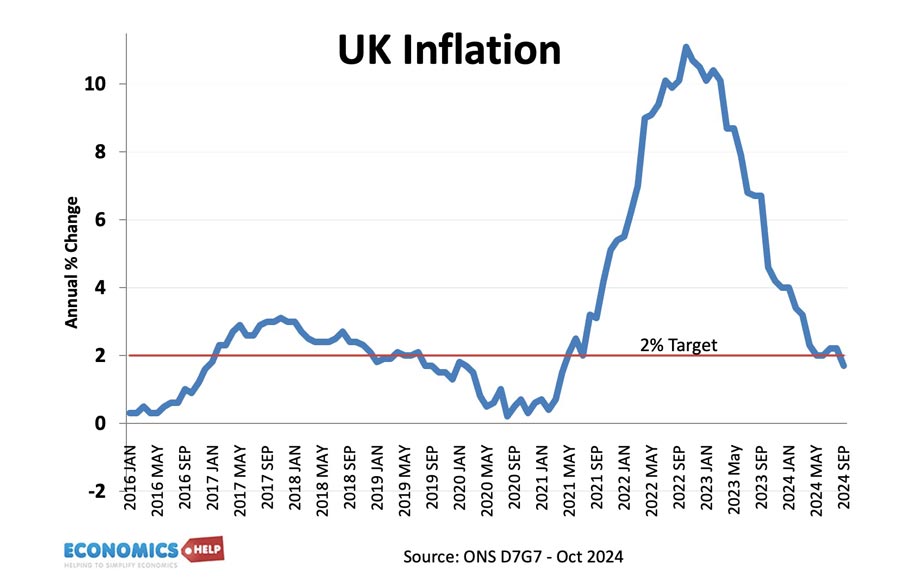

Current UK Inflation Rate

- CPI inflation rate: 2.3% (headline rate) CPI – D7G7 at ONS

- Source: Raw data General inflation tables | CPI annual % change D7G7 at ONS

Other measures of inflation

- (CPIH) CPI including owner occupiers’ housing costs – 6.2% (CPIH – L550)

- See: Measures of inflation

Reasons for low inflation in the UK until 2021

- Low worldwide inflationary expectations. Europe is experiencing very low rates of inflation.

- Fall in global inflation rates since 2007.

- Reduced consumer spending due to Covid downturn

- Weaker commodity price growth.

Reasons for surge in inflation during 2022

- Rising oil prices

- Rising gas prices

- Ukraine war disrupting gas/energy and food supplies.

- Lingering supply side issues from Covid lockdowns and impact on price of shipping.

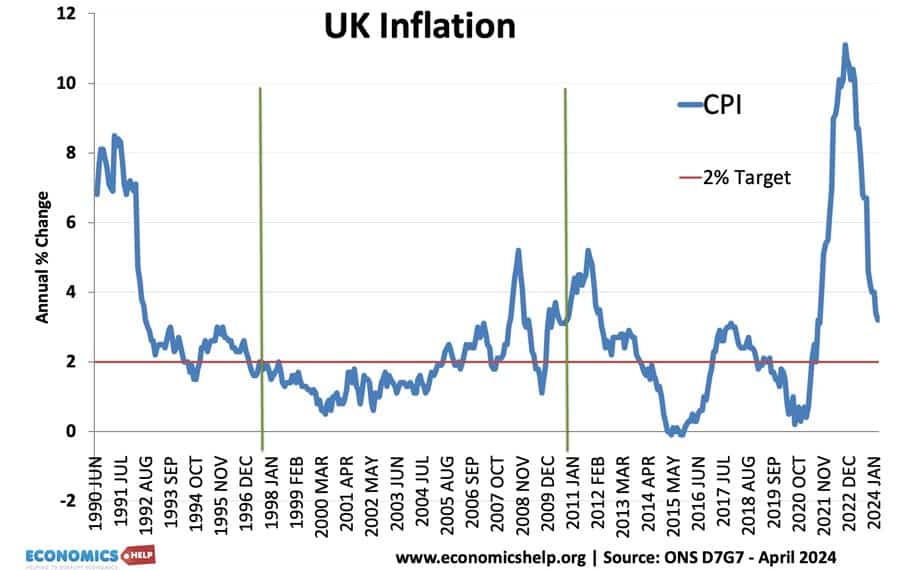

Inflation trends in the UK

Despite temporary cost-push inflationary factors in 2017, underlying inflationary pressures remain muted – at least compared to the past four decades.

The current UK inflation rate compares favourably to much of the post-war period.

