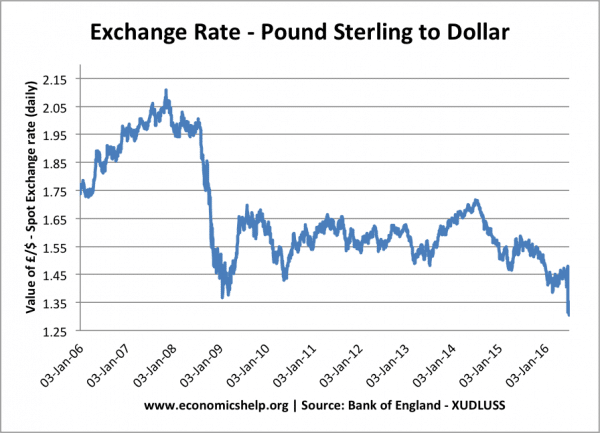

The Brexit vote has led to sharp fall in the value of the Pound, at one stage falling to £1 = $1.22 – a fall of over 15%. This will have a significant impact on British firms, consumers and also those outside Europe.

In short:

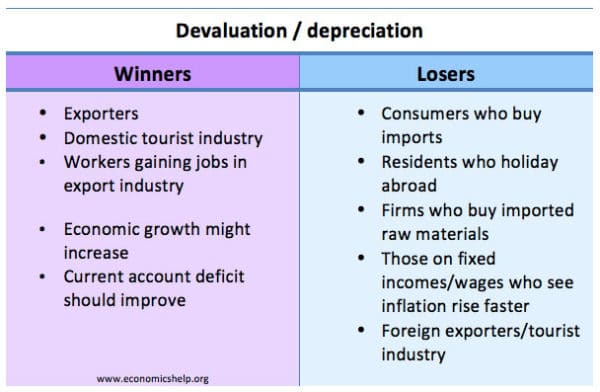

Winners from weak Pound

- UK exporters who will be more competitive.

- Foreign tourists coming to UK (a little ironic given context of Brexit vote!)

- Foreign investors who find British assets/housing cheaper.

- UK firms who earn profits abroad. (e.g. firms who have investments in the US)

Losers from weak Pound

- Foreign firms exporting to UK (e.g. Irish farmers hit by fall in Sterling)

- British holidaymakers going abroad will find US and EU more expensive

- Foreign workers in the UK. Working in the UK is relatively less attractive (could reduce incentive for net migration to the UK)

More detail.

Who benefits from a weak Pound?

- Firms selling goods abroad. Foreign buyers need less currency to buy the same quantity of UK goods. Therefore a weak pound means UK exporters can sell their goods cheaper and/or increase their profit margins. A weak Pound should help British manufacturers and exporters.

- However, the benefits of a weaker Pound depend on demand elsewhere in the world. If the Eurozone and US economies are struggling, then lower prices may be insufficient to lead to a big increase in UK export demand.

- Also, in recent years, British exports have proved to be quite inelastic. (British goods tend to be higher value goods and services – less sensitive to price change than manufactured clothes.

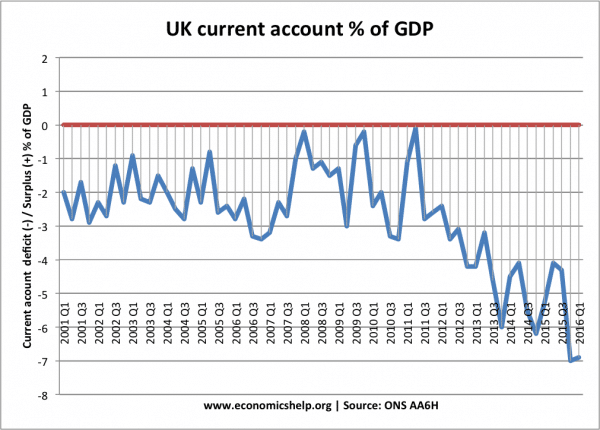

- The UK current account deficit. A fall in the value of the Pound should help improve the UK’s trade balance as exports become relatively more attractive than imports. The UK has had a persistent current account deficit since the early 1980s, in Q4 2015, it reached a record deficit of 7.2% of GDP. A weaker Pound will help reduce the deficit by making exports more competitive and reducing demand for imports. Though most people won’t notice any difference if the current account deficit reduces.

