Does rising interest rates always result in fall in house prices?

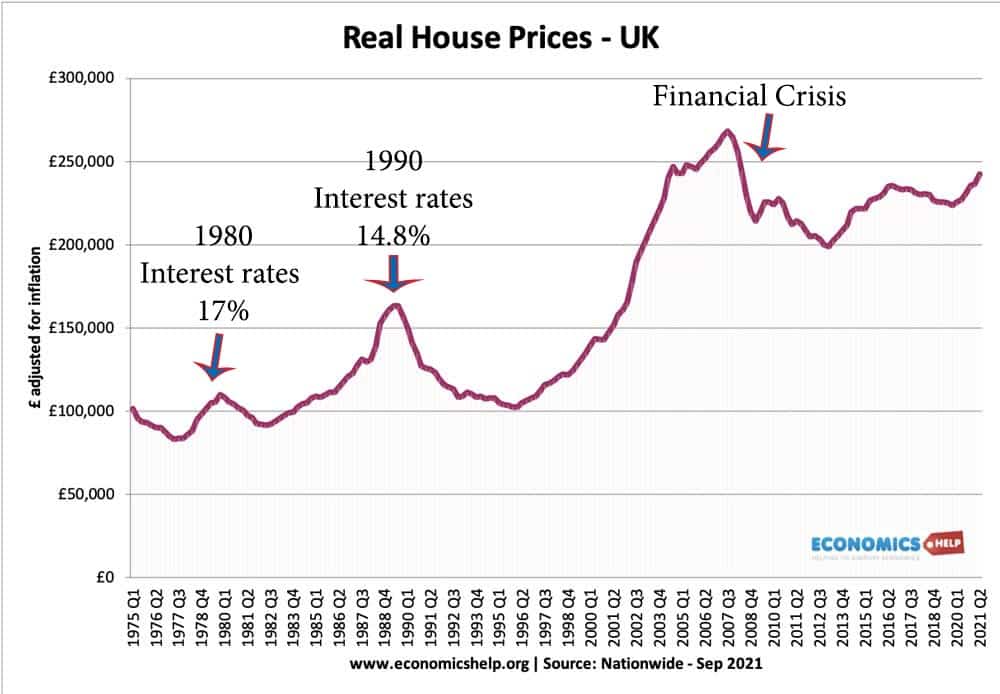

Readers Question: Does rising interest rates always result in a fall in house prices? No. It doesn’t always cause a fall in house prices. But, looking at historical data, when there is a sustained and significant rise in interest rates, it is very likely house prices will fall. For example, the 1981 and 1991 house …