1970s Inflation

The 1970s frequently saw double-digit inflation. This was due

- Cost-push factors – rapid rise in oil prices

- Rising wages due to powerful trade unions trying to keep up with living costs.

- Lack of independent monetary policy

- Inflation expectations rose

Late 1980s inflation

The inflation of the late 1980s was due to

- Rapid economic growth ‘The Lawson Boom‘ – growth was above the trend rate causing supply shortages

- Rise in house prices fuelling wealth effect

- Lack of independent monetary policy. The policy was partly set by ‘shadowing the D-Mark’ which led to loose monetary policy in late 1980s

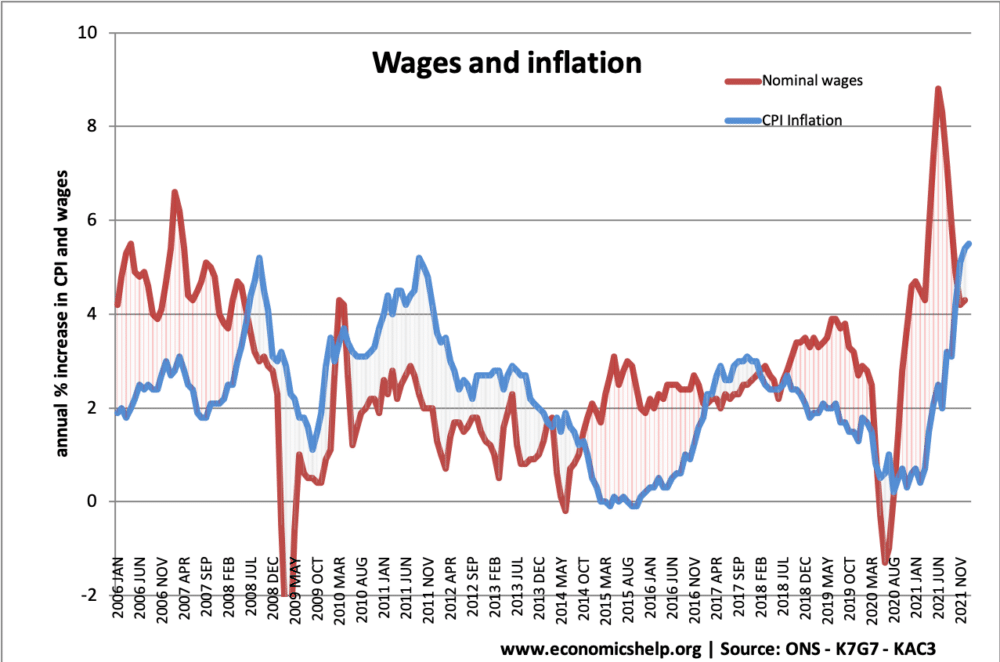

Inflation and wages

- Real wages = nominal wages – inflation.

- Usually, during a period of economic growth – wage growth is higher than inflation, this leads to positive real wage growth.

- During the economic recession of 2009-13 – we had a prolonged period of negative real wage growth. Wages rising at a slower rate than inflation.

- The end of 2014 saw the first signs of renewed wage growth and positive real wage growth.

Since 2008, there has been an unusual period of negative real wage inflation. (inflation higher than wage growth)

However, since the recovery from the Covid downturn, there has been a sharp increase in wages (likely to prove temporary)

