- Deflation is defined as a fall in the general price level. It is a negative rate of inflation.

- The problem with deflation is that often it can contribute to lower economic growth. This is because deflation increases the real value of debt – and therefore reducing the spending power of firms and consumers. Also, falling prices can discourage spending as consumers delay their purchases.

- Deflation is not necessarily bad – especially if it is caused by increased productivity. But often periods of deflation have led to economic stagnation and high unemployment.

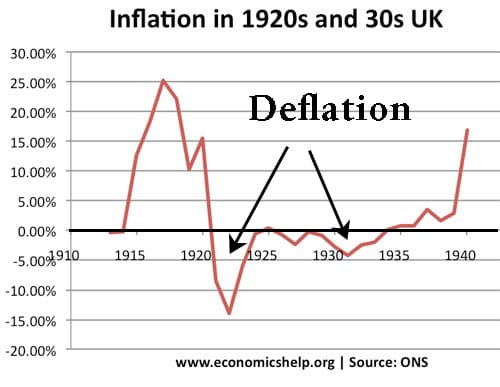

Graph showing deflation in the 1920s and 1930s.

In the twentieth century, periods of deflation have been relatively rare. The most significant period of deflation for the UK was in the 1920s and 1930s. These decades (especially, the 1930s) were characterised by high unemployment and economic depression.

Problems of Deflation

- Discourages consumer spending. When there are falling prices, this often encourages people to delay purchases because they will be cheaper in the future. In particular, it can discourage consumers from buying luxury goods / non-essential items, e.g. flatscreen TV – because you could save money by waiting for it to be cheaper. Therefore, periods of deflation often lead to lower consumer spending and lower economic growth; (this, in turn, creates more deflationary pressure in the economy). This fall in consumer spending was a feature of the Japanese experience of deflation in the 1990s and 2000s. (Japanese financial crisis).

- Increase real value of debt. Deflation increases the real value of money and the real value of debt. Deflation makes it more difficult for debtors to pay off their debts. Therefore, consumers and firms have to spend a bigger percentage of disposable income on meeting debt repayments. (in a period of deflation, firms will also be getting lower revenue, and consumers will likely to get lower wages). Therefore, this leaves less money for spending and investment. This is particularly a problem in a balance sheet recession where firms and consumers are trying to reduce their exposure to debt. Europe has a big burden of government debt; deflation will make it more difficult to reduce debt to GDP ratios.

- Increased real interest rates. Interest rates can’t fall below zero. If there is deflation of 2%, this means we have a real interest rate of + 2%. In other words, saving money gives a reasonable return. Therefore, deflation can contribute to an unwanted tightening of monetary policy. This is particularly a problem for Eurozone countries which don’t have recourse to any other monetary policies like quantitative easing. This is another factor that can lead to lower growth and higher unemployment.

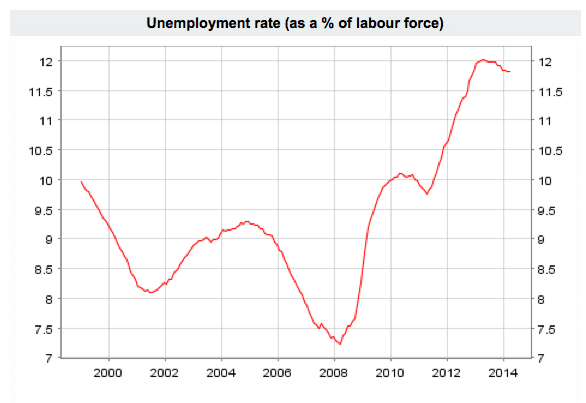

- Real wage unemployment. Labour markets often exhibit ‘sticky wages’. In particular, workers resist nominal wage cuts (no one likes to see their wages actually cut, especially when you are used to annual pay increases. Therefore, in periods of deflation, real wages rise. This could cause real-wage unemployment. Unemployment in Europe is a major problem – and low inflation is one reason.

