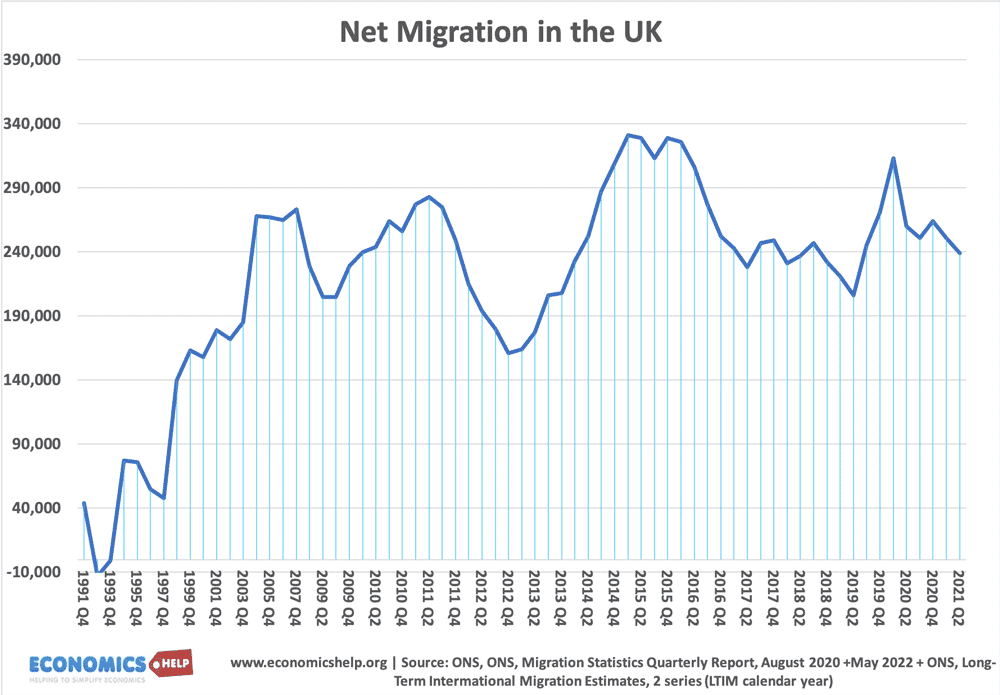

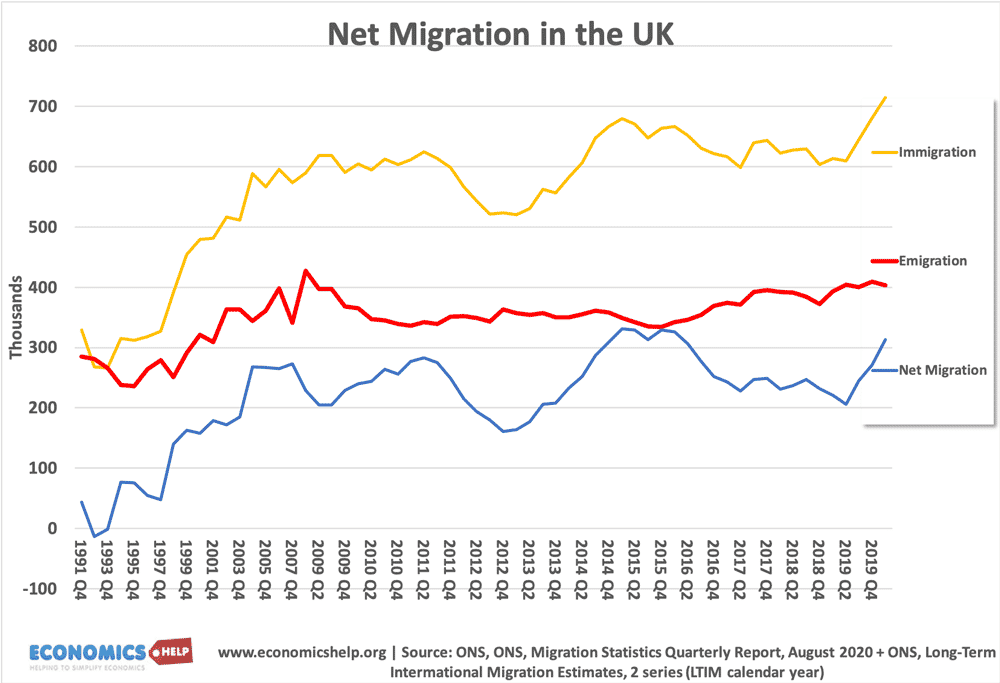

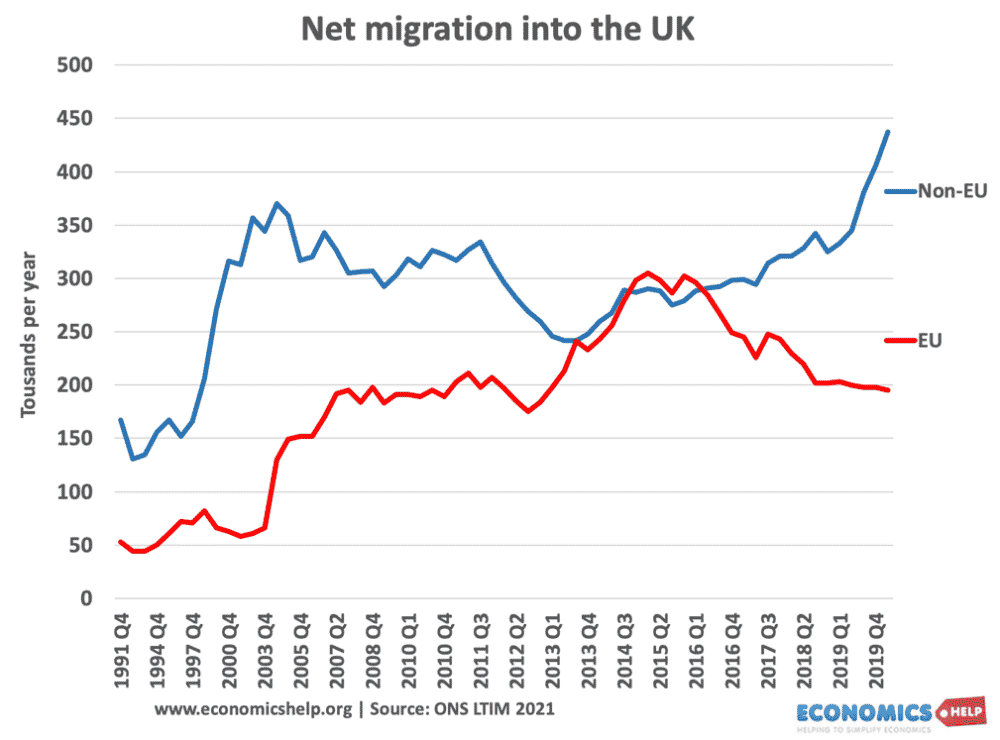

In the past two decades, the UK has experienced a steady flow of net migrants into the economy. The 2016 Brexit vote has led to a sharp fall in net EU migration, but to a large extent this has been offset by a rise in non-EU migration. This net migration has had a wide-ranging impact on the UK population, wages, productivity, economic growth and tax revenue. Does net migration benefit the UK economy?

- In 2021, Net long-term international migration was estimated to be +238,000 in 2016.

- In 2021 Q4, there were 18.766 applications for asylum.

- In 2019, there were 9.5 million people born outside the UK (estimated 14% of the UK’s population.) (5.8 million, non-EU, 3.6 million EU)

Inflows and Outflows

- In 2019, the top 6 countries for the source of migrants was India, Poland, Pakistan, Romania, Ireland.

EU vs Non-EU immigration

Traditionally non-EU immigrants are more likely to come for family reasons, whilst EU migration has been focused on work.

Impact of Net Immigration on UK Economy

1. Increase in Labour Force

Migrants are more likely to be of working age. The majority of migrants come for work or study (students) They may bring dependents, but generally net immigration leads to an increase in the labour force, a decline in the dependency ratio and increases the potential output capacity of the economy.