See more at UK wage growth

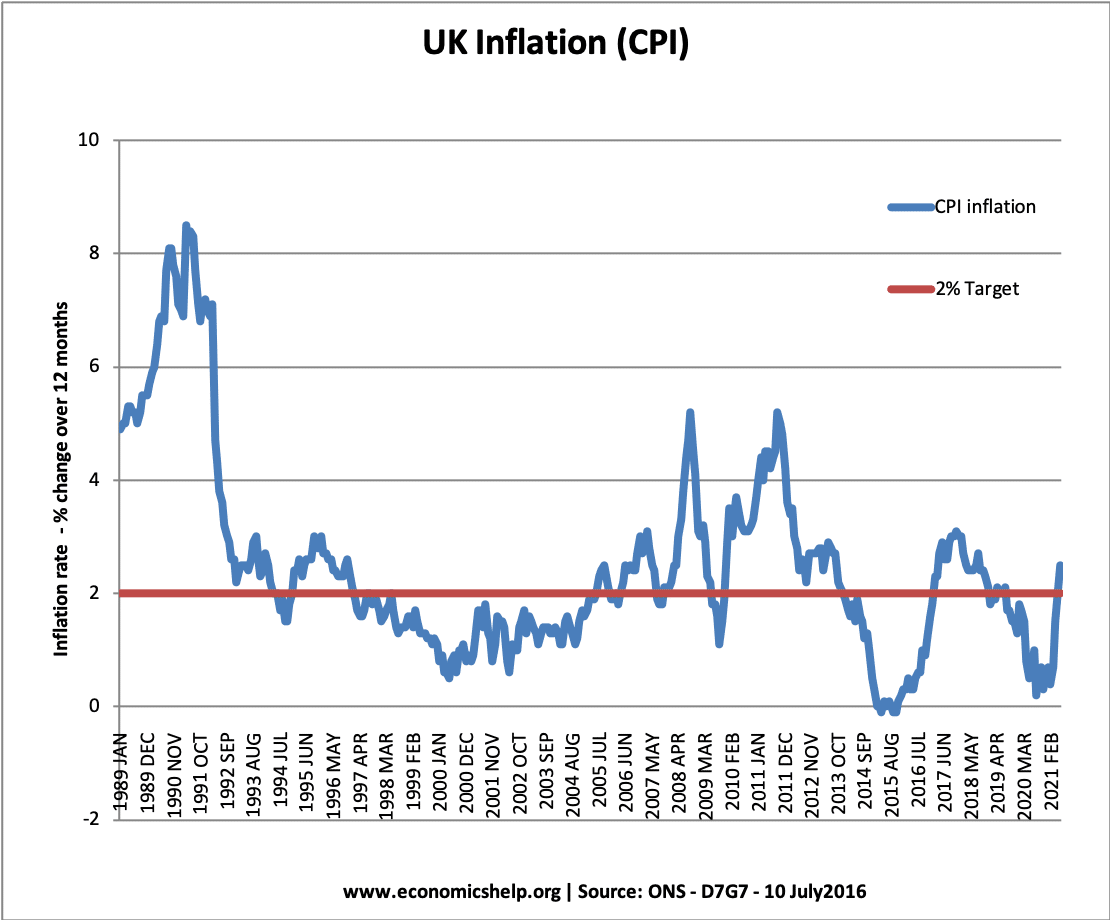

Inflation since 1990

- Inflation rose over 8% in the late 1980s due to the Lawson boom, which was a period of unsustainable economic growth.

- Inflation was low in the period 1992 to 2007. This was a period known as the ‘great moderation’

- The inflation of 2008 and 2012 was due to cost-push factors (devaluation and rising commodity prices)

