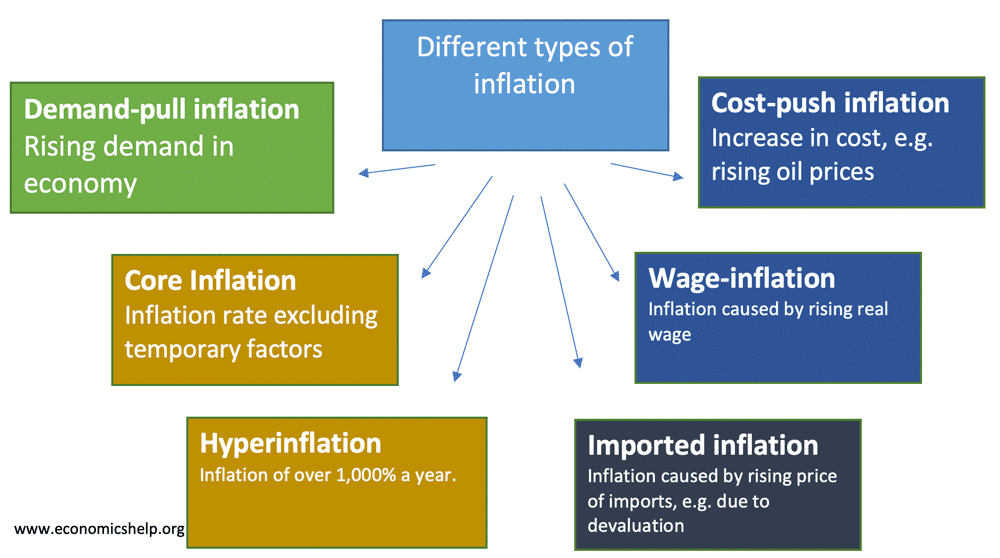

Inflation means a sustained increase in the general price level. The main two types of inflation are

- Demand-pull inflation – this occurs when the economy grows quickly and starts to ‘overheat’ – Aggregate demand (AD) will be increasing faster than aggregate supply (LRAS).

- Cost-push inflation – this occurs when there is a rise in the price of raw materials, higher taxes, e.t.c

We can also categorise inflation by how fast the price increases are, such as:

- Disinflation – a falling rate of inflation

- Creeping inflation – low, but consistently creeping up.

- Walking/moderate inflation – (2-10%)

- Running inflation (10-20%)

Types include of inflation include

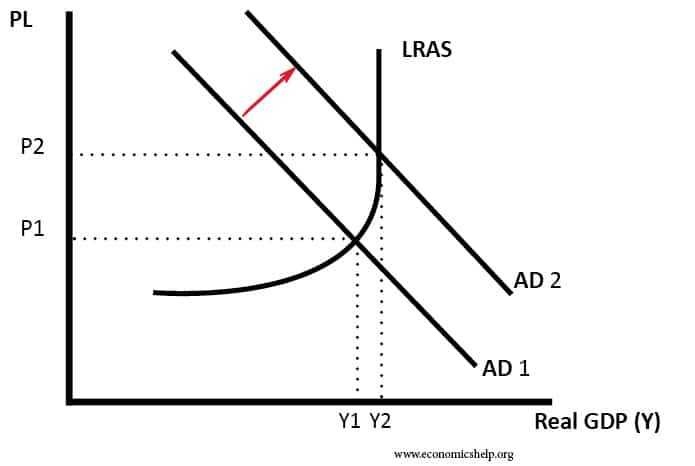

1. Demand-pull inflation

This occurs when AD increases at a faster rate than AS. Demand-pull inflation will typically occur when the economy is growing faster than the long-run trend rate of growth. If demand exceeds supply, firms will respond by pushing up prices.

A simple diagram showing demand-pull inflation

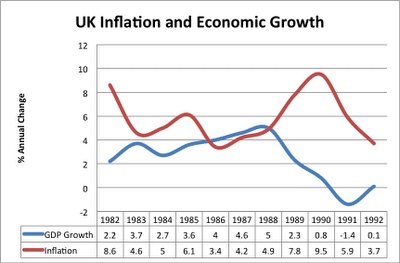

The UK experienced demand-pull inflation during the Lawson boom of the late 1980s. Fuelled by rising house prices, high consumer confidence and tax cuts, the economy was growing by 5% a year, but this caused supply bottlenecks and firms responded by putting up prices. Therefore the inflation rate crept up.

