UK Economy heading for deepest recession in generation

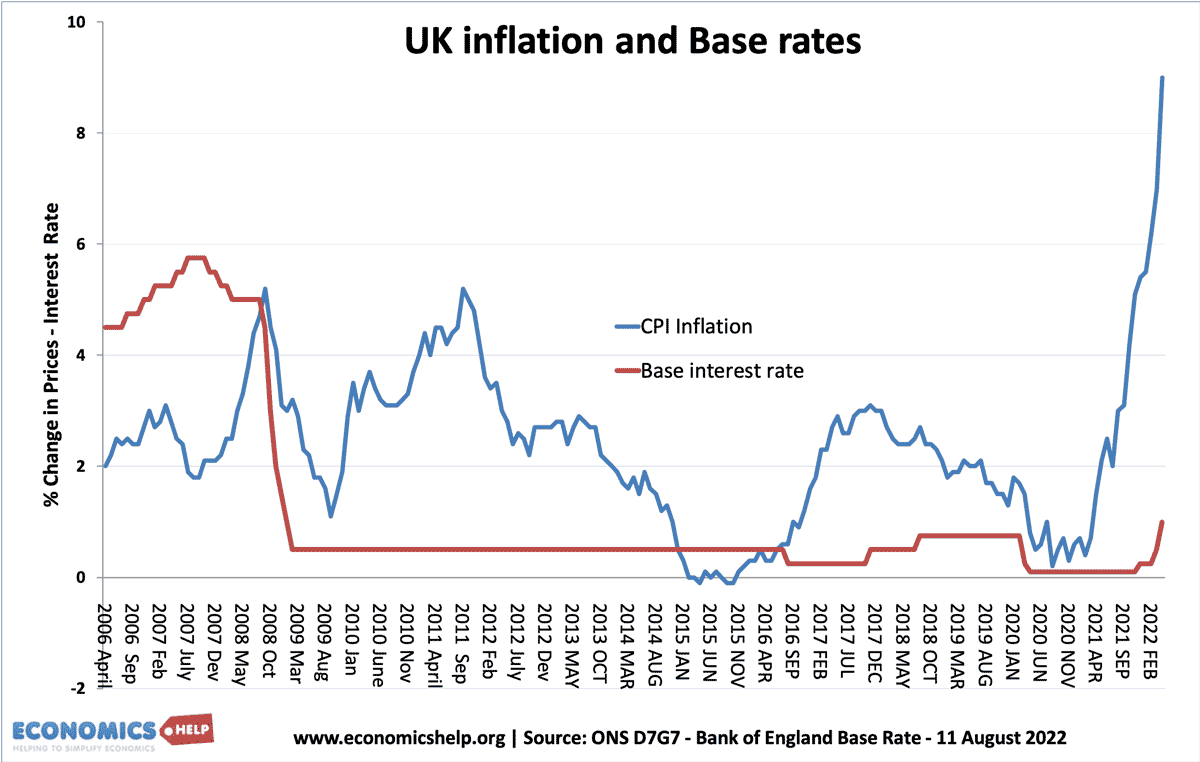

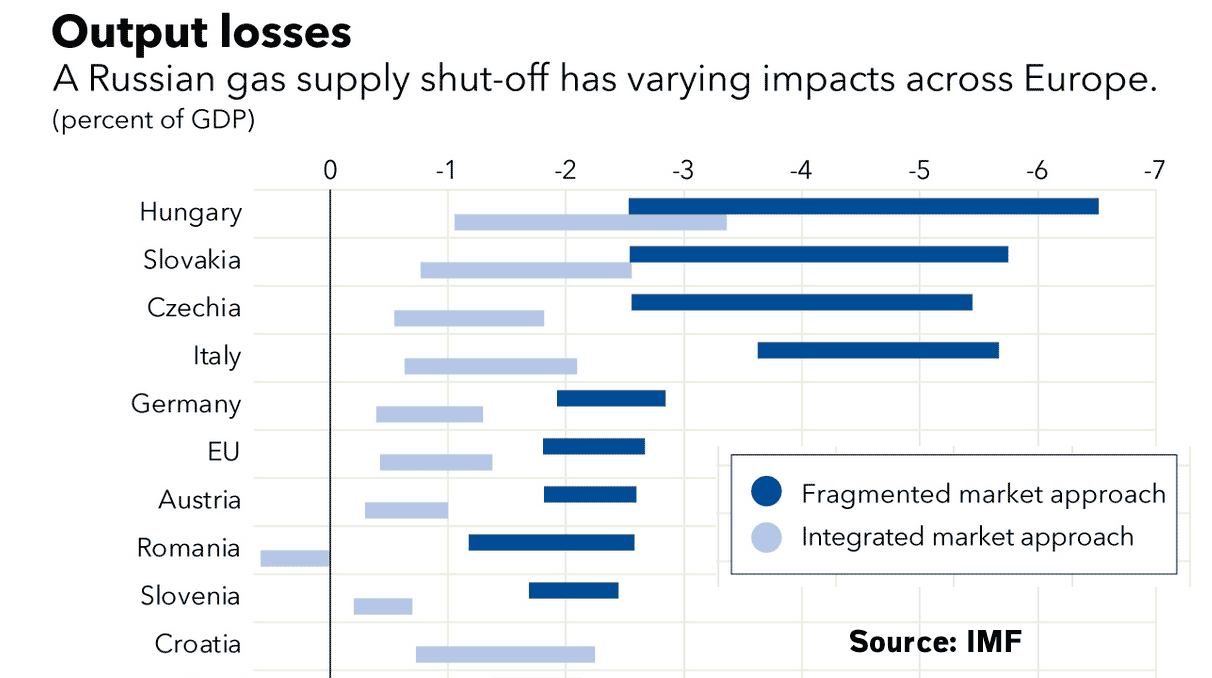

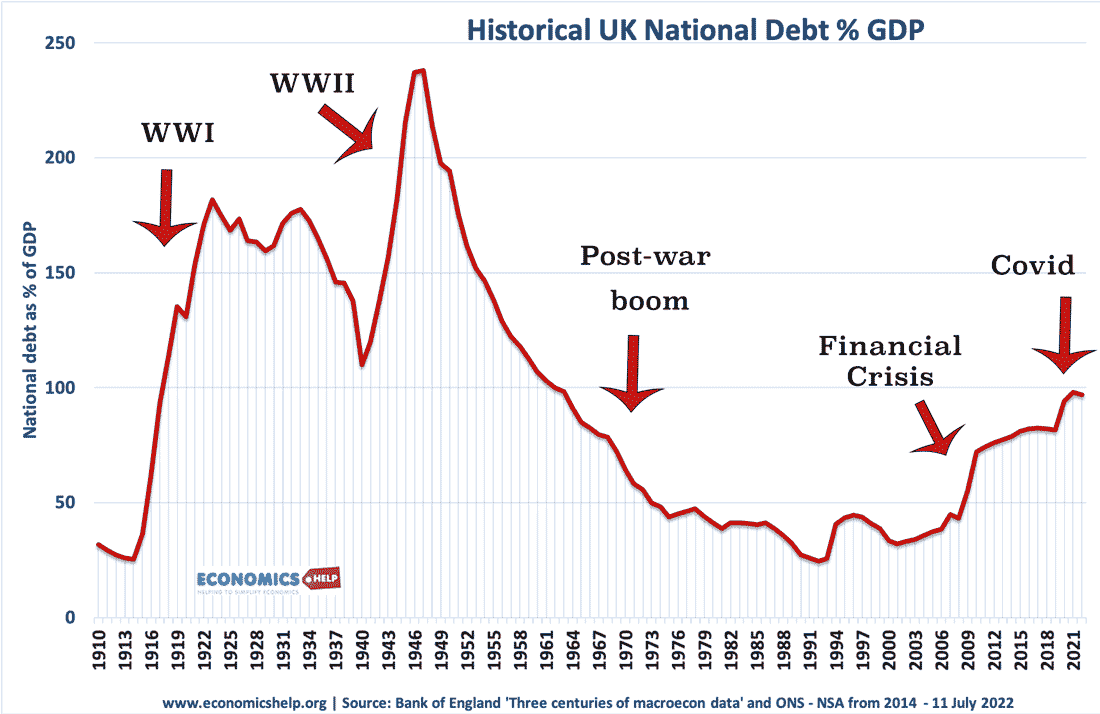