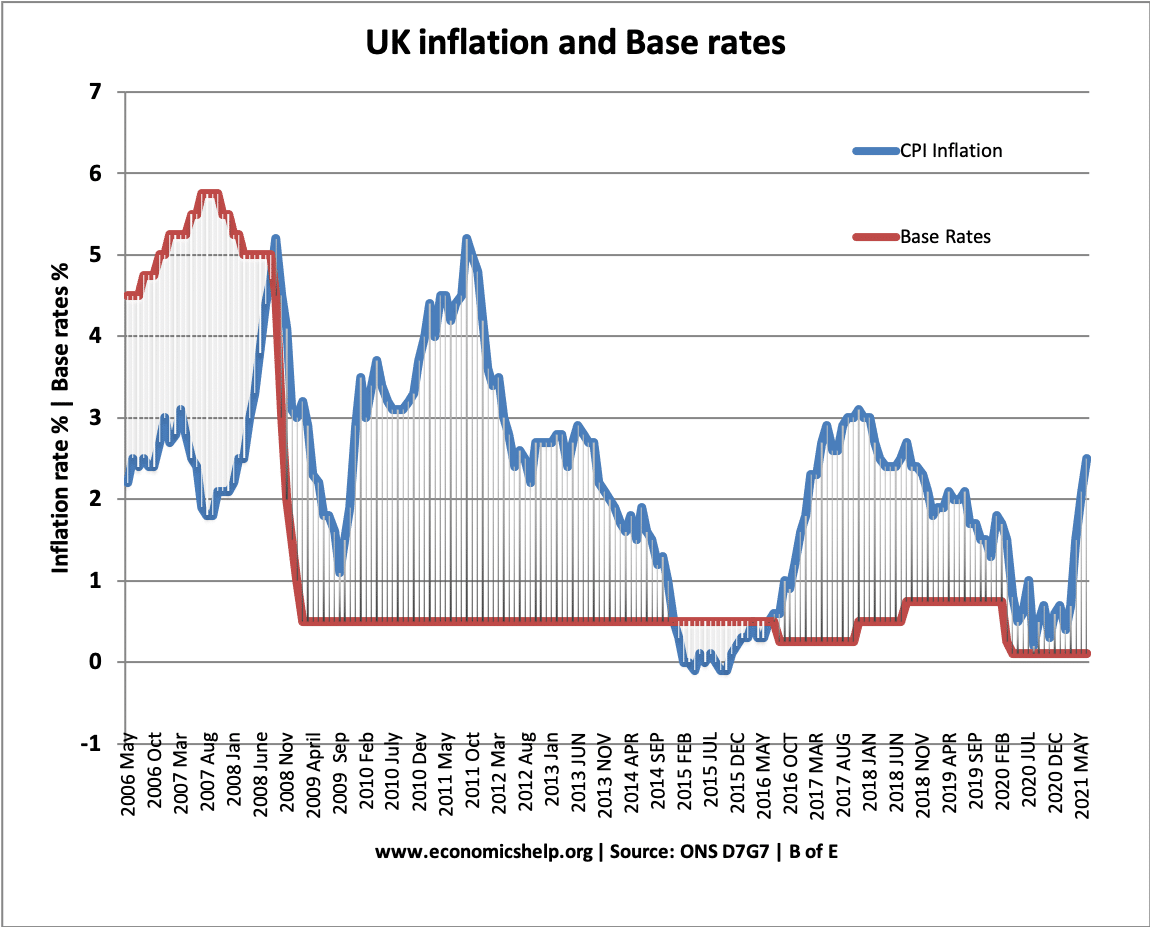

Inflation and interest rates

The Bank of England are responsible for monetary policy. They target an inflation rate of CPI = 2% +/-1. They also take into account economic growth.

Usually, with an inflation rate above 2%, you would expect the Bank of England to increase base rates to reduce inflationary pressures. However, since early 2009, the Bank of England kept base rates close to 0.5%. This is because the Bank of England are worried about the depth of the recession. They argued that the increase in inflation (e.g. during 2011) was due to temporary cost-push factors, such as taxes, commodity prices and effects of devaluation. Therefore, they tolerated CPI inflation above target rather than risk a deeper recession.

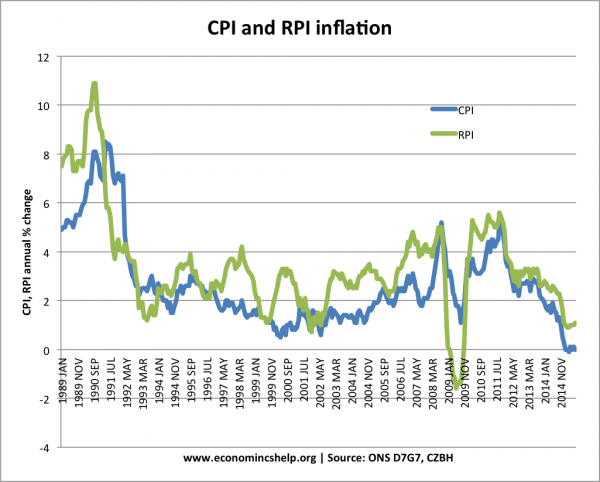

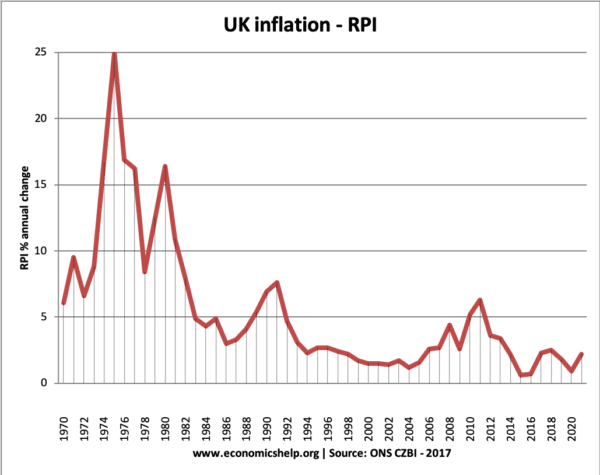

CPI and RPI

RPI is still published by the ONS, but it is no longer designated as a national statistic.

RPI includes more items, such as housing and mortgage interest rate costs. It is calculated in a different way to CPIH. See: Definitions of CPI, RPI, RPIX

The ONS also publishes a new measure RPIJ – which involves a new method of calculating RPI

Producer inflation

The producer price index measures the price of manufactured goods as they leave the factory gate.

There is also an input price index which measures cost of raw materials. These are both a guide to future inflationary pressures.