- More difficult for relative prices and wages to adjust. If the average prices or wages are increasing by 3%, it is easier for some goods to rise by 0% and some to rise by 6%. With inflation of 0%, it is harder to get this relative change in prices or wages.

- Deflation can become entrenched and difficult to end. The experience of Japan in the late 90s and 00s was that when deflation became the new norm, it was very hard to change inflation expectations and regain normal growth.

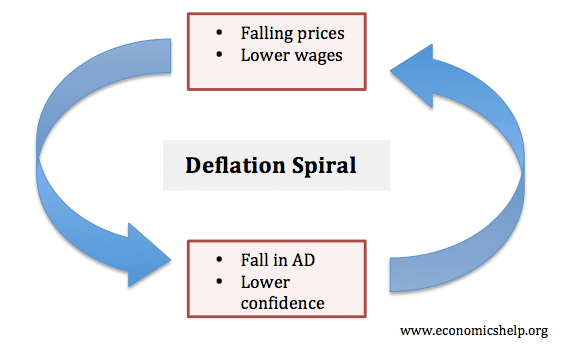

- Falling prices – lower confidence – leads to lower spending – falling prices

- Falling prices – leads to lower wages – leads to less spending and lower costs

- Falling prices – changes inflation expectations – people delay purchases until price falls.

Doesn’t deflation make us better off because things are cheaper?

Remember deflation usually means falling wages (or at least stagnant wages). It also means higher unemployment. People with debts, for example, mortgages, credit cards are likely to feel the squeeze more. Prices may be falling, but the amount of money you have to spend is also likely to be falling.

Deflation is only good if prices are falling and your disposable income is rising.

It is true that some people, especially net savers, may feel better off during a period of deflation. But, the problem is the wider macro-economic consequences of recession and unemployment.

Problems of low inflation

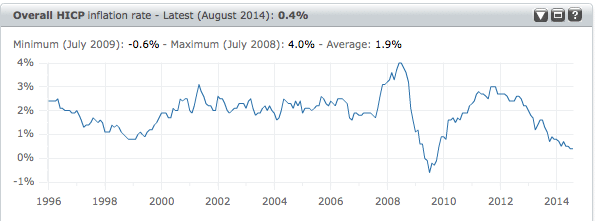

EU inflation falling to 0.4% in August 2014.

Deflation is quite rare, but increasingly common are periods of low-inflation (or disinflation) – inflation below the government target of 2%. Even low inflation can be a real economic problem – though on a smaller scale than deflation. Problems of low inflation include:

- Increased real debt burden. If people expected an inflation rate of around 3-4%, they might take out debts, assuming a future inflation rate of 3-4% to help reduce the real value. However, if inflation is at 0.5%, the real value of the debt will fall much more slowly than expected. Governments will also struggle to reduce debt to GDP ratios because with low inflation, tax revenues will rise much more slowly than expected.

- Tight monetary policy. With inflation of 0.5% and ECB interest rates of 0.5% – monetary policy is too tight harming the economic recovery. This is particularly a problem for Europe because they are reluctant to pursue quantitative easing.

- The difficulty of adjusting wages and prices. This is particularly a problem for the Eurozone where a fixed exchange rate means countries like Spain rely on a prolonged period of falling prices to restore competitiveness.

Potential benefits of deflation

Despite the many serious costs of deflation. The ‘right kind of deflation’ could be beneficial.

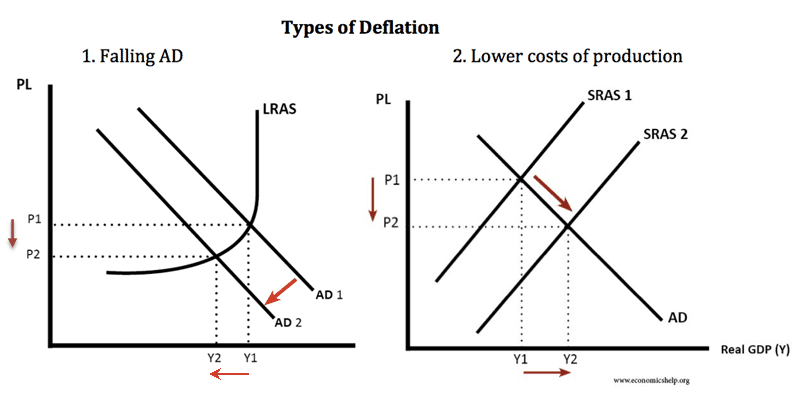

On the left, deflation is caused by falling demand. It leads to lower output.

