Economic impact of Margaret Thatcher

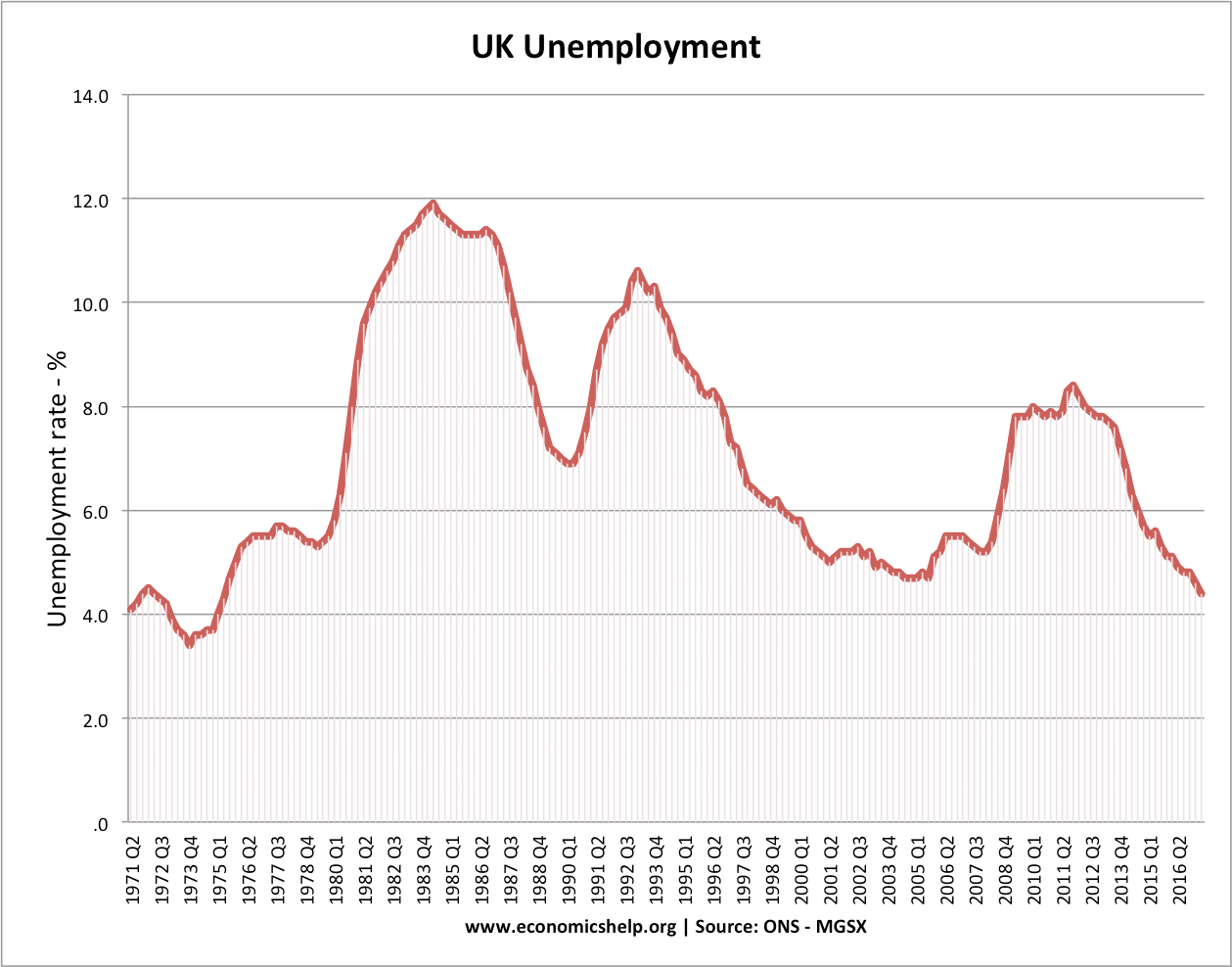

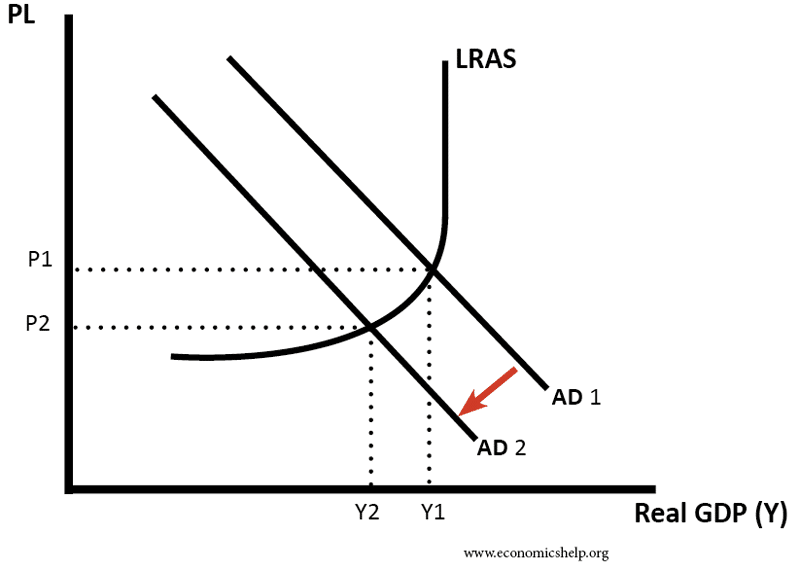

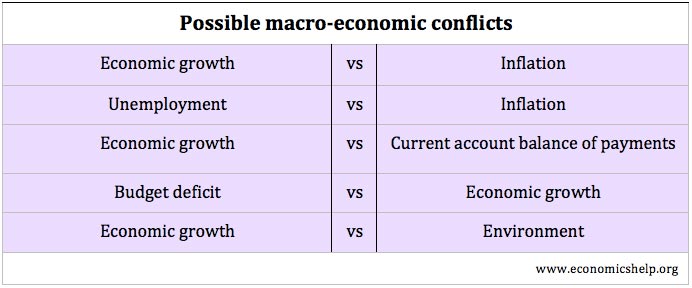

A look at the economic and social impact of Mrs Thatcher’s economic policies. Summary of Thatcher’s Economic policies Belief in the desirability of free markets over government intervention. E.g. pursuing policies of privatisation and deregulation. The pursuit of supply-side policies to increase efficiency and productivity. Reducing the power of trades unions and increased labour …