This graph shows inflation and economic growth in the UK during the 1980s. High growth in 1987, 1988 of 4-5% caused an increase in the inflation rate. It was only when the economy went into recession in 1990 and 1991, that we saw a fall in the inflation rate. See: Demand-pull inflation.

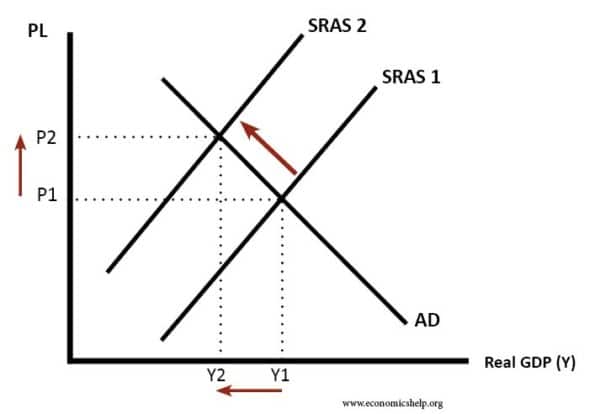

2. Cost-push inflation

This occurs when there is an increase in the cost of production for firms causing aggregate supply to shift to the left. Cost-push inflation could be caused by rising energy and commodity prices. See also: Cost-Push Inflation

Diagram showing cost-push inflation.

Example of cost-push inflation in the UK

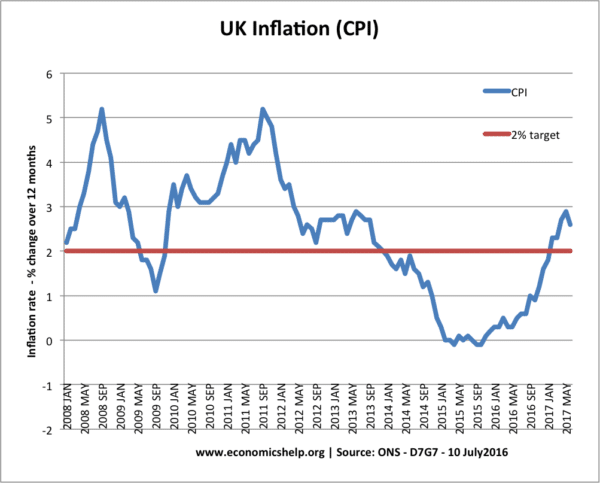

In early 2008, the UK economy entered a deep recession (GDP fell 6%). However, at the same time, we experienced a rise in inflation. This inflation was definitely not due to demand-side factors; it was due to cost push factors, such as rising oil prices, rising taxes and rising import prices (as a result of depreciation in the Pound) By 2013, cost-push factors had mostly disappeared and inflation had fallen back to its target of 2%. After the June 2016 Brexit referendum, Sterling fell another 13% causing another period of cost-push inflation in 2017.

Sometimes cost-push inflation is known as the ‘wrong type of inflation‘ because this inflation is associated with falling living standards. It is hard for the Central Bank to deal with cost push inflation because they face both inflation and falling output.

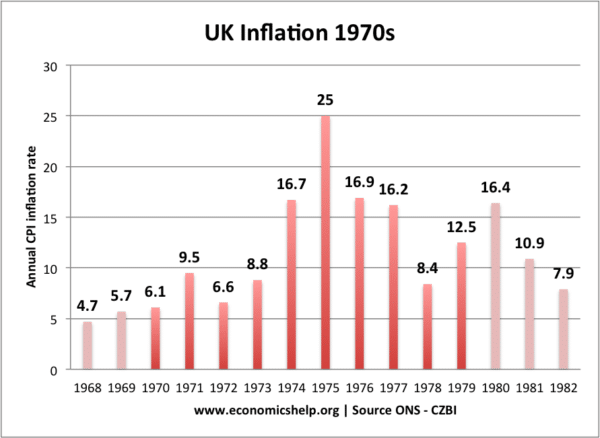

3. Wage Push Inflation

Rising wages tend to cause inflation. In effect, this is a combination of demand-pull and cost-push inflation. Rising wages increase costs for firms, and so these are passed onto consumers in the form of higher prices. Also rising wages give consumers greater disposable income and therefore cause increased consumption and AD. In the 1970s, trades unions were powerful in the UK. This helped cause rising nominal wages; this was a significant factor in causing inflation of the 1970s.

