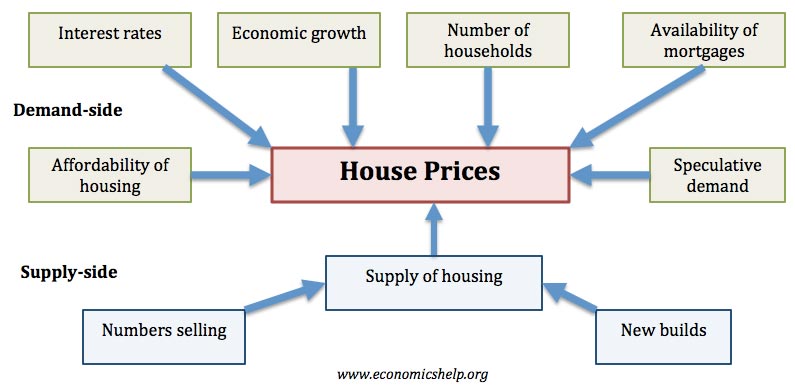

The housing market is influenced by the state of the economy, interest rates, real income and changes in the size of the population. As well as these demand-side factors, house prices will be determined by available supply. With periods of rising demand and limited supply, we will see rising house prices, rising rents and increased risk of homelessness.

Factors determining house prices

Main factors that affect the housing market

- Economic growth. Demand for housing is dependent upon income. With higher economic growth and rising incomes, people will be able to spend more on houses; this will increase demand and push up prices. In fact, demand for housing is often noted to be income elastic (luxury good); rising incomes leading to a bigger % of income being spent on houses. Similarly, in a recession, falling incomes will mean people can’t afford to buy and those who lose their job may fall behind on their mortgage payments and end up with their home repossessed.

- Unemployment. Related to economic growth is unemployment. When unemployment is rising, fewer people will be able to afford a house. But, even the fear of unemployment may discourage people from entering the property market.

- Interest rates. Interest rates affect the cost of monthly mortgage payments. A period of high-interest rates will increase cost of mortgage payments and will cause lower demand for buying a house. High-interest rates make renting relatively more attractive compared to buying. Interest rates have a bigger effect if homeowners have large variable mortgages. For example, in 1990-92, the sharp rise in interest rates caused a very steep fall in UK house prices because many homeowners couldn’t afford the rise in interest rates.