Policies to reduce inflation

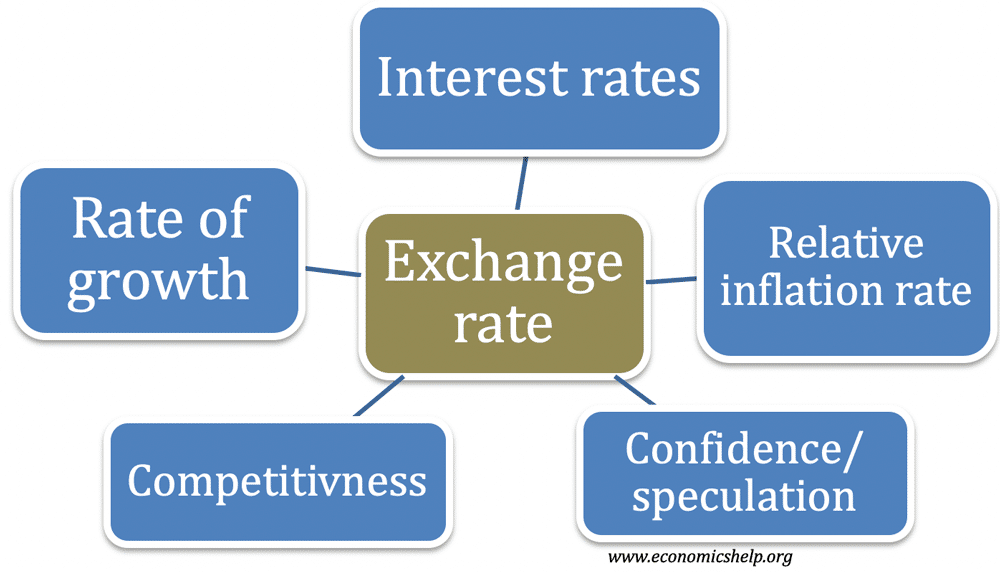

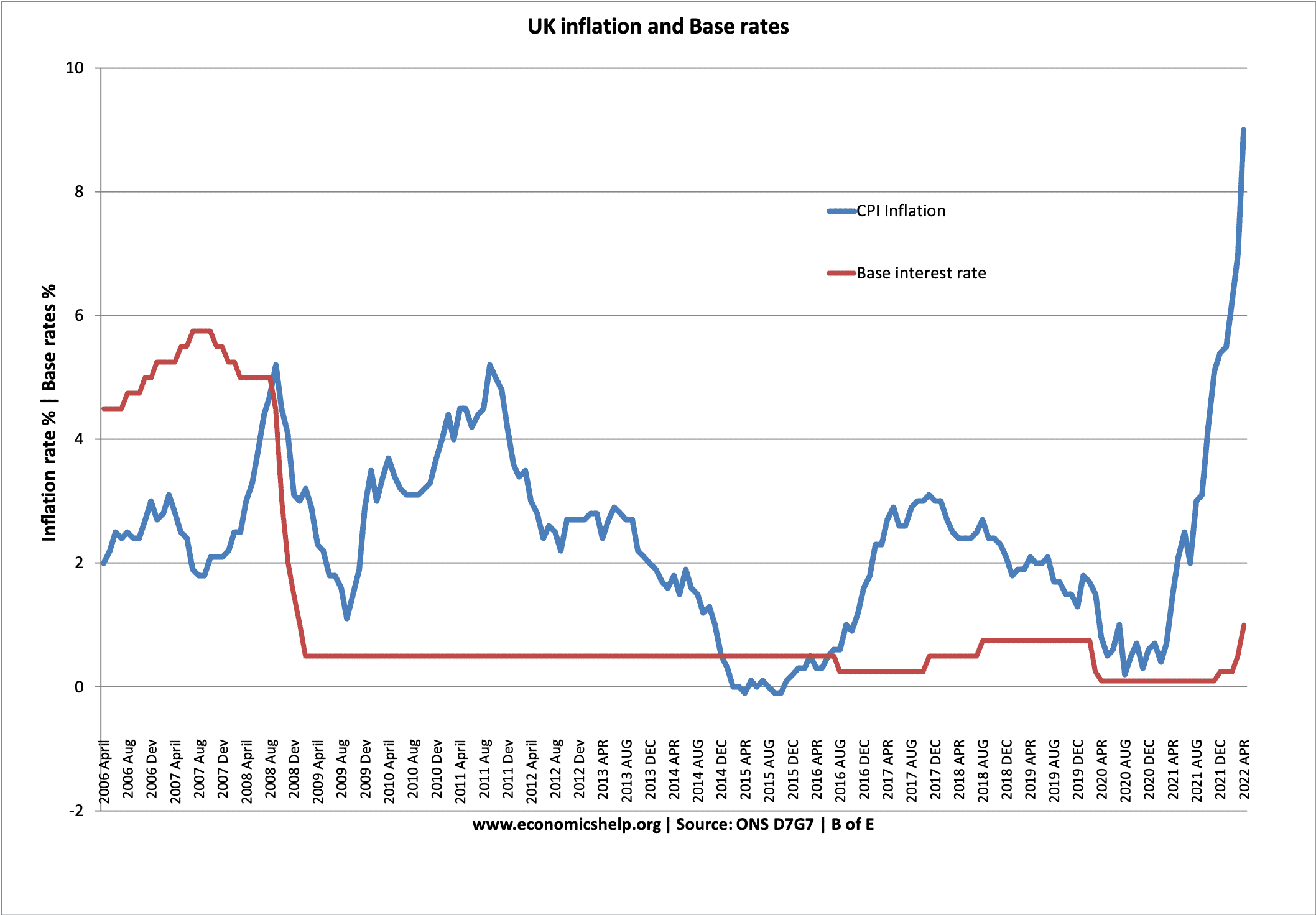

Inflation is a period of rising prices. The primary policy for reducing inflation is monetary policy – in particular, raising interest rates reduces demand and helps to bring inflation under control. Other policies to reduce inflation can include tight fiscal policy (higher tax), supply-side policies, wage control, appreciation in the exchange rate and control of …