- Flexible firms who can shift from selling to the foreign market. If firms can switch sales from domestic sales to exporting, they will benefit from more competitive exports. This depends on their market and how flexible their business is.

- Economic growth. Given the uncertainty around Brexit, it may lead to lower UK investment and lower spending – this could lead to lower economic growth and even a recession. (See: will Brexit cause a recession?) The fall in the Pound helps to sustain domestic demand and will offset factors causing lower economic growth. However, it does depend on whether Europe wants to buy UK exports. If Eurozone enters into recession, the fall in the Pound may only have limited impact on increasing exports.

- Workers paid in dollars. If the Pound falls in the long-term, there may be more incentive for British workers to find employment in the US or Europe, because the dollar wage will earn relatively more.

Who loses from a weak Pound?

- British consumers buying imported goods. Many imported items like food, petrol and electrical goods will become more expensive as the Pound weakens. This will push up shop price inflation. If the devaluation is sustained, we could see permanently higher prices in the shops. Though if the economy is very weak, underlying inflationary pressures will remain low.

- Inflation. As a rough rule of thumb, a 10% devaluation may increase prices by 2-3%. The components of the CPI most affected by a devaluation are: (regression coefficient – Source: FT)

- Air travel (-1.29)

- Vegetables (-1.22)

- Gas (-0.71)

- Fuel (-0.54)

- Books (-0.35)

- British tourists. Going abroad to New York or Paris will be more expensive as a Pound will get less foreign currency.

- Firms importing raw materials. Firms who import raw materials from Europe / rest of the world will face a large rise in costs. Some firms have no alternative but to import raw materials and goods from abroad. For example, companies importing champagne or Spanish food items to sell to British consumers will be facing a tough time because the Euros strength has reduced their profit margins.

- Uncertainty may reduce capital flows. Combined with the uncertainty of Brexit and loss of direct access to Single Market, foreign investors may decide the UK is not a good place to save and invest their money. This could lead to a degree of capital flight, which will magnify the initial fall in the Pound.

- Foreign workers. A devaluation in the Pound makes the UK a less attractive for foreign workers. For example, with a fall in the value of the Pound, migrant workers from Eastern Europe may prefer to work in Germany – rather than the UK. UK agricultural firms may have to push up wages to keep foreign labour. (see: migrants become more picky about UK jobs FT )

- Home grown fruit and veg. In recent years, the UK agricultural sector has seen a rise in the UK produced fruit and veg, but this has been heavily reliant on migrant labour. If firms find it hard to attract workers because of weaker Pound, they may shift production overseas.

Evaluation

- A crucial issue is whether the fall in the Pound is temporary or sustained. If the Pound is temporary, many people will only see short-term fluctuations in prices. However, if the fall in the Pound is sustained, it will lead to a long-term fall in purchasing power for goods from abroad.

- Also, the impact on exporters depends on many other factors. There have been periods of a decline in value of the Pound where UK firms haven’t really benefited because they had poor productivity growth and other problems. However, if foreign demand is high for British goods, many firms could benefit from lower Pound.

- However, the devaluation of 1992, proved to be helpful in strong economic growth, with low inflation. See: 1992 devaluation

- Another issue is how Brexit will affect UK and Eurozone economies. If the UK saw a large fall in inward investment because it is no longer in the Single Market, this could lead to lower aggregate demand and negate the benefit of higher export demand.

How far will the Pound fall?

Other economic issues of Brexit

Low-interest rates

A factor in the fall in the Pound is the very low-interest rates of the UK.

Related posts on exchange rate