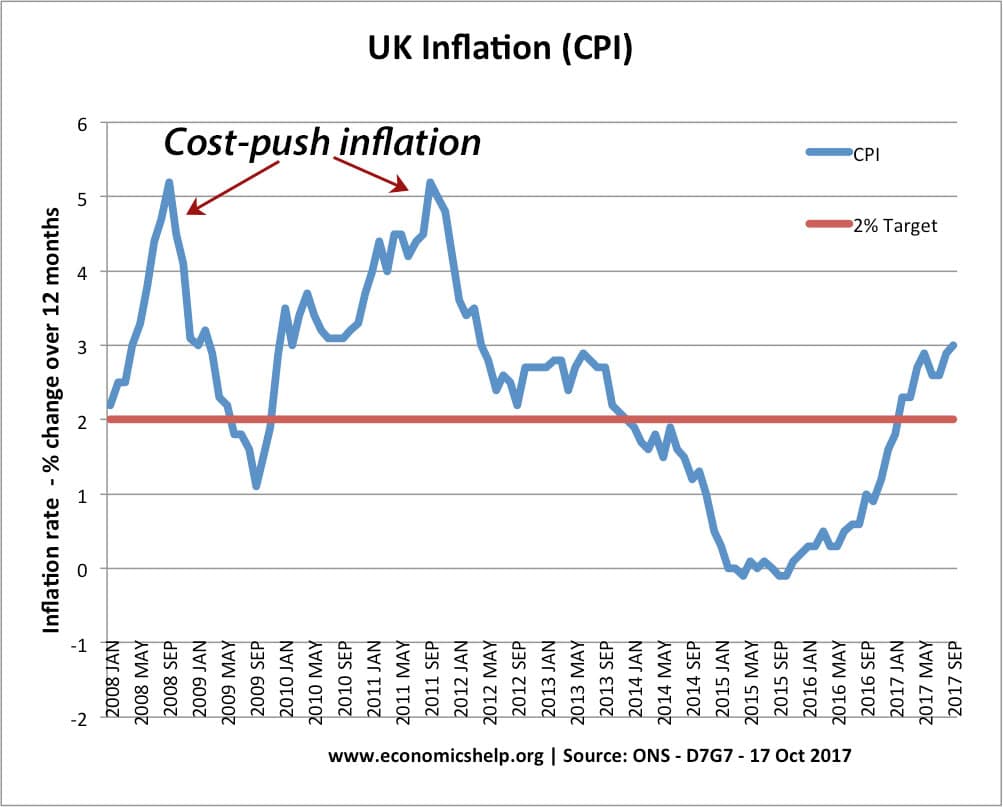

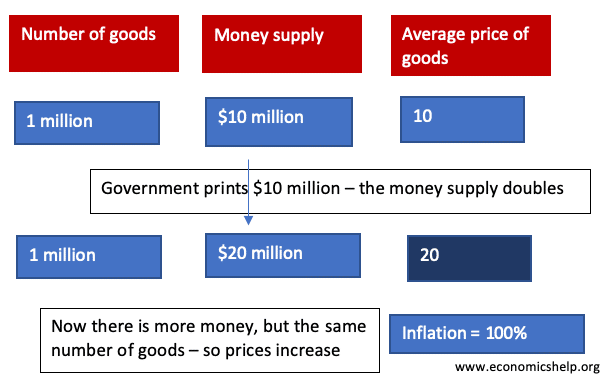

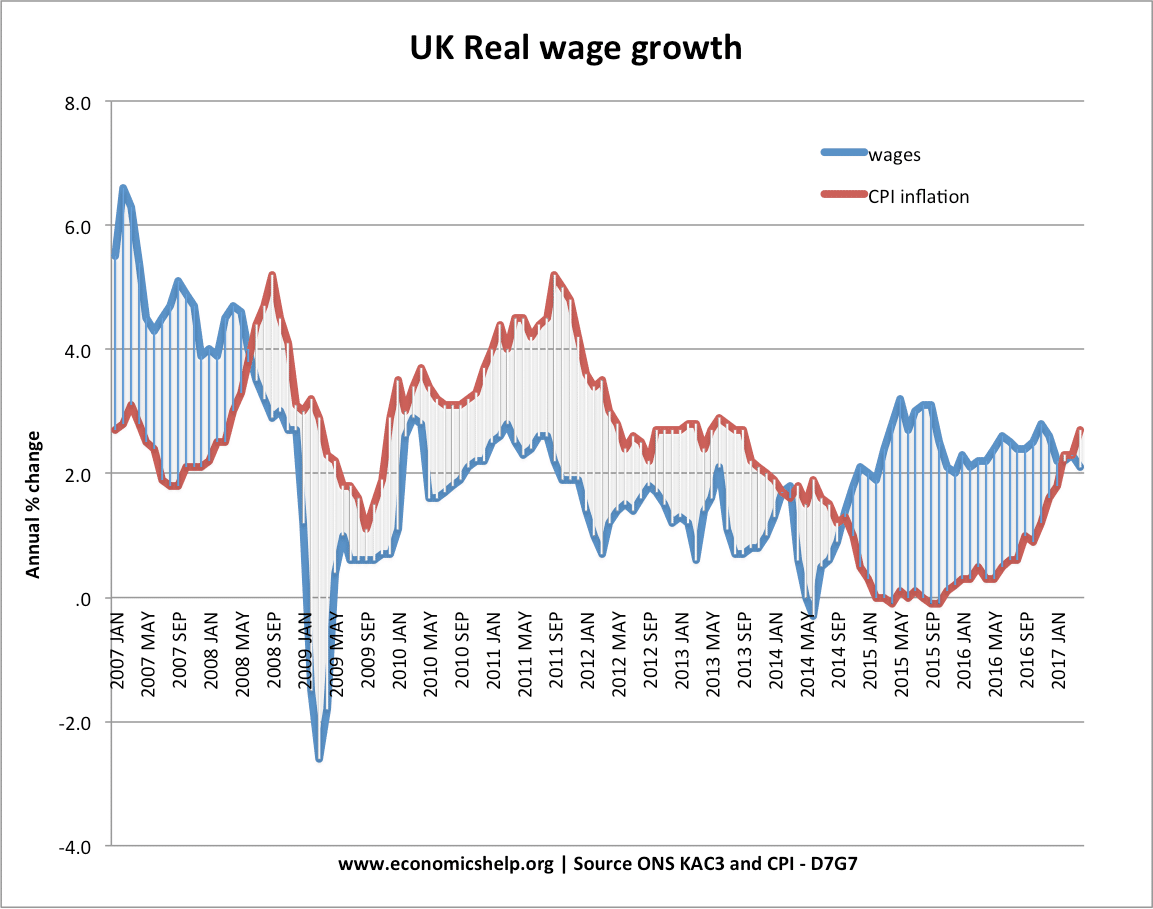

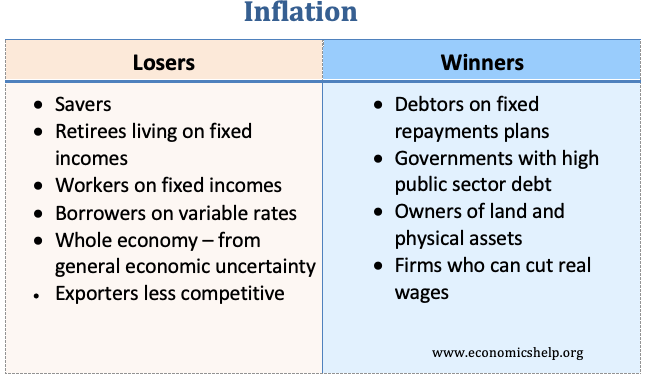