2. Increase in aggregate demand and Real GDP

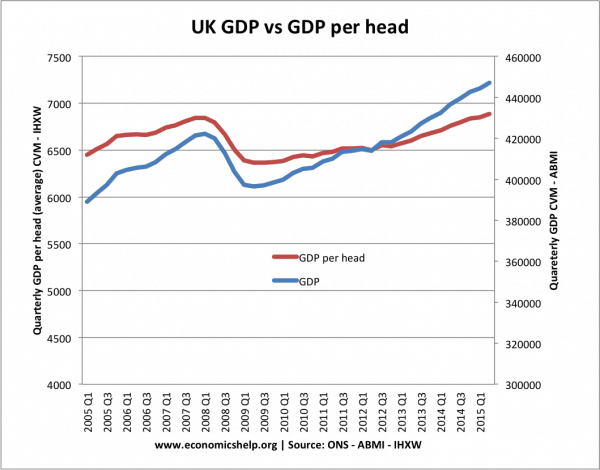

Net inflows of people also lead to an increase in aggregate demand. Migrants will increase the total spending within the economy. As well as increasing the supply of labour, there will be an increase in the demand for labour – relating to the increased spending within the economy. Ceteris paribus, net migration should lead to an increase in real GDP. The impact on real GDP per capita is less certain.

In fact, net migration can make economic growth look stronger than it is. In the period 2005-2015, UK real GDP has increased significantly faster than GDP per head. See GDP per capita for more info.

3. Labour Market Flexibility

Net migration could create a more flexible labour market. Migrants will be particularly attracted to move to the UK if they feel that there are job vacancies in particular areas. For example, during the mid-2000s, there was a large inflow of workers from Poland and other Eastern European economies – helping to meet the demand for semi-skilled jobs, such as builders and plumbers. The government has also sought to attract migrants from various countries to meet shortfalls in job vacancies in key public sector jobs, such as nursing.

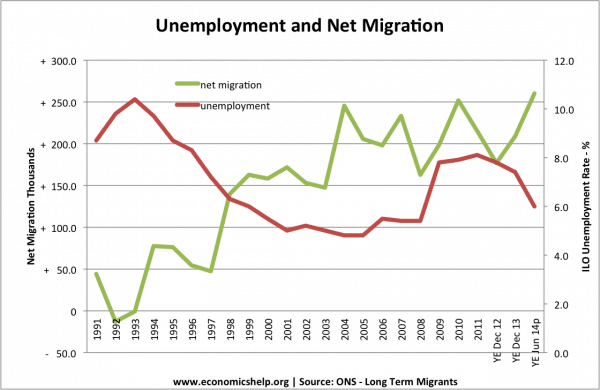

- In theory, a period of higher unemployment might discourage migrants (this has occurred in the case of Ireland). However, the UK aw continued net migration despite higher unemployment 2008-12. Since 2012, unemployment has fallen considerably and migration has remained fairly constant.

4. Positive impact on the dependency ratio

With an ageing population, the UK is forecast to see an increase in the dependency ratio. However, net migration helps to reduce the dependency ratio. Migrants are more likely to be a source of working-age people, and this helps to reduce the ratio of retired to working people. The Migration Observatory reports, that in 2019, 70% of the foreign born were aged 26-64, compared to 48% of the UK born (link). This younger population has benefits for the government’s budget. If migrants are of working age, they will pay income tax, VAT – but will not be claiming benefits.

5. Impact on particular sectors

An important reason for net migration is higher education. In 2019/20, according to Higher Education Statistics Agency (HESA) there were 556,625 international students (link), studying in the UK. These students may not show up in long-term migration trends. But, the short-term effects are quite important. The London Economic analysis estimate that students of 2018-19 contributed a net £25.9 billion to the UK economy (link – pdf). A very significant contribution. These payments also help to finance higher education for domestic students.

