What is the optimal inflation rate?

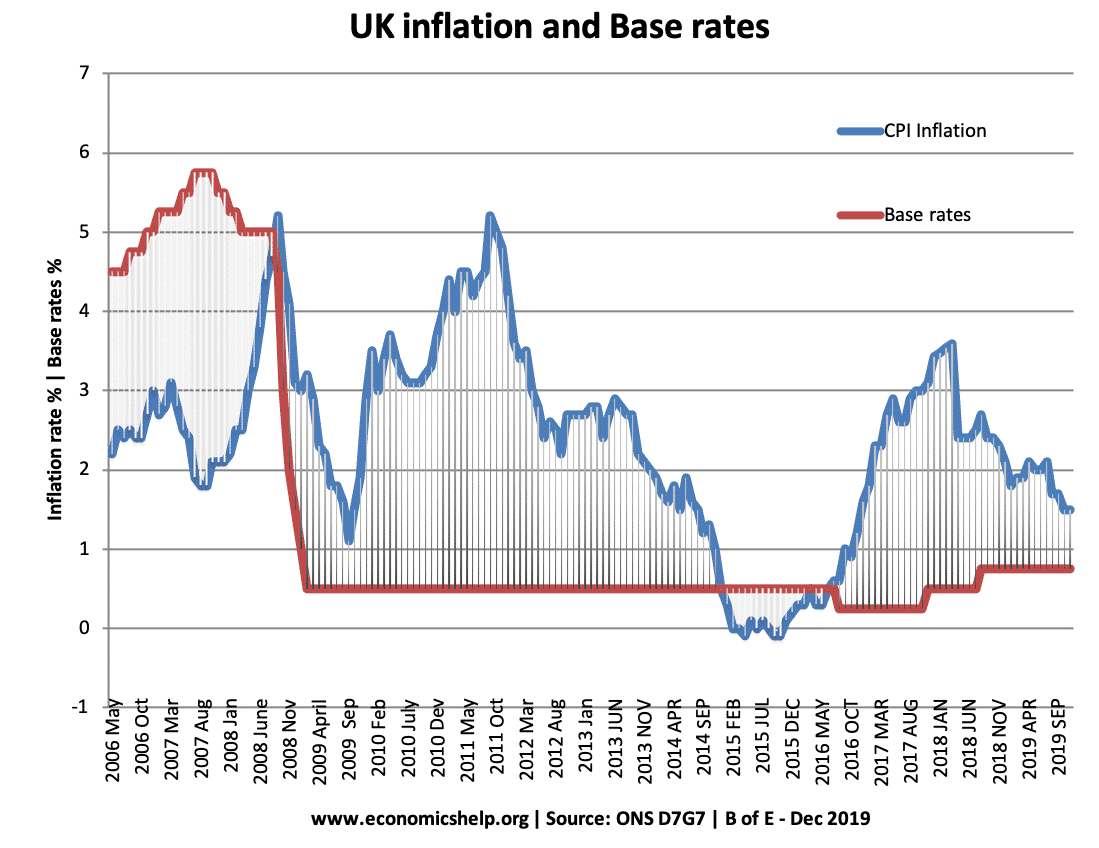

The optimal inflation rate is often considered to be around 2%. For example: The UK target inflation of 2% +/-1 The ECB target inflation of less than 2% US Federal Reserve target inflation of less than 2% (But from 2020 are likely to make inflation target symmetrical like the UK) Why Central Banks wish to …