Definition: The money supply measures the total amount of money in the economy at a particular time. It includes actual notes and coins and also any deposits which can be quickly converted into cash. There are different measures of the money supply.

- Narrow Money e.g. M0 = This is the level of notes and coins in circulation + banks operational balances at the Bank of England.

- Broad money e.g. M4 money supply is defined as a measure of notes and coins in circulation (M0) + bank accounts. It is a broader definition because it includes bank accounts and not just notes and coins in circulation.

(The technical definition of M4 includes private-sector retail bank and building society deposits + Private-sector wholesale bank and building society deposits and Certificate of Deposit. [link])

Monetarist theory of Inflation

According to the Monetarist theory of inflation, there is a direct link between the money supply (M) and the inflation rate.

MV=PY

Monetarists believe velocity of circulation (V) is fairly stable. and Y (real output determined by supply-side factors)

- Therefore, if we have a situation where the money supply rises faster than real output, it will cause inflation.

Milton Friedman was an important advocate of monetarist theory, pointing out many situations where government decisions to increase the money supply led to inflation. For example

- Confederacy printing money in Civil War causing inflation

- Growth in money supply in the 1970s causing higher than anticipated inflation.

“Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output.

Friedman (1970) The Counter-Revolution in Monetary Theory.

Link between money supply and inflation in practice

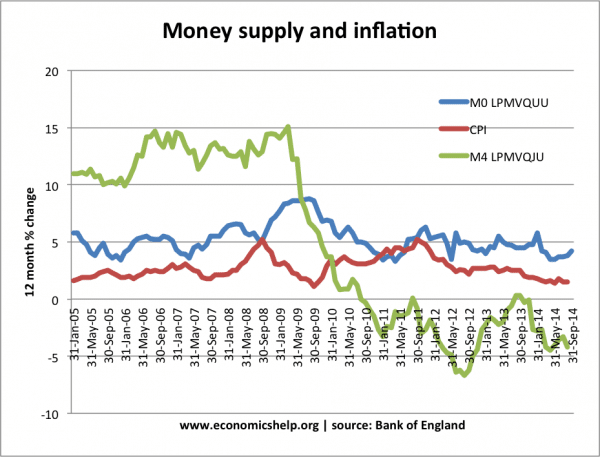

However, although a rise in the money supply can cause inflation, in practice, the link is not clear-cut – inflation can be determined by several factors other than the money supply.

Still, M4 money supply growth can give a guide to underlying inflation and economic activity. For example, in 2011, 2012, the UK experienced cost-push inflation. But, the Bank of England didn’t increase interest rates, they felt the economy was still weak. Later CPI inflation fell, and in late 2014 is 1.5% – below the government’s target.

A resurgence in M4 will be a key factor in ending quantitative easing and increasing interest rates.

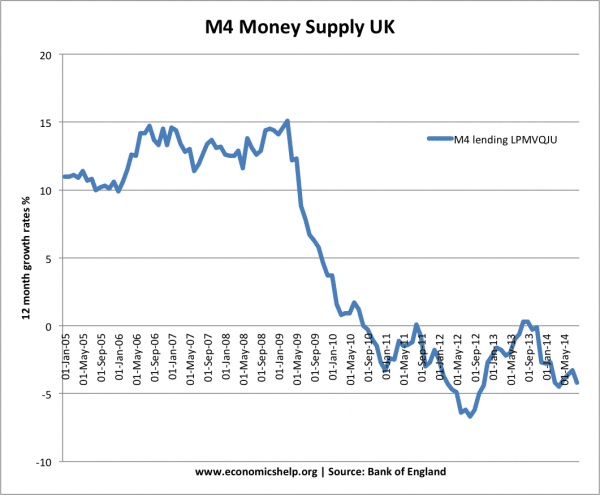

M4 Money Supply

click to enlarge – Source: Money databases LPMVQJU at Bank of England | see also (HM Treasury databank)

M4 is a key statistic because it can illustrate the underlying strength of economic activity. When the economy went into recession, we see a sharp fall in M4 growth from 15% a year to negative growth in mid-2008.

The negative M4 growth during 2011 and 2012 was a sign that economic activity was falling and unsurprisingly the economy went into a double-dip recession.

The past governor of the Bank of England, Mervyn King has said that M4 remains an important variable for influencing monetary policy. Negative M4 growth is a key factor in the justification for more quantitative easing, keeping interest rates low and attempts to bolster bank lending.

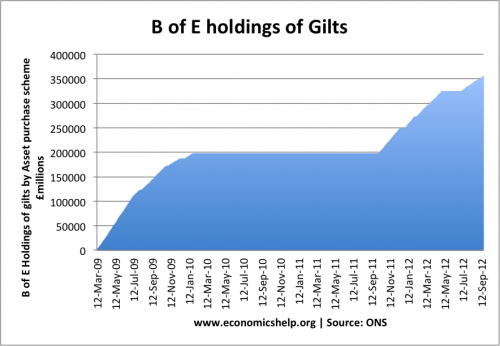

Quantitative easing

Quantitative easing involves the creation of electronic money by the Bank of England to purchase gilts from the financial sector. In theory, this should increase the money supply.

See also: Quantitative easing and inflation

At the start of quantitative easing, M.King said:

“the unprecedented actions of the Monetary Policy Committee to inject £200bn directly into the economy…have averted a potentially disastrous monetary squeeze” Bank of England pdf)

Therefore, without quantitative easing, we may have seen a bigger fall in the money supply and a deeper recession.