See more at: Input and producer prices

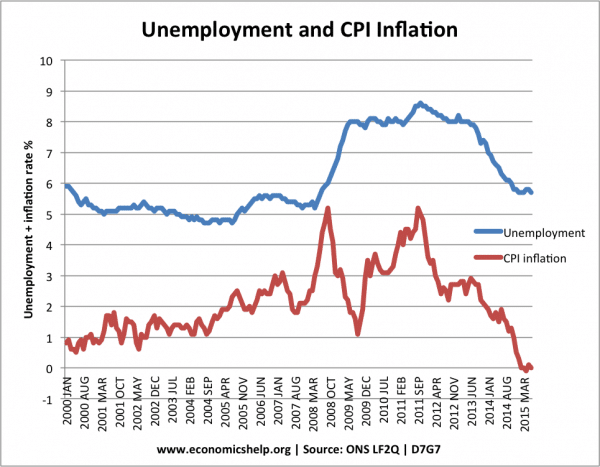

Inflation v Unemployment

Unemployment and Inflation

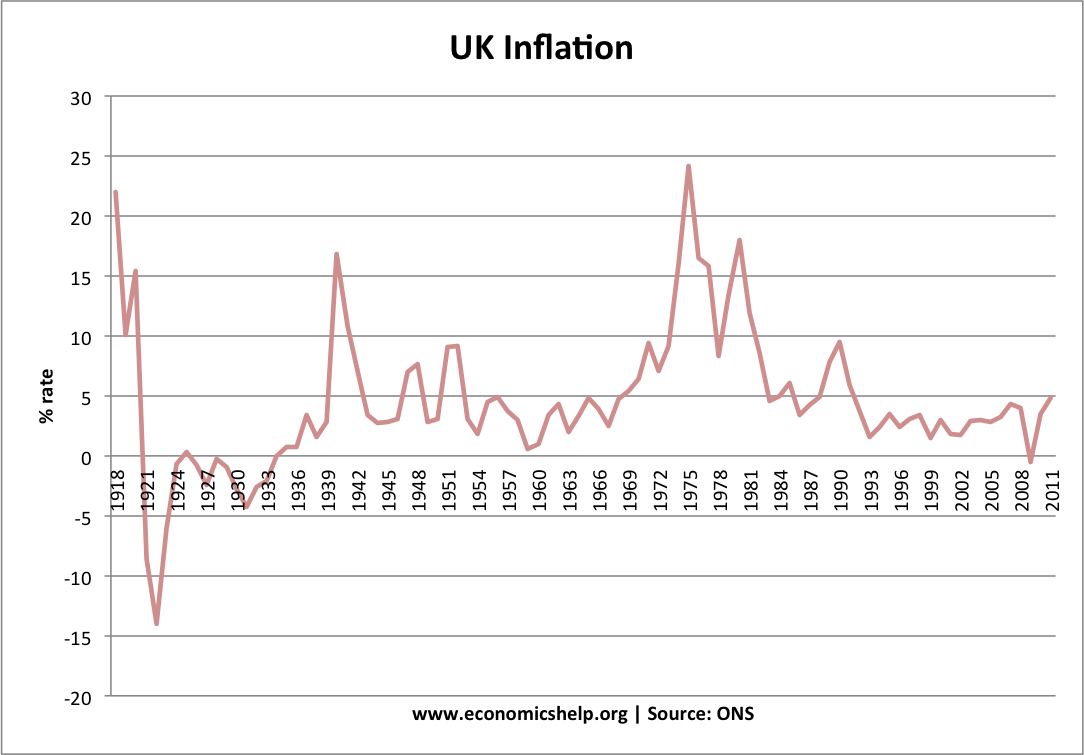

Historical Inflation

UK inflation since 1918

Note the period of deflation in the 1920s / 30s

The highest periods of inflation were:

- During the two world wars

- 1970s inflation

Including tuition fees gives a false impression. If they were not paid by students/parents they would be paid by taxpayers. The real issue is whether the introduction of fees increases quality and/or efficiency in education.

The hike in fees will be offset by reduced taxes (at some time).

If only we had maintained the levels between 1983-89; i.e. keeping inflation at a similar level to GDP we wouldn’t be where we are now!

Wether growth is sustainable or not, you can’t have infinite growth in a finite system, fact!

Control inflation with taxes thus when inflation is high (demand exceeds supply) increase taxes – two effects reduces demand AND gives money to invest in increasing supply. If you use interest rates the rich receive the extra money so no real reduction in demand is created but there is a real reduction in companies able to borrow to invest in increased production (supply).

Basic mistake UK governments since 1960 have been making because the civil service is full of arts degree students without a clue

Thanks for the helpful and informative article. This is what I was looking for.

What is Cvoid Downturn?