On the right, deflation is caused by increased productivity – it enables lower prices and higher output.

The right kind of deflation will cause:

- Deflation from increased efficiency and lower costs of production. The right kind of deflation involves lower prices through increased productivity and better technology. A-Level students should think of the Aggregate Supply curve shifting to the right – which both lowers the price level and increases real GDP.

- Improved international competitiveness. If one country has deflation, and others have inflation, then that country will become more internationally competitive, leading to a rise in exports. During Japan’s deflation, they saw strong exports – which helped offset the fall in consumer spending (though it still wasn’t enough). However, if there is a region-wide period of deflation – e.g., Europe in 2014, then you are not getting this competitive advantage.

Although deflation in the twentieth century is often associated with economic recession. In the nineteenth century, deflation was compatible with economic growth.

Related pages

External link

I think it important to distinguish general price level increases (decreases) and inflation (deflation) . Increase in RPI/CPI consequent on (say) large oil price rise are not inflation per se. They may start an inflationary process as people try to maintain real income through pay rise to match price rises. However, if we (the UK) as a whole must pay more for oil then we, on average, must be worse off. Accepting the higher prices without asking for more pay achieves the UNAVOIDABLE reduction in living standards without the risk of inflation. It is the risk of inflation that causes the Bank to either raise or hold up interest rates in face of the negative supply shock of imported cost increases (which is already tending to push the economy towards slow down/recession).

Hi, I’m writing something about deflation and I’d like to quote this article. What is the suggested citation?

Thanks

You are totally clueless to what deflation/inflation is.

Prices do not inflate. Prices go up or down. What inflates, or expands, is the money supply.

Inflation may lead to prices raising while deflation may lead to prices dropping. But that ain’t a given. Inflation may very well be preventing prices from dropping as they would without inflation. But are kept the same despite other factors to due inflation. That happens if you import a lot and prices are dropping abroad, due to inglation you may never see the price drop reflected in consumer prices.

Lower prices discourage spending. Are you joking? Arr you out of your mind? People buy more stuff exactly because prices are droping.

Cellphones, laptops, TVs, cars, they are all getting cheaper. Are keeping your old phone because newer phones are cheaper? No! You buy new phones exactly because the prices are droping every year. You don’t hold to old stuff because prices of new stuff are falling. You stuff. That caused the housing bubble in 2008, house prices and mortage interested rates kept falling, so people bought houses they could not afford. But they didn’t get discourage waiting for the low of lows. That is non sense.

Your understanding of economics is unfortunate and dominates the circles. That is making us kings of debt. And its non sense.

> Lower prices discourage spending. Are you joking? Arr you out of your mind? People buy more stuff exactly because prices are droping.

This is a misunderstanding. If individual prices fall of a particular good fall, then people will buy more. But, if all prices are falling in the economy, then it often (though not always) causes lower consumer spending because of effects confidence/real value of debt e.t.c.

This is well articulated thought.

Easy for you to say either way, but deflation can only be positive for one group.. You are missing the effect on retirees. It is a fallacy to think that retirees have any control of their income. Social security adjustments seem large until you discover that the goods and services, and also housing paid for by the retired and I assume disabled are well below the cost of living increases. As an example, in my own case, I received the SS increase of $140 and nothing more on my small pension. In two years, gasoline is now 58 percent higher, my apartment 15 percent higher, my groceries 17 percent, a stop at a fast food restaurant almost 50 percent, Add to that gas/electric 24 percent. I give you percentages, you can guess what this means compared with the $140 increase.