Impact of funding for lending on credit and saving

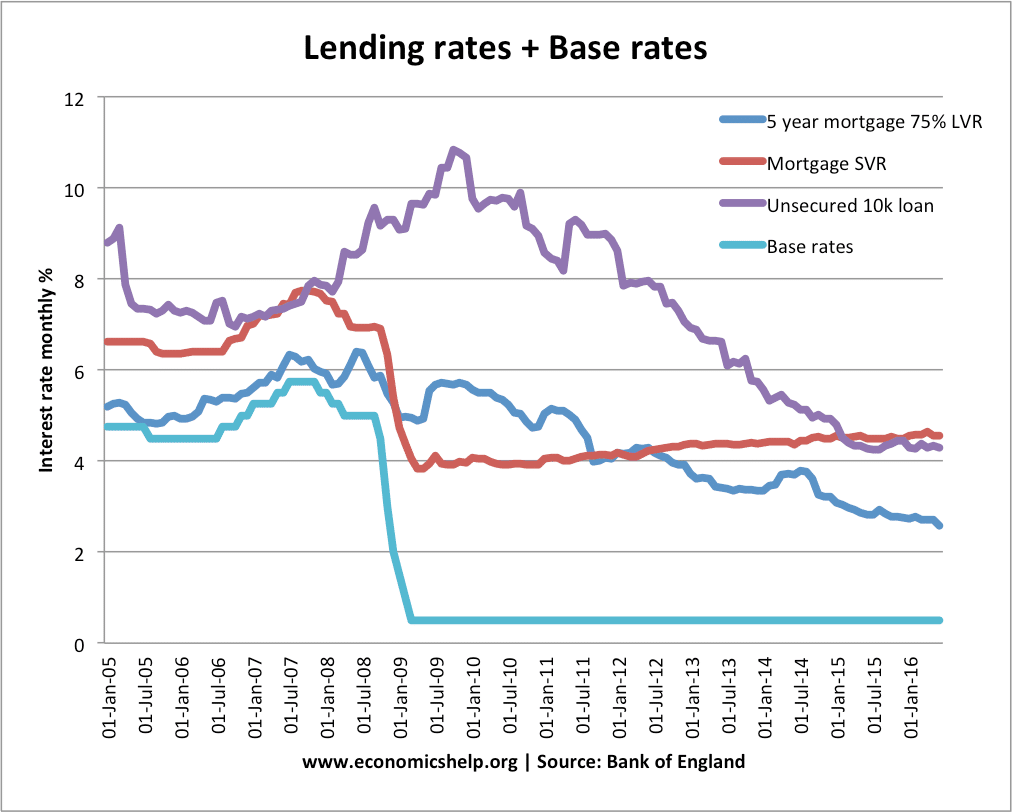

There is mixed evidence about the success of the Funding for Lending scheme Firstly, there is evidence that credit is still tight and firms are struggling to gain finance. Since last August, £1.8bn of credit has been drained out of the system At the same time, up to 40 lenders have accessed the £16.5bn in …