Impact of deflationary fiscal policy in UK

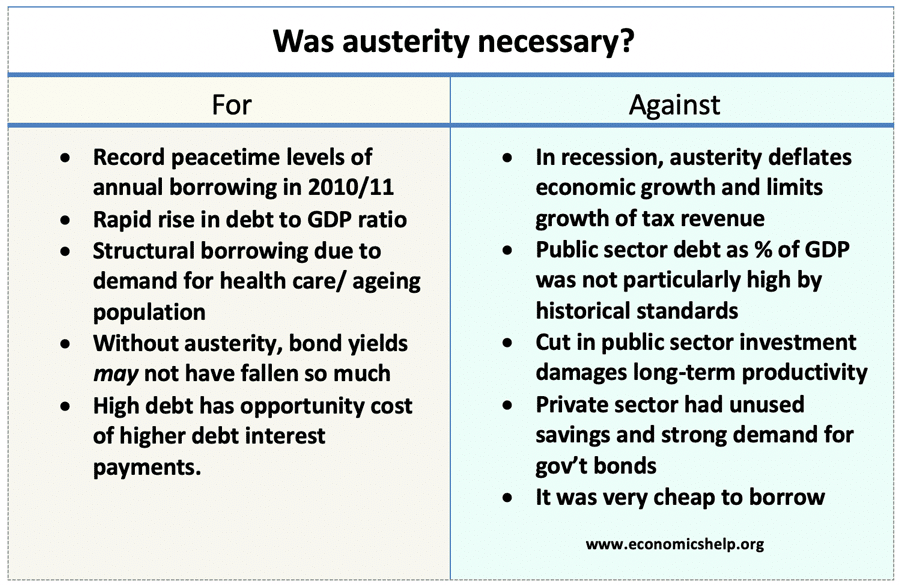

A report by NIESR suggests that austerity pursued by the government in 2010, needlessly led to a delayed economic recovery and could have cost the UK 5% of GDP or £1,500 per person. The austerity was unnecessary because The lower growth led to delayed rises in tax increases and Interest rates were at 0%, and …