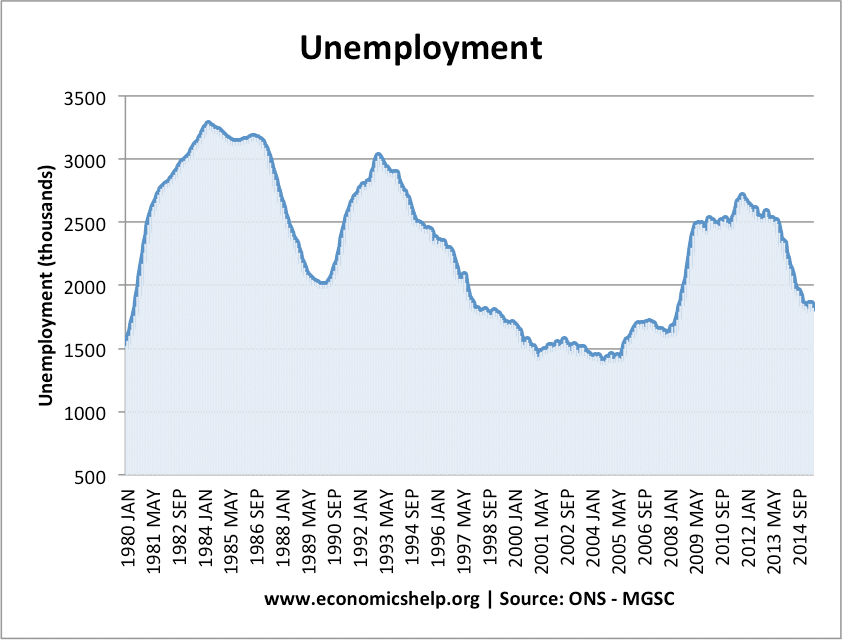

Reasons for falling UK unemployment

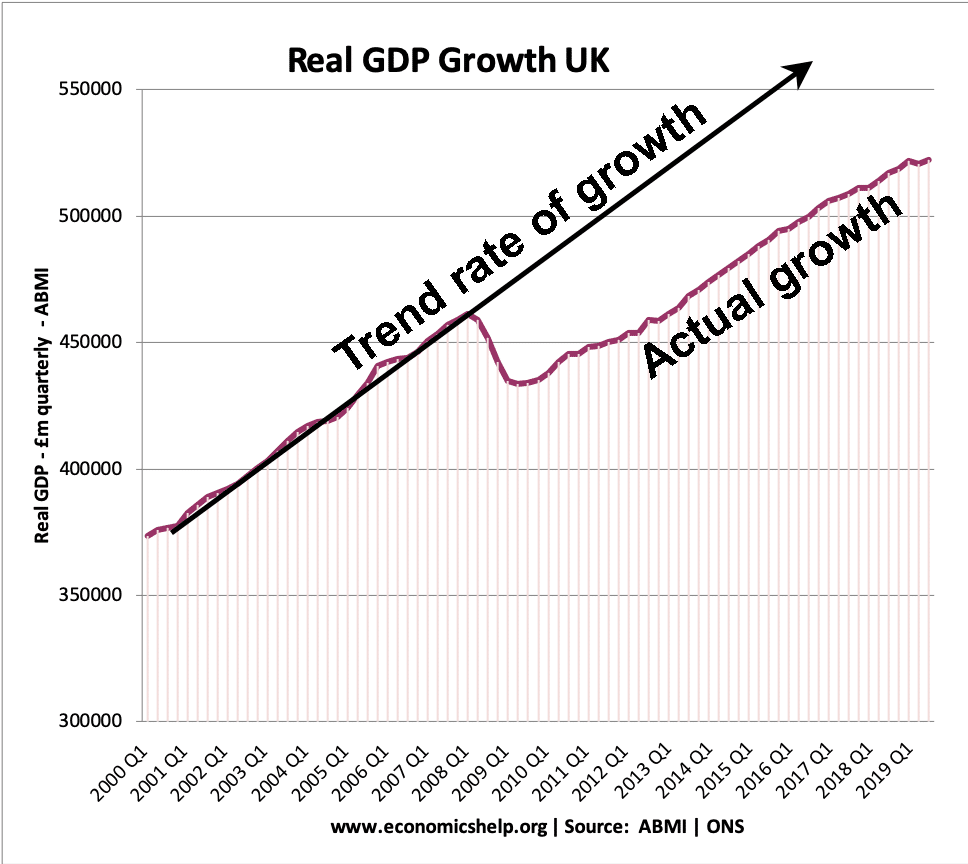

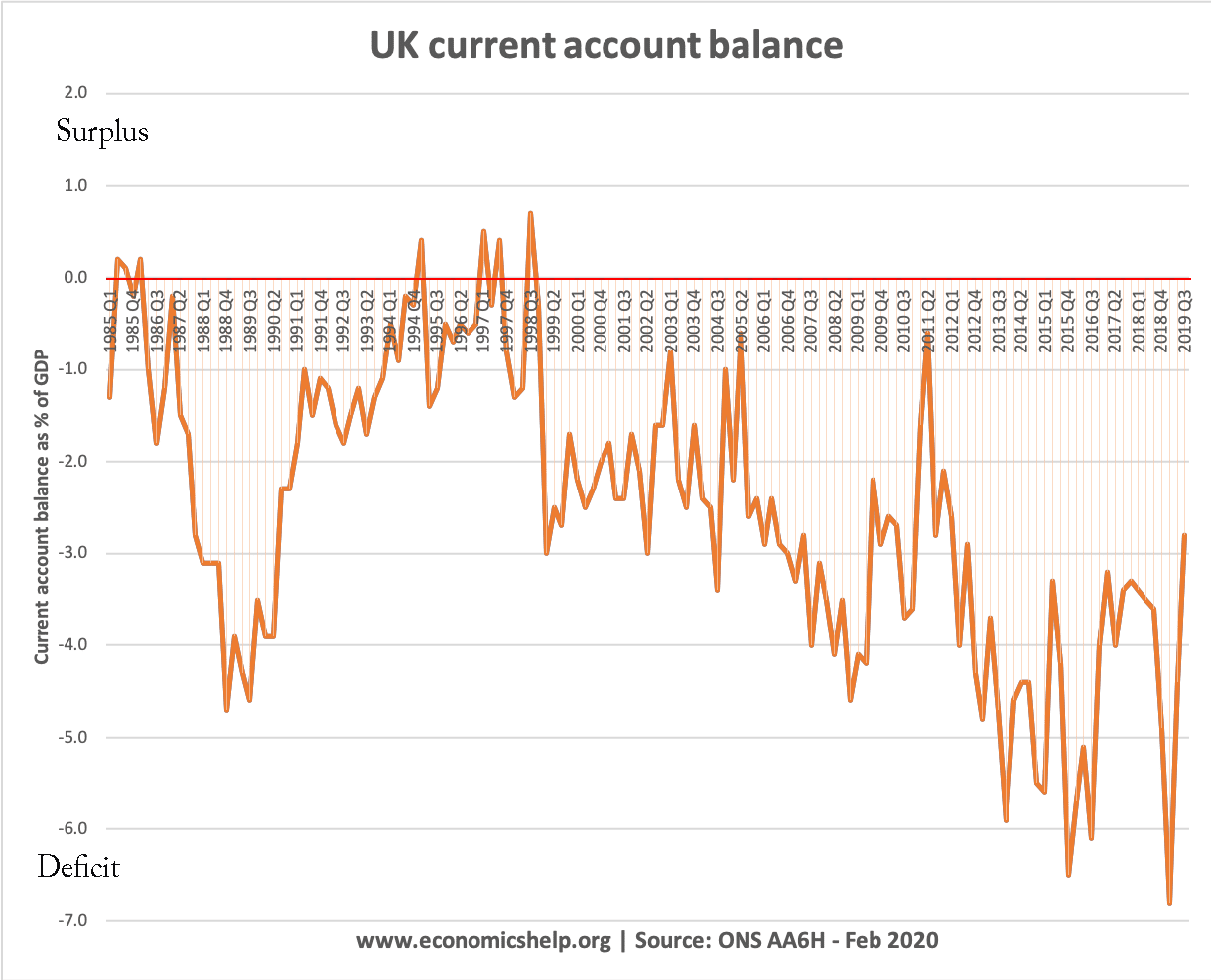

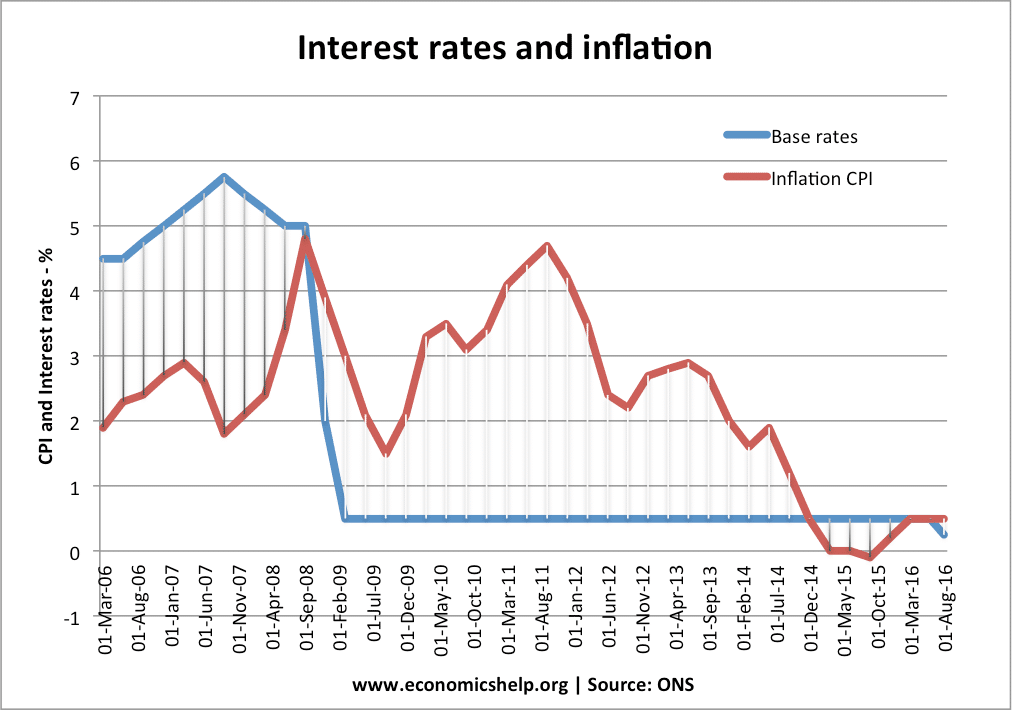

Despite weak economic growth of the past decade, UK unemployment has fallen quicker than we might expect. It appears the natural rate of unemployment has fallen and despite record employment levels, wage pressures remain muted. Different reasons for this fall in unemployment include – low productivity, more flexible labour markets, disguised unemployment (underemployment) and growth …