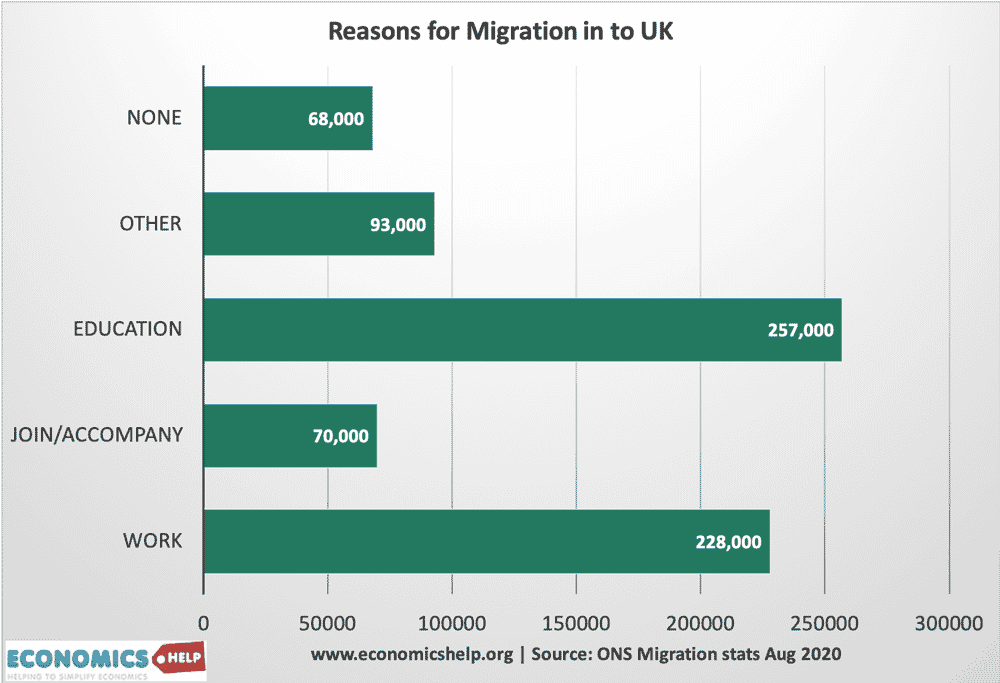

The latest ONS report suggests formal study is the biggest reason for net migration into the UK. See also: reasons for net migration into the UK

6. Social issues

Another issue felt keenly in the UK, is the concept that we are already ‘overcrowded’ In this case, a rapid increase in the population due to migration could lead to falling living standards. For example, the UK faces an acute housing shortage, but also an unwillingness to build on increasingly scarce green belt land. In many cities, it is difficult to build more roads because of limited space. The increased population could increase congestion and urban pollution. Therefore, the increase in real GDP has to be measured against these issues which affect the quality of life.

7. Economies of scale

Others may argue that concepts of ‘overcrowding’ are misplaced. In the nineteenth century, people were already worried about overcrowding. But higher population densities are in one sense more efficient and have a lower environmental impact. Other countries like Belgium have an even greater population density than the UK. Also, if migrants help to grow the economy, there will be more tax revenue to finance public infrastructure.

8. Welfare benefits

A popular idea is that immigrants are more likely to receive welfare benefits and social housing. The suggestion is that Britain’s generous welfare state provides an incentive for people to come from Eastern Europe and receive housing and welfare benefits. While immigrants can end up receiving benefits and social housing. A report by the University College of London, suggests that :

- However, despite the positive figures in the decade since the millennium, the study found that between 1995 and 2011, immigrants from non-EEA countries claimed more in benefits than they paid in taxes, mainly because they tended to have more children than native Britons.

In recent years, claiming unemployment benefits in the UK is quite strict – the claimant count measure of unemployment is much less than the labour force survey (see: Unemployment stats). People have to prove they are looking for work. Also, the criteria to be given an immigration visa from non-EU countries is increasingly strict. The migrant often have to show they have a degree of savings or an offer of a good job. The UCL report on immigration suggested that immigrants tend to be more highly skilled than native workers.

- In 2011, 32% of recent EEA immigrants and 43% of non-EEA immigrants had university degrees, compared with 21% of the British adult population.

Does Immigration Cause Unemployment?

No clear link between migration and unemployment. Net migration occurred with falling unemployment 1991-2005, but rising unemployment from 2008-12. The fall in unemployment since 2012 may have attracted more migrants coming to work.

A common question people often ask – is whether immigration causes unemployment? Migrants have often been blamed for ‘taking our jobs’ – especially in periods of high unemployment, and in local areas of above-average unemployment.

Firstly, net migration is compatible with low unemployment. Net migration helped the US population to increase drastically around the turn of the century, but this didn’t cause unemployment. Migrants bring both an increased supply of labour and higher demand for labour. In the 1990s, net migration was consistent with falling unemployment in the UK.