4. Imported Inflation

A depreciation in the exchange rate will make imports more expensive. Therefore, the prices will increase solely due to this exchange rate effect. A depreciation will also make exports more competitive so will increase demand.

5. Temporary Factors

The inflation rate can also increase due to temporary factors such as increasing indirect taxes. If you increase VAT rate from 17.5% to 20%, all goods which are VAT applicable will be 2.5% more expensive. However, this price rise will only last a year. It is not a permanent effect.

Core Inflation

One measure of inflation is known as ‘core inflation‘ This is the inflation rate that excludes temporary ‘volatile’ factors, such as energy and food prices. The graph below shows inflation in the EU. The headline inflation rate (HICP) is more volatile rising to 4% in 2008 and then falling to -0.5% in 2009. However, the core inflation (HCIP – energy, food, alcohol and tobacco) is more constant.

Types of inflation by rate of increase

Creeping inflation (1-4%)

When the rate of inflation slowly increases over time. For example, the inflation rate rises from 2% to 3%, to 4% a year. Creeping inflation may not be immediately noticeable, but if the creeping rate of inflation continues, it can become an increasing problem.

Walking inflation (2-10%)

When inflation is in single digits – less than 10%. At this rate – inflation is not a major problem, but when it rises over 4%, Central Banks will be increasingly concerned. Walking inflation may simply be referred to as moderate inflation.

Running inflation (10-20%)

When inflation starts to rise at a significant rate. It is usually defined as a rate between 10% and 20% a year. At this rate, inflation is imposing significant costs on the economy and could easily start to creep higher.

Galloping inflation (20%-1000%)

This is an inflation rate of between 20% up to 1000%. At this rapid rate of price increases, inflation is a serious problem and will be challenging to bring under control. Some definitions of galloping inflation may be between 20% and 100%. There is no universally agreed definition, but hyperinflation usually implies over 1,000% a year.

Hyperinflation (> 1000%)

This is reserved for extreme forms of inflation – usually over 1,000% though there is no specific definition. Hyperinflation usually involves prices changing so fast, that it becomes a daily occurrence, and under hyperinflation, the value of money will rapidly decline.

Related concepts

- Shrinkflation – when the price stays the same, but firms reduce the size of the good – effectively a price increase.

- Disinflation – a fall in the inflation rate. It means prices are increasing at a slower rate.

- Deflation – a fall in prices – a negative inflation rate.

Example of Inflation in the UK

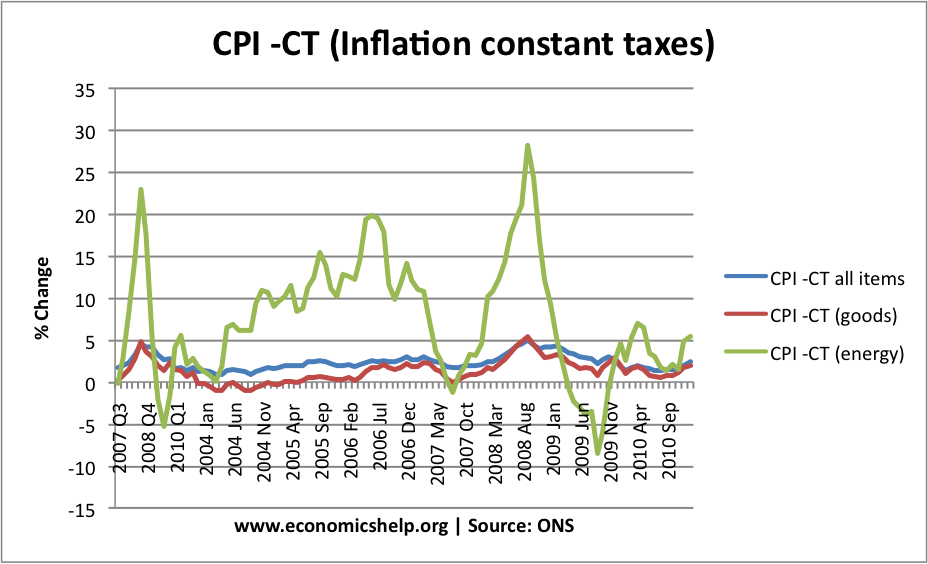

This shows that energy prices were very volatile in this period, contributing to cost-push inflation in 2008.

