Increasing interest rates in the time of a recession

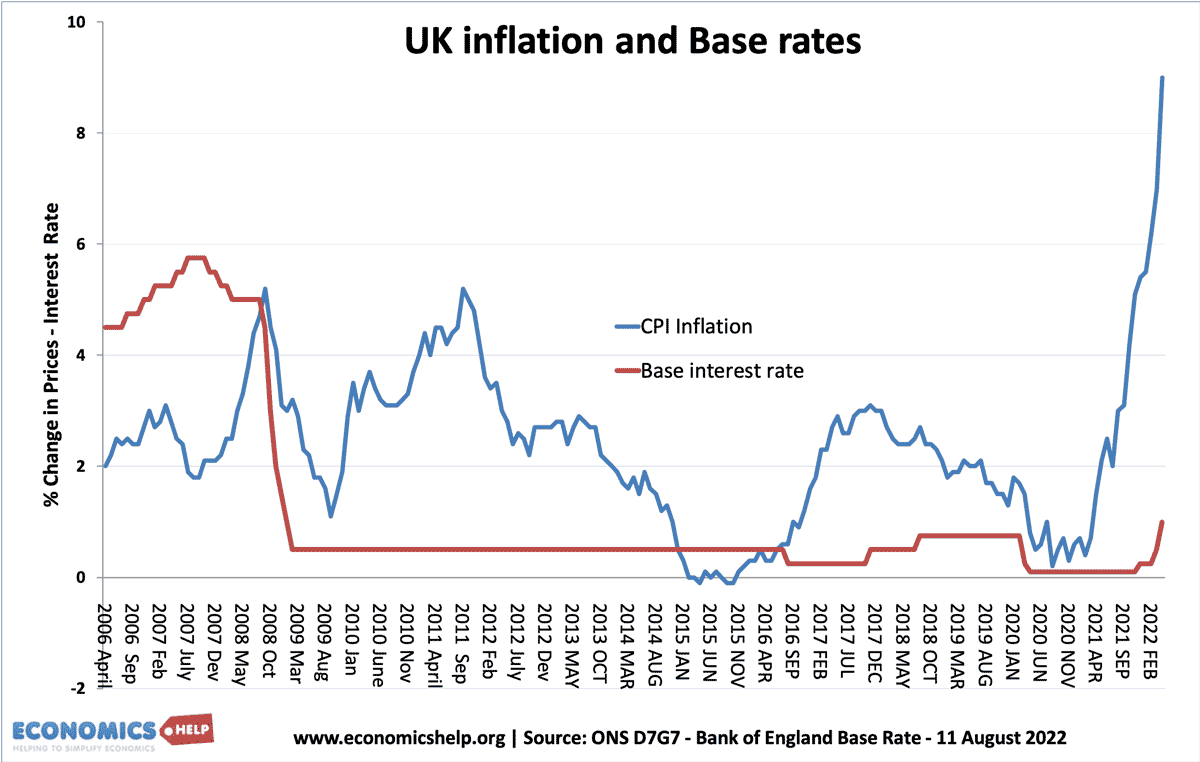

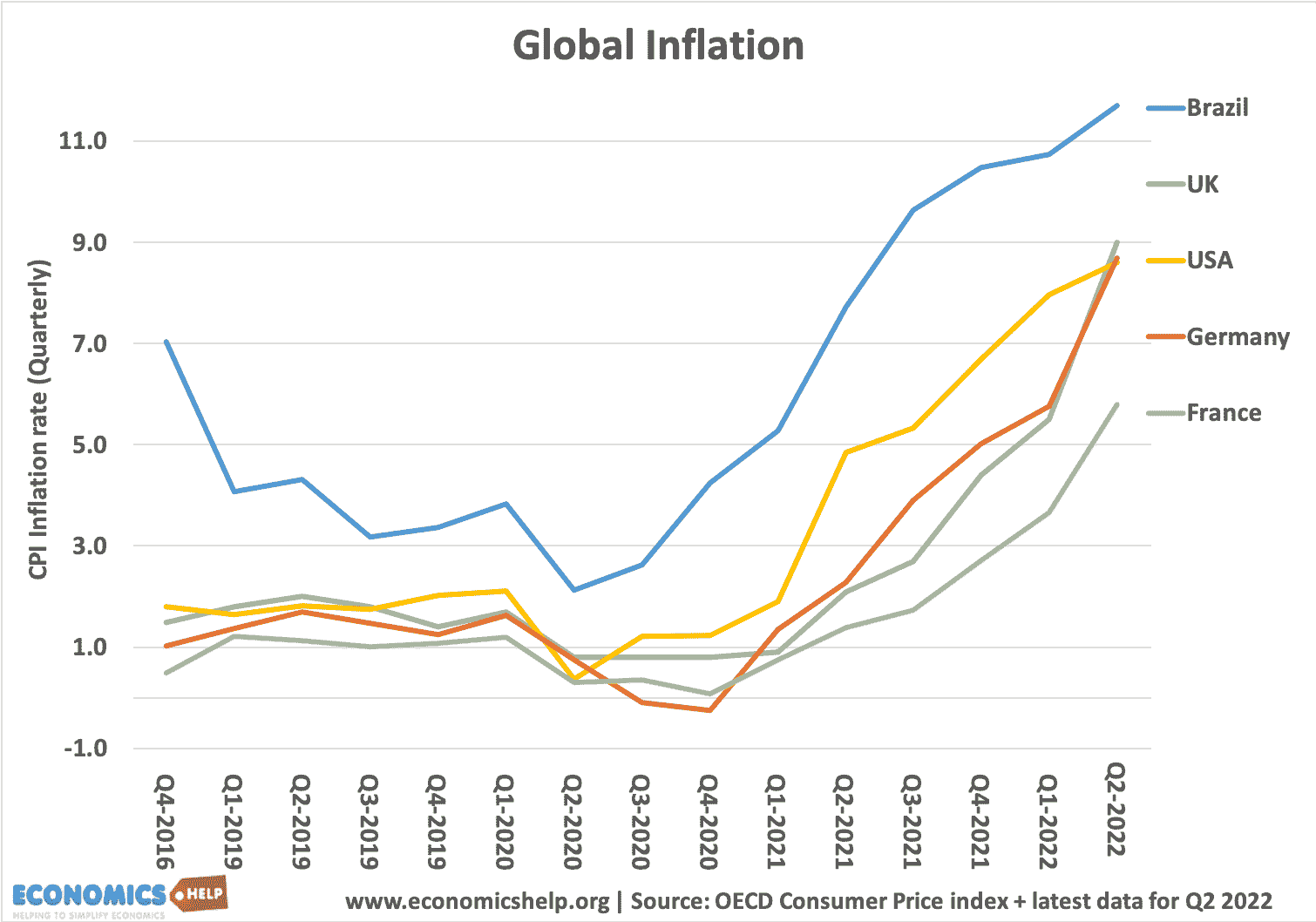

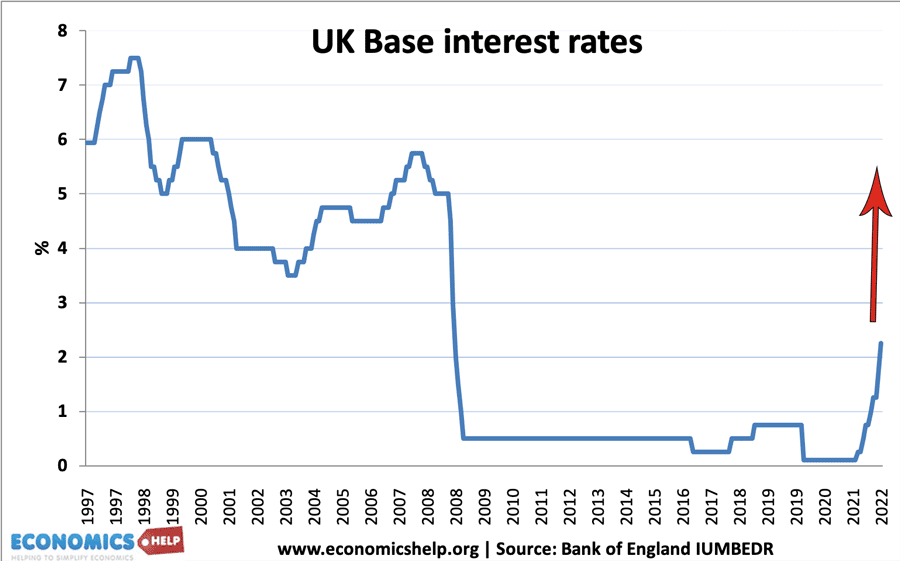

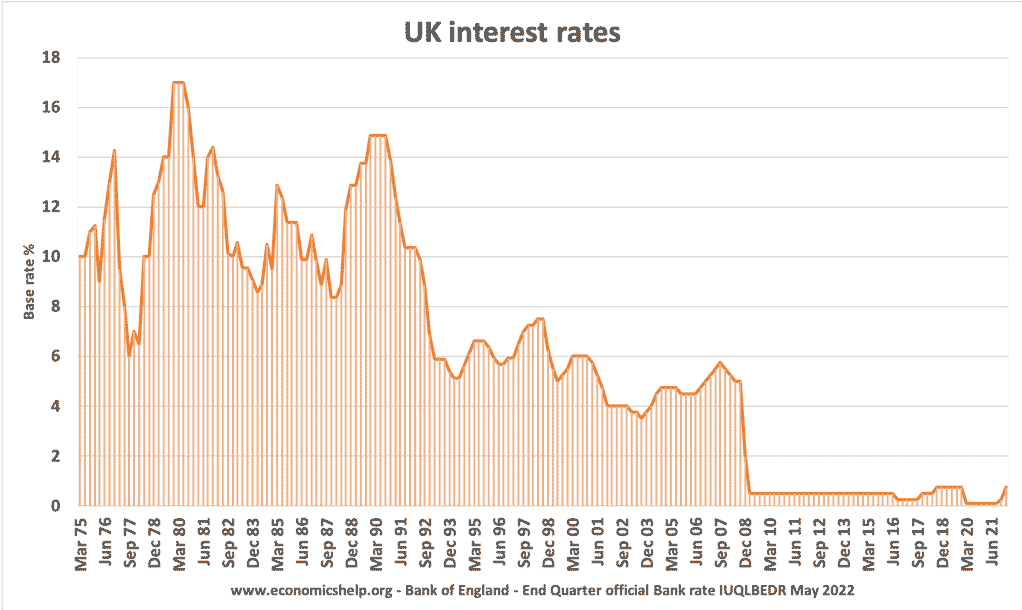

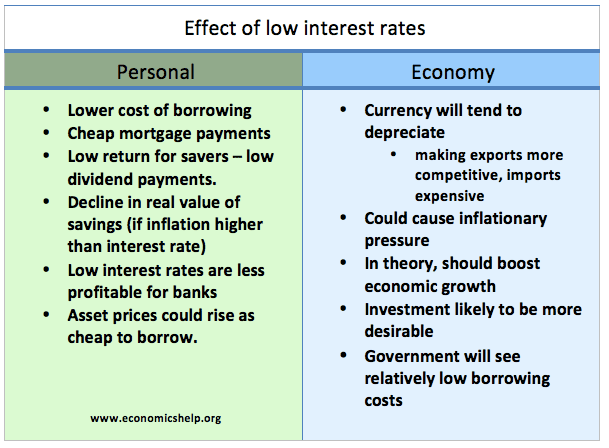

Central Banks around the world are increasing interest rates because of concerns about inflation. However, the curious feature of this economic cycle is that Central Banks are raising rates, just as economies go into recession. Higher interest rates will, therefore, exacerbate the economic downturn and cause a deeper recession and higher unemployment. So why are …