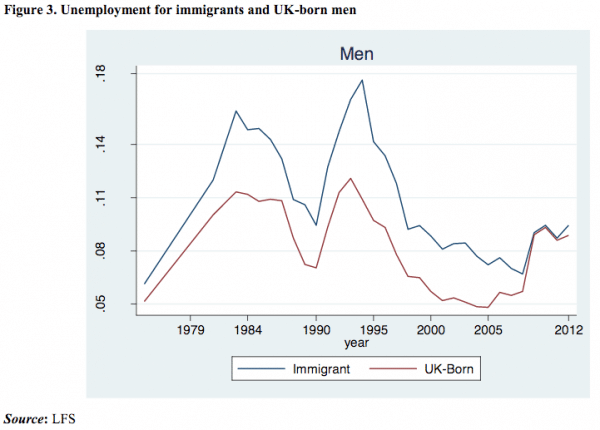

However, in periods of high unemployment, it may be much more difficult for migrants to find work. This may be exacerbated if the migrants have poor English, low skills and or suffer racial discrimination. In this case, net migration could add to the unemployment problem. However, the underlying cause of unemployment is not net migration, but the recession.

Another factor that determines the impact on unemployment is the skills and qualifications of immigrants. If migrants have low skills, they are more likely to experience structural unemployment. In the 1950s, immigration into the UK from the Caribbean was encouraged for manual labour (driving buses e.t.c.) to fill job vacancies. However, when the period of full employment ends, migrants may be more liable to be unemployed, if they lack the skills to find new work.

The impact on unemployment in the current crisis depends on the type and skills of workers who are migrating into the UK.

This shows that the unemployment rate for immigrants tends to be higher than for UK born workers. This gap is especially true during recessions. One reason put forward is that immigrants tend to be more likely to be working on short-term contracts, and so in a downturn are more likely to be laid off.

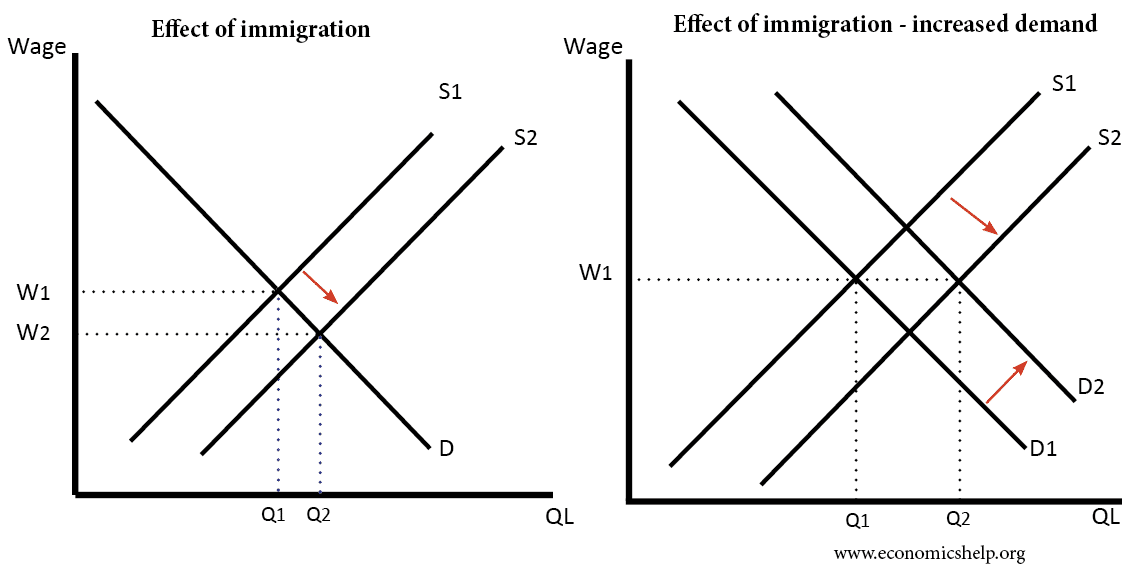

Does Immigration Push Down Wages?