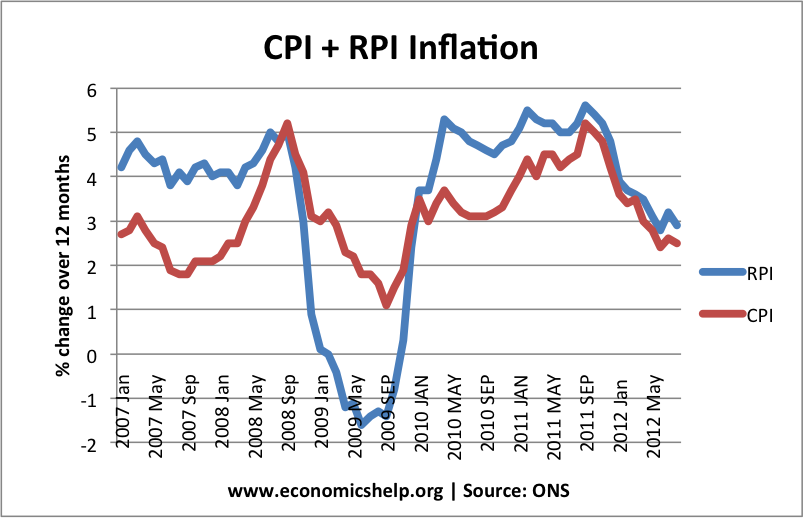

Different measures of inflation

There are different measures of inflation. RPI includes mortgage interest payments. In 2009, interest rates were cut, therefore, RPI measure of inflation became negative. CPI excludes the effect of mortgage interest payments. The ONS now produce a statistic CPIH, which is CPI – owner occupier costs.

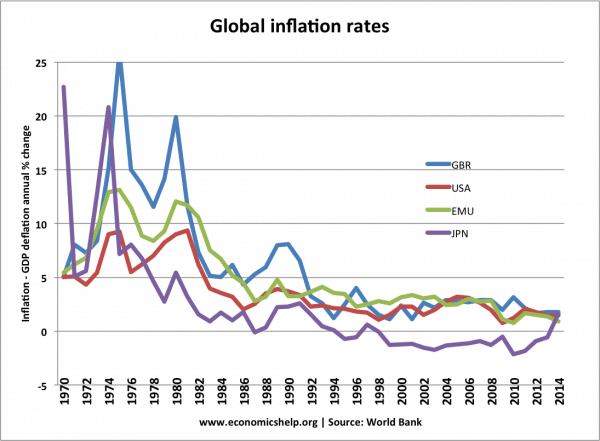

Global inflation

Inflation tends to be global. In the 1970s, rising oil prices caused inflation in most major economies. Since the 1990s, inflation has fallen across the world.

Related

- Shrinkflation – when prices stay the same but the size of the product is reduced.

- UK inflation graphs

- RPI CPI CPIX

- CPI vs Core CPI

- Causes of Inflation

Last updated: 4 Nov 2019, Tejvan Pettinger, www.economicshelp.org, Oxford, UK

Good day,please my question is that,how inflation can be tackle by the government in NIGERIA

Inflation can be easily understood,it’s just that one must be committed and its must be someone with ambition.

You haven’t mentioned anything about creeping ,walking , hyper inflation.. can you please add that

sure, have done

Thank you I would I like to ask different between galloping and running inflation as classification of inflation

Thank you so much.

my question is, what is stagflation?

https://www.economicshelp.org/blog/glossary/stagflation/

Stagflation is characterized by slow economic growth and relatively high unemployment—or economic stagnation—which is at the same time accompanied by rising prices (i.e. inflation). Stagflation can also be alternatively defined as a period of inflation combined with a decline in gross domestic product (GDP).

Stagflation occurs when the government or central banks expand the money supply at the same time they constrain supply. … It can also occur when a central bank’s monetary policies create credit. Both increase the money supply and create inflation. At the same time, other policies slow growth.

Can inflation cause with the lack of resources?

yes, because lack of resources especially raw materials will call for cost-push inflation as this calls for increase in costs of production.

Resources like labor insufficiency will lead to low production capacities in production and services, this results into rise of demand over supply.

yeah that would be cost-pull inflation caused by lack of resources and the prices is forced by the market to go up i think.

I am curious as to why there is no mention of inflation caused by government printing of money to cover government spending and debt. This would directly dilute the purchasing power of a currency, wouldn’t it, and therefore be the root cause of inflation in some instances?