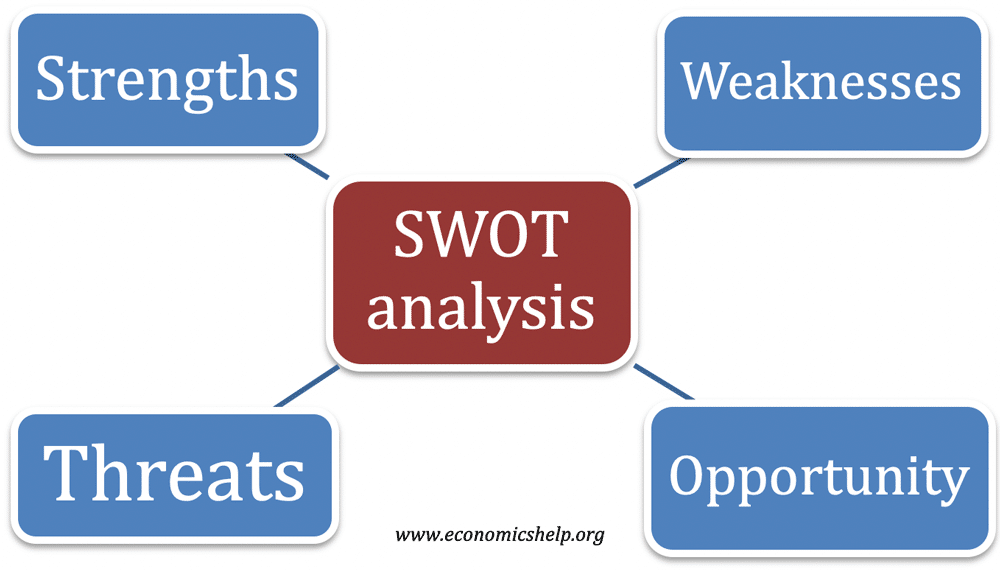

SWOT analysis – Examples

SWOT analysis is looking at a businesses – strengths, weaknesses, opportunities, threats. SWOT analysis is useful for a business looking at strategic planning for the future. How can the firm survive, grow and remain relevant. Examples of strengths Current profitable orders. Existing brand loyalty and brand recognition Loyal customer base Mailing list and details of …