From one perspective an increase in the labour supply may push down wages. This is especially true if migrants are keen to accept lower wages (e.g. willing to bypass traditional union bargaining). However, again, net migration doesn’t have to push down wages. The massive immigration into the US, during the twentieth century, was consistent with rising real wages. Increased migration, will also affect demand for labour due to higher spending in the economy. Immigration increases labour supply – but also increased labour demand.

However, particular labour markets may notice lower wages if there is a concentration of immigrants willing to work. For example, if wages are high in a particular agricultural market, migration from a low-income country may lead to falling wages in these specific markets.

Also, some migrants may be more vulnerable and more willing to work in the black market (e.g. accept a wage below the equilibrium).

Further reading: Lump of labour fallacy – the fallacy that increased labour supply always pushes down wages.

Bank of England study on wages and immigration

A Bank of England found a rise in immigration had a tiny impact on overall wages – with a 10% increase in immigration – wages fall by 0.31%. However, the negative effect was greater for semi/unskilled workers in the service sector, with a 10% rise in immigration reducing wages the equivalent of 2%. B of E report. However, this explains only a small fraction of the real wage decline since 2007.

Video on Immigration

Evaluation of Immigration

The impact of net immigration depends on:

- The skills and qualifications of migrants. The UK is increasingly strict on allowing only skilled workers.

- How easy do migrant find it to assimilate in the destined country? E.g. in the 1950s and 1960s, migrants from the Indian sub-continent / Caribbean may have found it more difficult to find employment due to poor English / racial discrimination.

- It depends on the age profile of migrants. If a high % are young workers, then this can help reduce the dependency ratio – a crucial issue for the government budget.

- It depends on the current economic climate. In a recession, migrants will find it harder to gain employment.

- It depends on the type and skills of migrants. Migrants from Eastern Europe may be more flexible and return home if the economic situation deteriorates. Low skilled migrants are more likely to be structurally unemployed.

- Migrants can be a source of foreign income, e.g. tuition fees from foreign students. However, migrants may also send a substantial portion of their earnings to relatives abroad – reducing the wealth of UK.

- Can the Economy absorb a greater population? For example, what are the impact on public services, levels of congestion, and housing?

Impact of Immigration on housing

Positive net migration levels are a significant factor in increasing the number of households in the UK. Given limited housing supply (and difficulties of increasing supply), this is putting upward pressure on UK house prices and the price of renting.

Related

- Reasons for net migration into the UK

- Immigration and the black market

- Flexible labour markets and immigration

- Long-term migrants data at ONS

NOTE: EEA – European Economic Area – EU, plus EFTA countries Norway, Iceland and Liechtenstein.

Your posts are very instructive, which I later learned a lot from. It was great I hope you get more new posts! beautiful article

More cheap expandable Labour = less incentive for companies to invest in technology. They would rather hire and fire cheap Labour from less developed countries. That means a lot more people doing something that someone with the right tools could get done themselves.

Thank you for your suggestion Preeti, we will try to explain in a more specific way on our future articles.

good post. I just stumbled upon your blog and wanted to say that I have really enjoyed reading your blog posts.

Really good article, thank you for sharing

Nice and helpful post for me. Thanks

This really helpful. Thank you

the good blog, the Leave a Legacy is not going away forever.

Your blog is very informative. thanks for Sharing this blog.

I am worndering to find such an informative content . thank you

I am worndering to find such an informative content . thank you for This article

Hi, I’d like to ask where you got the datasets for this. Interesting read by the way!

The UK has become a stagnating economy relying on cheap third world labor, this has destroyed all the innovation in the country. Just need to see the performance of the FTSE 100 to understand that the british economy hasn’t evolved since the 19th century, oil stocks, tobacco stocks, banks… The correlation of the charts of decelerating growth and increased migration shows it very well. The GDP growth is artificially maintained with migration but the reality says otherwise. People can barely house themselves in big cities, wages have been stagnating for two decades. It’s useless to look at absolute numbers PPP GDP already tells you more. And we are not even talking about the human costs of living in cities where the autochthonous european people are now just small minorities and being replaced by cheap labor forces. This situation comes from the lack of courage of governments and also the people who voted them into office. The decline will not stop, it will be slow and painful.

very nice blog for sharing

GTU