However, the relatively weak money supply growth figures also suggest that quantitative easing was limited in its ability to stimulate bank lending and get money to the real economy.

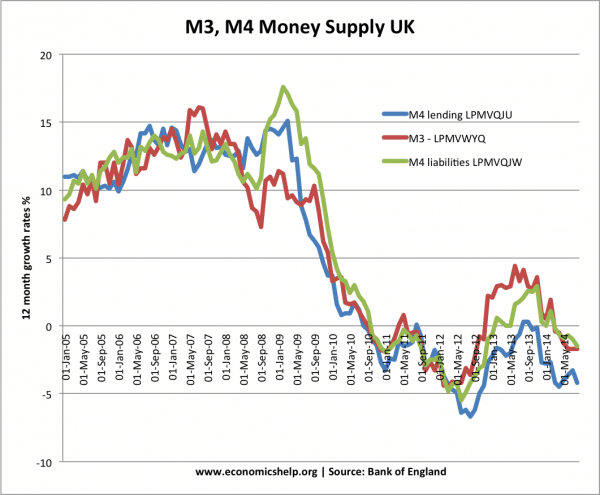

Money Supply M3 and M4

Different measures of M3, M4 show strong growth (over 10%) until 2009, where growth rates fall. In 2012, we see a fall in M4 lending and M4 liabilities. Even during the economic recovery of 2013, 2014, money supply growth is weak and has become negative in late 2014

UK Inflation

Inflation has often been above target during this period of negative broad money supply growth.

Why can inflation be high and yet money supply growth negative?

- Inflation is still affected by cost-push factors, higher imported prices, raw material prices, taxes.

- The fall in money supply reflects the depressed nature of the economy and fall in investment.

- In 2007, the household savings rate was 2.3%. In March 2012, this has increased to 7.7%.

- Consumer confidence shows little sign of recovery, and the banking sector was still very weak.

- The relationship between money supply and inflation has always been weak. Money supply can vary due to changes in way of managing bank accounts and money

Why is broad money supply growth negative – despite economic recovery?

UK economic growth has been positive since 2013, yet the broad money supply growth has not matched the economic recovery.

I’m not entirely sure why this is. But, it reflects the fact bank lending is still weak. Also, level of savings is not increasing as people spend their disposable income. It suggests the economic recovery may still be quite tentative.

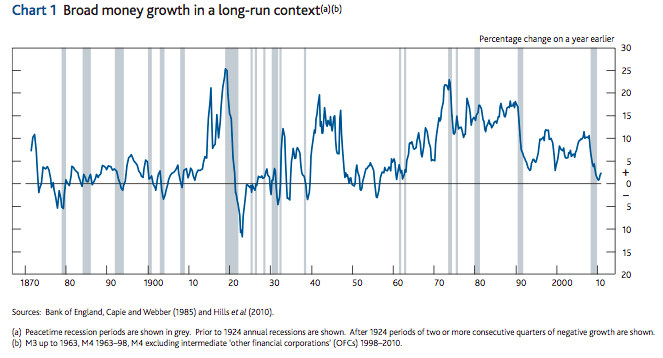

Historical Broad Money supply growth

UK Broad money supply. Source: Bank of England

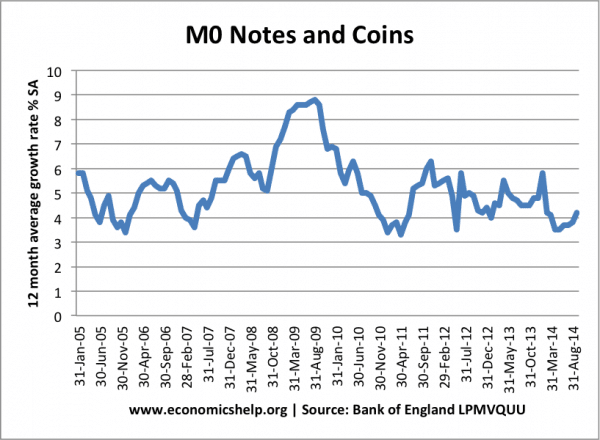

M0 notes and coins

This is a ‘narrow’ definition of money, it includes just notes and coins in circulation

Narrow money growth has been less affected by the recession and has remained constant. However, M0 is a relatively small percentage of the total money supply.

Related

Hi I was wondering if you could put up a direct web address link for where you found the data on the M4 money supply growth. I can’t seem to find it! Thanks a lot

Hi Sam,

It always takes a bit of time to find right place on Bank of England site.

Money supply is here

http://www.bankofengland.co.uk/boeapps/iadb/index.asp?first=yes&SectionRequired=A&HideNums=-1&ExtraInfo=false&Travel=NIxSTx

I want to know about relationship between increase in printed money and corresponding increase in broad money M3.

What will happen to the money supply when the Federal Reserve starts to unwind its balance sheet.Will this affect mainly the M1money supply.

Why did CPI not jump as a result of QE, as the monetarist theory supposes? Because of the business downturn resulting from the scare stories published daily by the score. Buyers lengthened their term preference and sellers reduced prices to move stock off the shelves. At the same time, online retail had just started to get big, so big that without QE the CPI might have gone negative. High street retailers cut prices to the bone to survive. Add in the Wal-Mart effect from the entry of aggressive cut-price brick-and-mortar retailers, which triggered a response from the Goliaths. It’s a complex situation that can’t easily be charted, but the monetarist theory of inflation is supported by case studies from many other countries than the UK.