Could a new Labour Government Reverse UK Economic Decline?

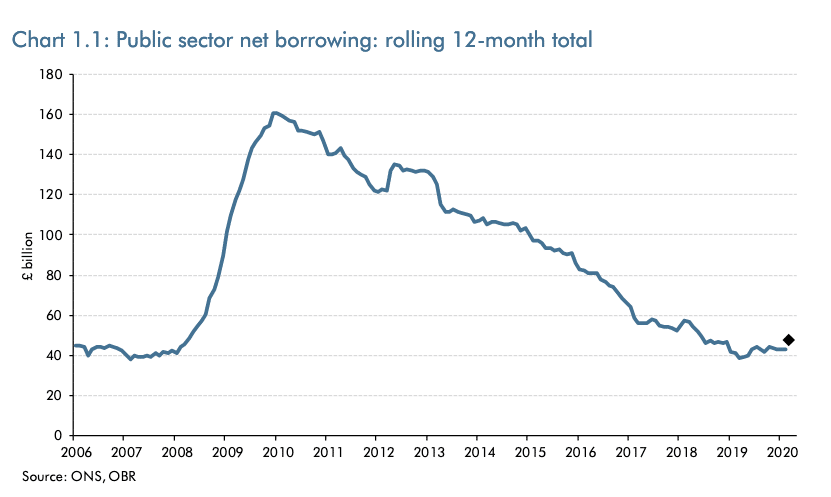

The UK economy is in dire straights. High inflation, low growth and rising debt. Since 2007, productivity has slowed down, leading to lost output and one of the worst growth rates in the OECD. The brunt of the slowdown has been felt by average workers, who have seen an unprecedented fall in real wages and …