Can Inflation Cause a Recession?

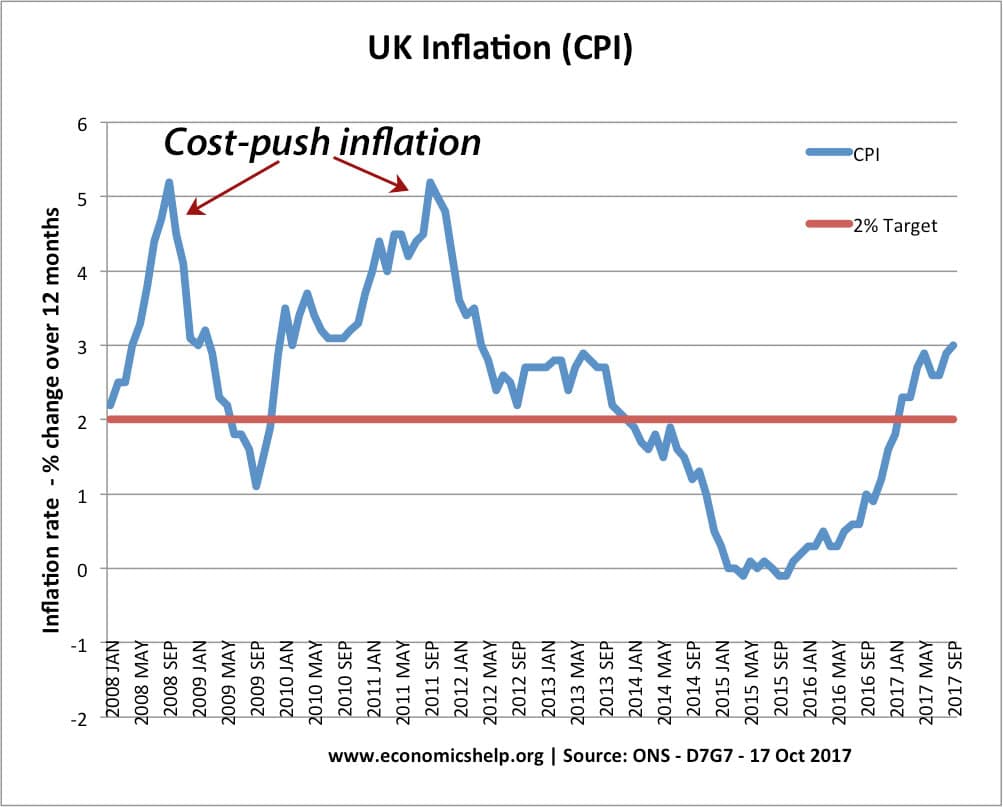

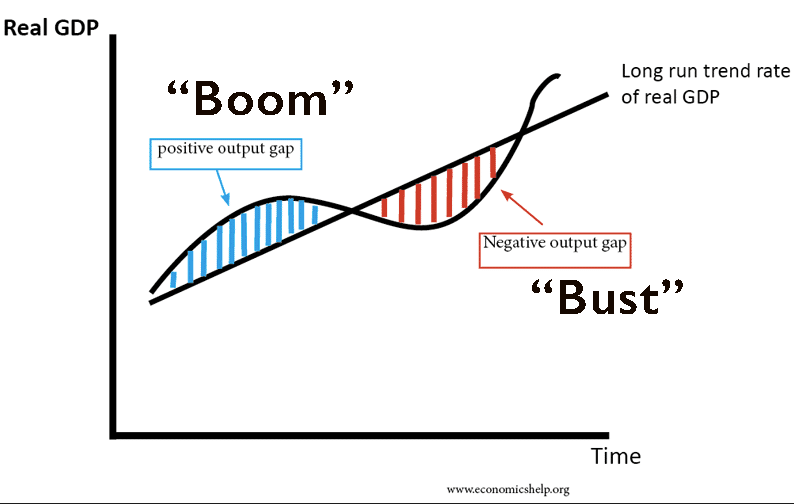

Readers Question: Can inflation cause a recession? Inflation is not the main cause of recessions. Usually, recessions are caused by factors such as high-interest rates, fall in confidence, fall in bank lending and decline in investment. However, it is possible that cost-push inflation can contribute to a recession, especially if inflation is above nominal wage …