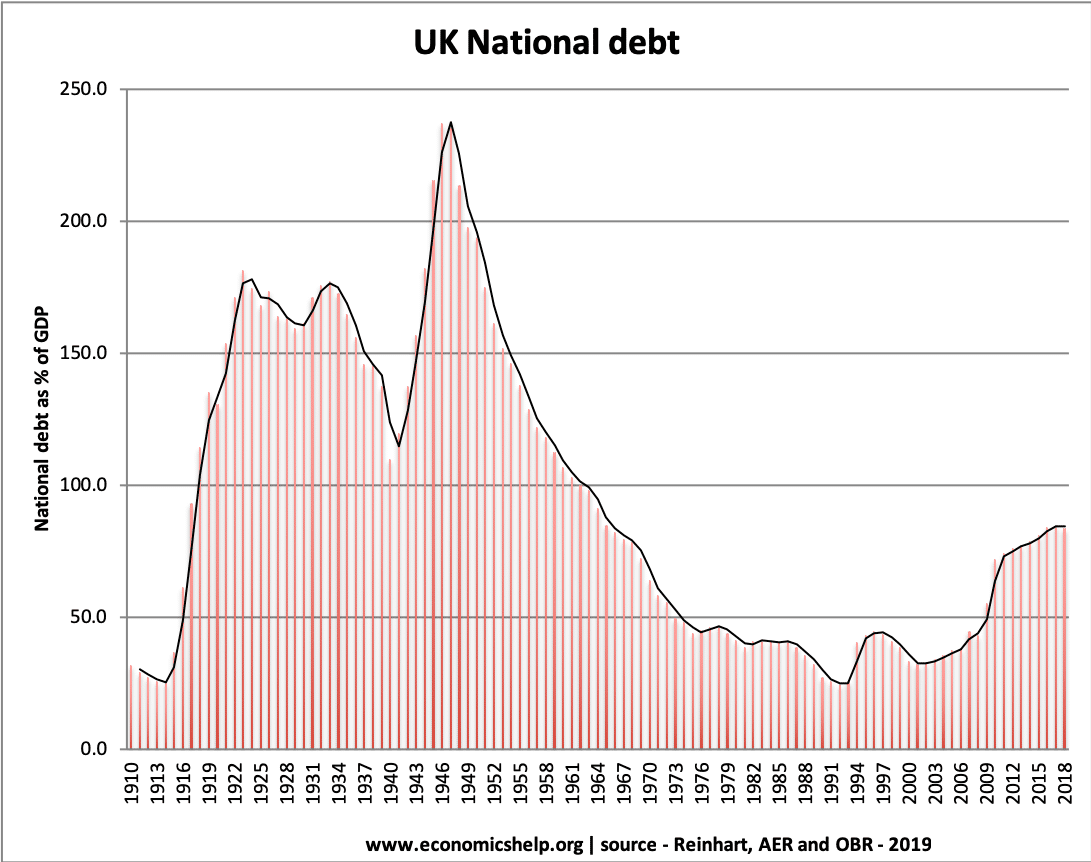

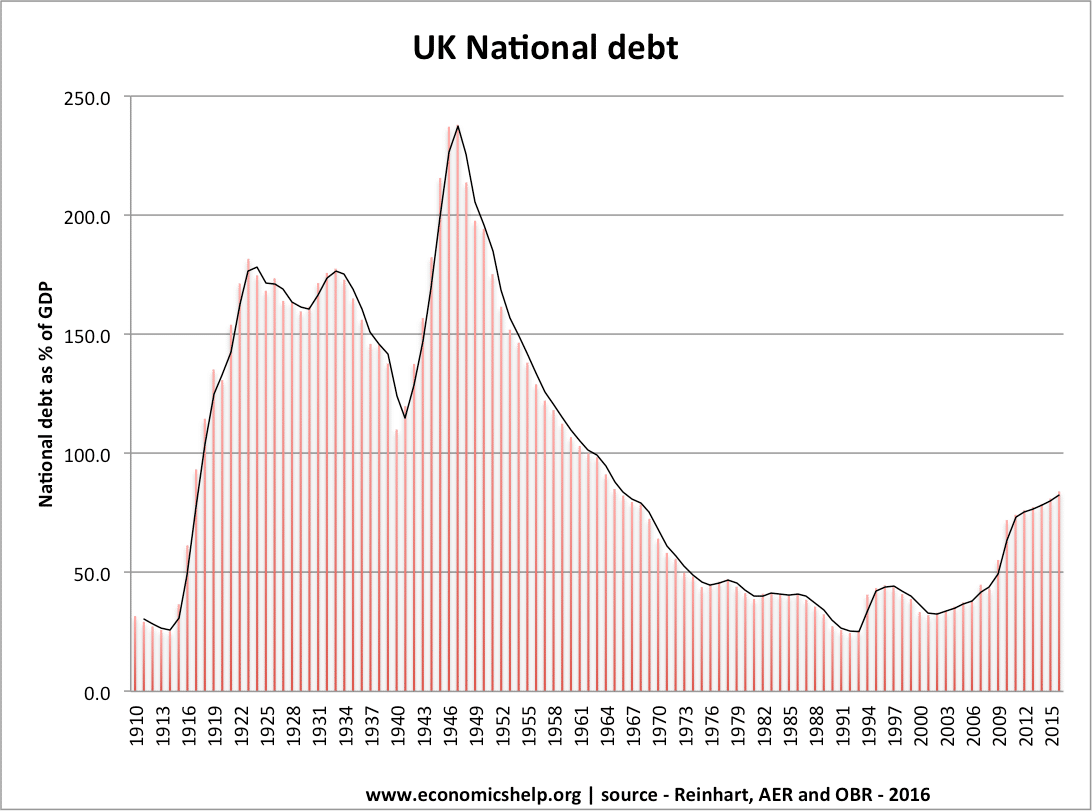

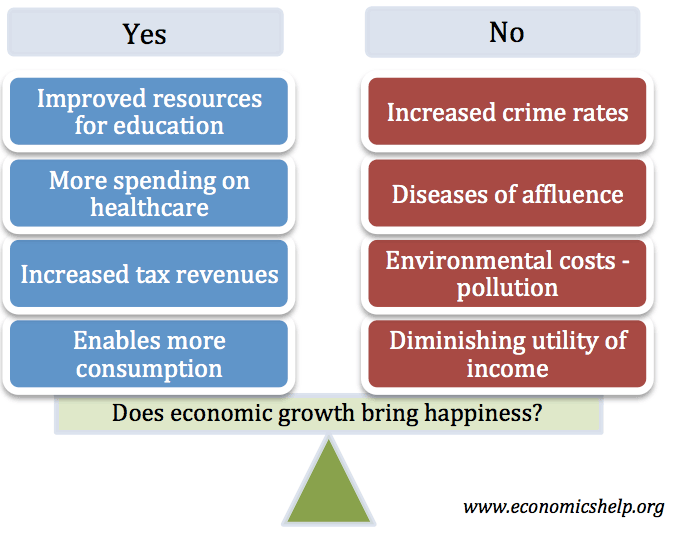

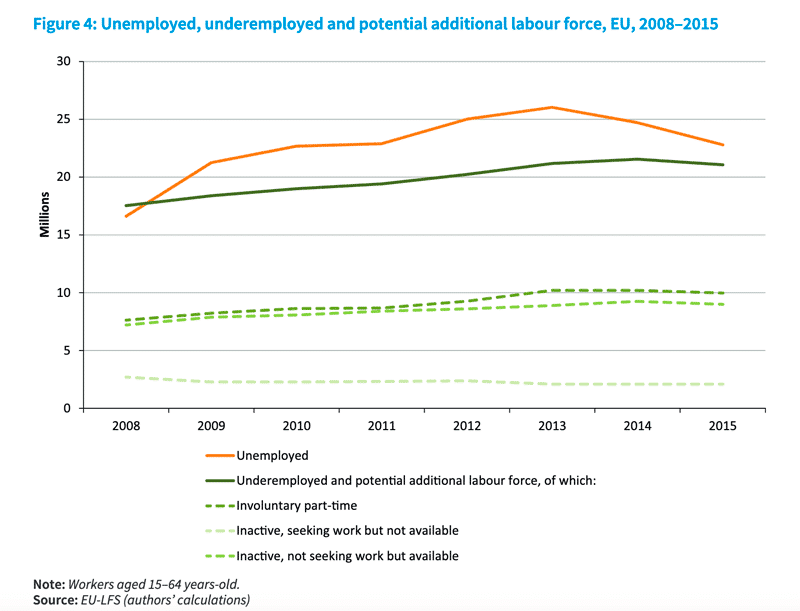

A recession (fall in national income) will typically be characterised by high unemployment, falling average incomes, increased inequality and higher government borrowing. The impact of a recession depends on how long it lasts and the depth of the fall in output. The main costs of a recession will be: Unemployment Fall in income – shorter …