Diminishing marginal utility of income and wealth suggests that as income increases, individuals gain a correspondingly smaller increase in satisfaction and happiness.

In layman’s terms – “more money may not make you happy”

Alfred Marshall popularised concepts of diminishing marginal utility in his Principles of Economics (1890)

“The additional benefit a person derives from a given increase of his stock of a thing diminishes with every increase in the stock that he already has”

– Alfred Marshall, Principles of Economics

Utility means satisfaction, usefulness, happiness gained. Utility could be measured by the amount you are willing to spend on a good.

Example of why increasing income leads to diminishing returns

Marginal utility of first £100

If you have zero income and then gain £100 a week. This £100 will improve your living standards significantly. With this £100 you will be able to pay for the basic necessity of life – food, drink, shelter and heating. Without this basic £100 a week, life would be tough.

Marginal utility of income increasing from £500 to £600 (6th £100)

However, if you already gain £500 a week, an extra £100 has a proportionately smaller increase in utility. You may be able to eat out at restaurants more often, but it doesn’t significantly affect your standard of living and happiness. At £500 a week, you can afford most things you need. But, most people would be happy to gain an extra £100 to spend on luxuries like going out.

Marginal utility of income increasing from £10,000 to £10,100

If you are earning £10,000 a week – you would hardly notice an extra £100 a week. You may not even have the time or ability to spend it; this extra income is liable to be just saved. Therefore, we say the marginal utility of an extra £100 at this income level is very limited.

Therefore as income increases, the extra marginal benefit to individuals declines.

Diminishing marginal utility of wealth

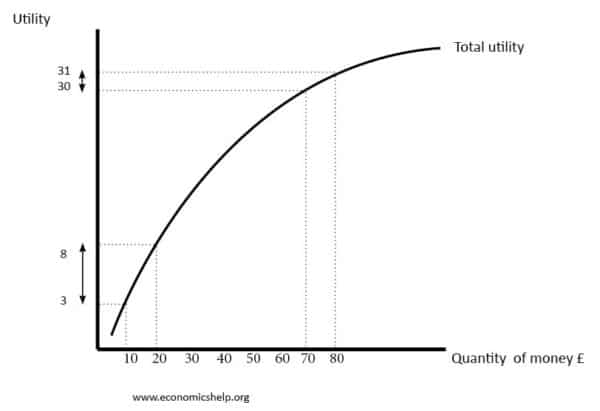

However, an increase in wealth from £70 to £80 leads to a correspondingly small increase in utility (30 to 31).

This concave graph shows a diminishing marginal utility of money and a justification for why people may exhibit risk aversion for the potentially large losses with small probabilities.

Diminishing marginal utility of wealth

Income is the amount of money received per time period. Wealth is a stock concept (the amount of savings, property owned)

It is a very similar effect with wealth. If you have savings of £10,000 – this can be useful for giving you insurance in periods of unemployment or the need to buy large items, like a new cooker. If you own one car, it can be useful for getting to work. Also, owning a house is a form of wealth, and it is important for giving you a place to live.

However, suppose your wealth increases. If you now own two cars, the extra benefit is much diminished compared to the first car. It might be useful to have two cars in case one breaks down, but you can only drive one at a time. If you have 7 or 8 cars like a collector, you may get some joy from having a collection, but the extra utility of that 8th car is significantly lower than the working person who has just one car to get to work.