Will a surge in borrowing cause a debt crisis in the UK?

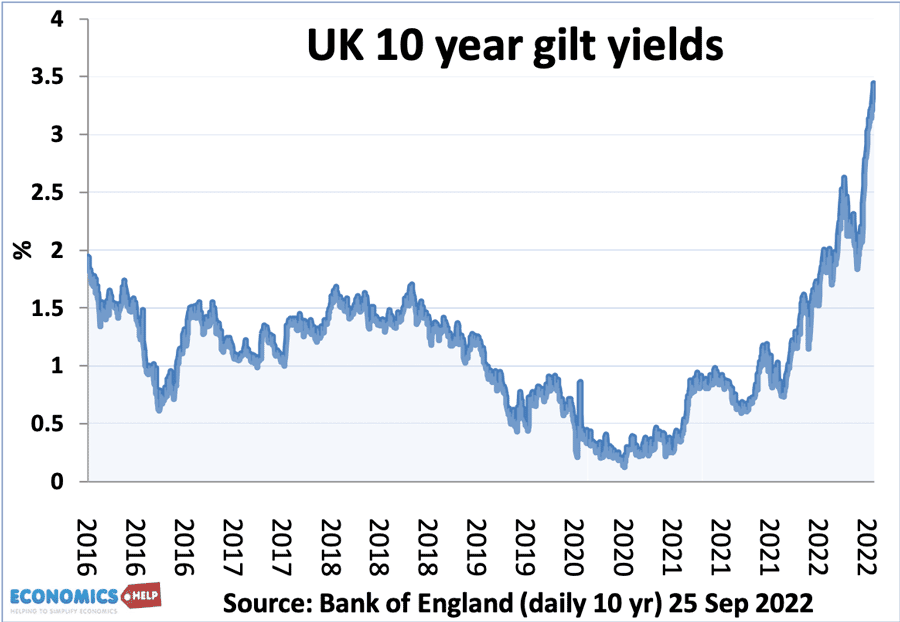

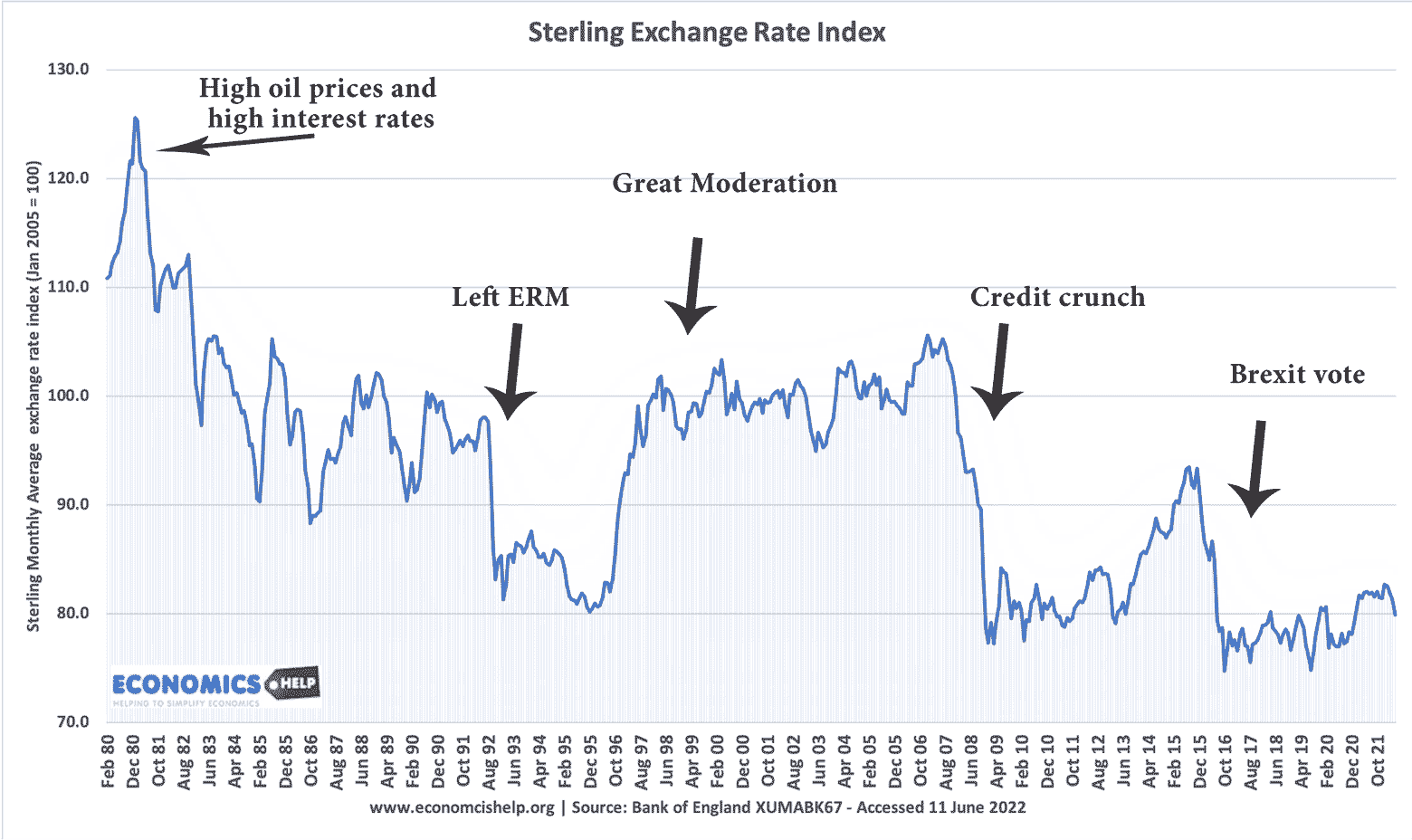

As the chancellor Kwasi Kwarteng was announcing his radical budget of energy bailout, and tax cuts for corporations and high-income earners, the markets took a dim view. Sterling fell and bond yields on government debt rose as investors sold UK bonds in response to the deteriorating outlook. Uniquely for such a large change of …