Why QE Will Cost the Taxpayer?

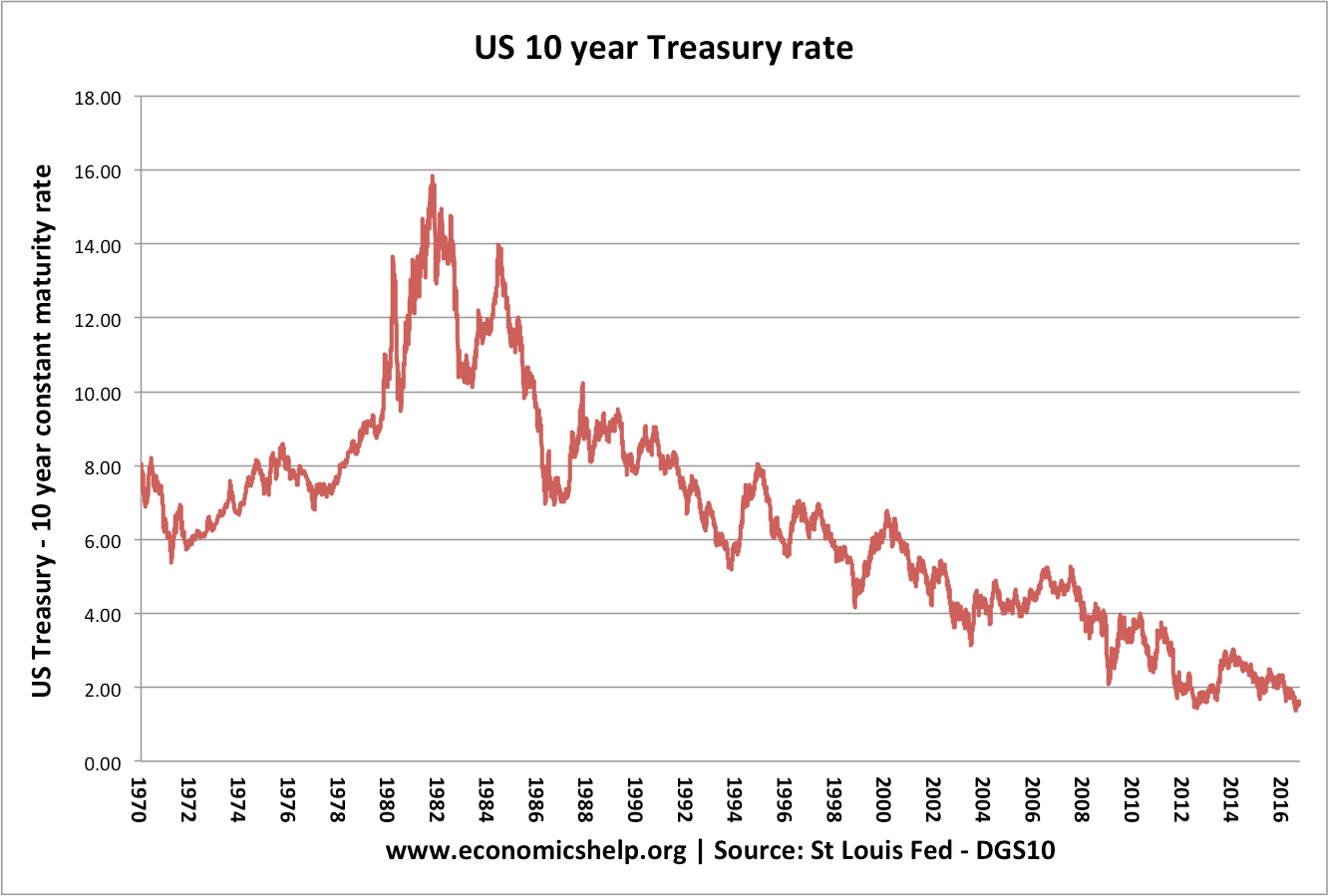

Under Quantitative Easing, the Central Bank created large quantity of bank reserves and bought bonds. Commercial bnks saw an increase in bank reserves. Initially, this made it cheaper for the UK Treasury to borrow. The Bank of England gained interest on the long-term bonds it bought, and for a time paid no interest on the …