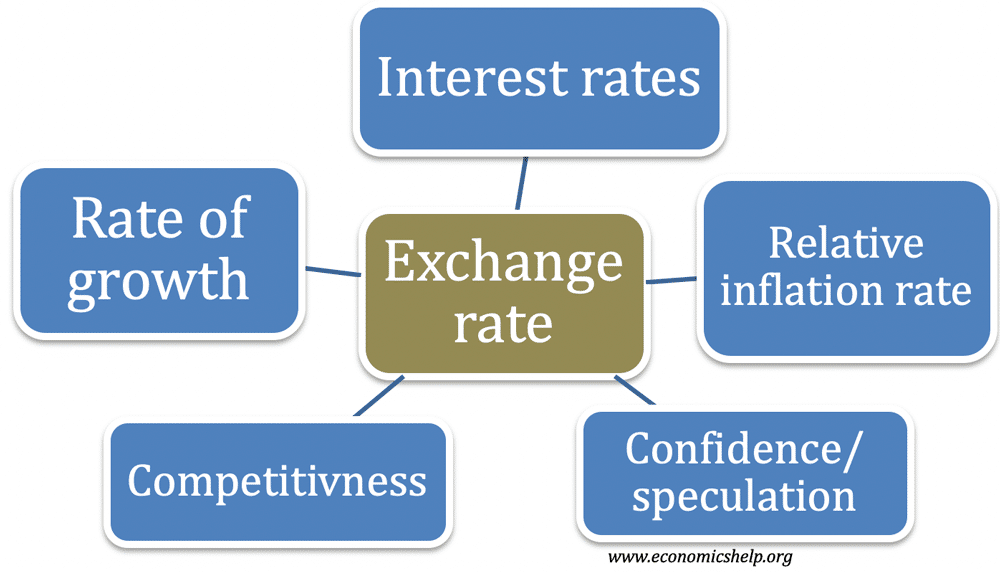

A recent report by the Bank of England made for grim reading. UK Output is forecast to fall and inflation is predicted to rise to a level not seen since the early 1980s. The UK like many economies is facing short-term pressures – rising energy prices, supply shortages and slowing growth. But, the malaise of …