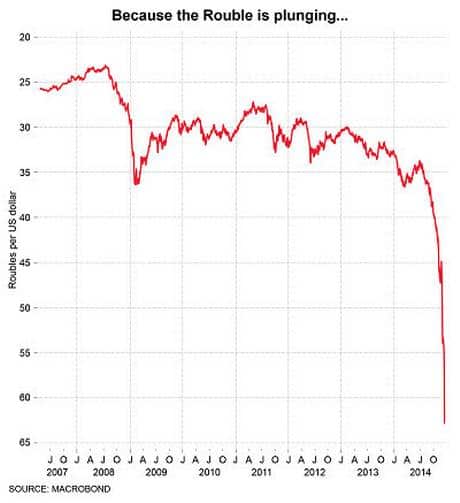

With economic sanctions and a plummeting price of oil, the Russian economy is seeing a real economic crisis. The value of the rouble is falling – causing inflation and a decline in living standards. Government tax revenues are falling as oil tax revenues decline. On top of a falling Rouble, the economy faces recession due to declining export revenues, falling real incomes, a collapse in confidence and higher interest rates.

Causes of Russian economic crisis

Oil dependent economy. The Russian economy has done well in recent years from high oil and gas prices. This has led to strong export revenues and government tax revenues. In 2012, the oil and gas sector accounted for 52% of federal tax funds and 70% of exports But, the near 50% in oil prices have caused the economy to suffer. Unfortunately, the strength of the oil industry has meant alternative manufacturing industries remain undeveloped – and unable to benefit from more competitive export prices. The Russian oil economy is an example of the Dutch disease.

Falling oil prices. The oil price has collapsed from $115 a barrel in June 2014 to just above $60 in Dec 2014. Falling oil prices have caused a big fall in export revenue, a fall in real GDP and a fall in government tax revenues.

Economic sanctions. Sanctions imposed by the EU and US since the issues around the Ukraine have damaged the ability of some Russian firms to raise finance. On their own, the sanctions are quite limited in effect, but combined with the timing, they are a big blow to confidence in the Russian economy.

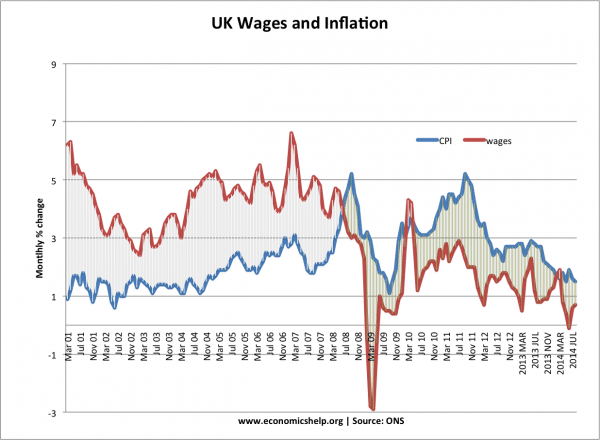

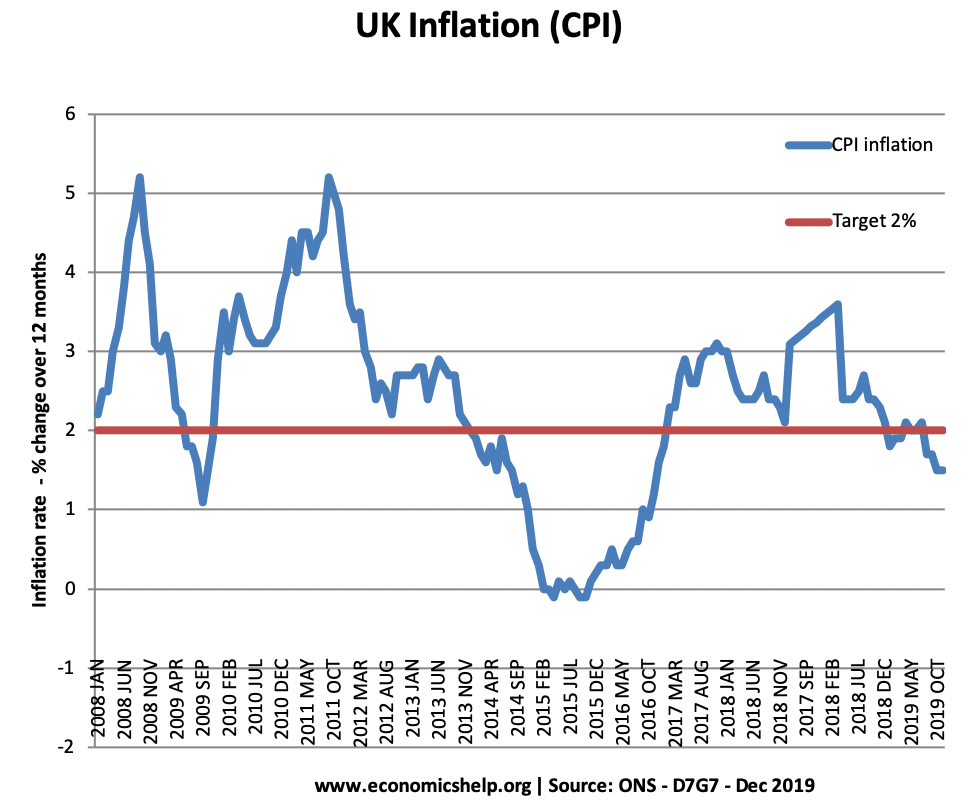

Recession. Due to the 50% devaluation in the Rouble, the price of imported goods has increased, leading to imported inflation. With inflation running at 9%, consumers are seeing a fall in real wages. Wages, pensions and benefits are not keeping up with rising cost of living. This is causing lower spending. The Central Bank faces a difficult dilemma – because of the recession it needs to cut interest rates, but the falling Rouble has caused it to increase interest rates to 17% – to try and protect the value of the Rouble – but, this will further reduce spending and lower growth. (See: effect of higher interest rates). With the oil and gas sector hit, big firms are likely to lay off workers, due to the fall in demand and revenue. This rise in unemployment will exacerbate the recession. It’s a tough combination of factors, which give the government and Central Bank little room for manoeuvre.

Source: Independent

Falling Rouble. Despite high foreign currency reserves, the Rouble has fallen in value, suggesting investors have lost confidence in the Russian Central Bank, the Russian economy and the Rouble. The problem of the falling confidence in the Rouble, is that it is encouraging capital flight – where Russians seek to protect the value of their wealth by transferring it into other currencies outside Russia. This is a toxic mix – a self-reinforcing cycle of falling Rouble, causing more people to give up on the Rouble.