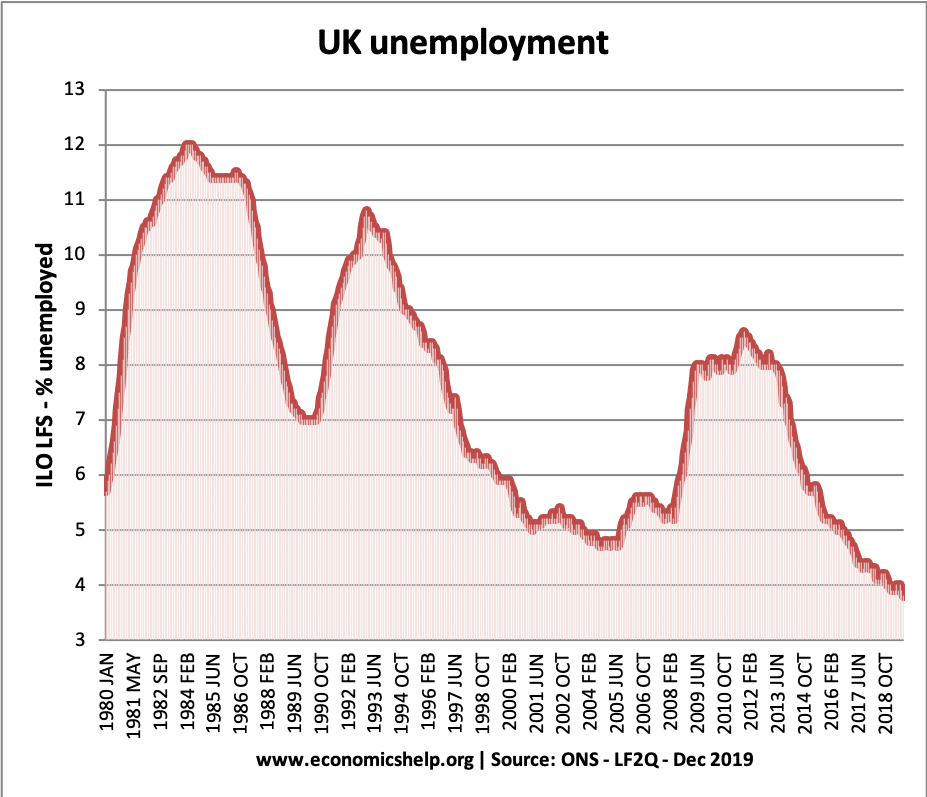

Despite weak economic growth of the past decade, UK unemployment has fallen quicker than we might expect. It appears the natural rate of unemployment has fallen and despite record employment levels, wage pressures remain muted. Different reasons for this fall in unemployment include – low productivity, more flexible labour markets, disguised unemployment (underemployment) and growth in part-time, self-employment.

After the much milder 1981 recession, UK unemployment rose to over 3 million (around 11%) and remained high well until the mid-1980s. After the 1991 recession, unemployment again rose sharply, to just over 3 million. But, after the 2009 recession, unemployment has fallen quicker than expected.

In Europe, unemployment has recently risen to record levels. Only in the US, has unemployment shown a similar fall, but the US has seen much stronger economic recovery than the UK.

Unemployment rate Feb 2020

- UK unemployment – 3.8%

- US unemployment – 3.7%

- French unemployment – 8.6%

Why has unemployment been falling, when the economy is relatively weak?

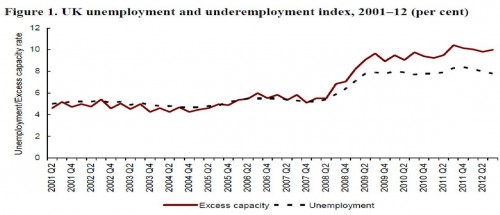

1. Flexible Labour Markets. Evidence suggests that UK labour markets are more flexible. For example, it is easier to cut hours and keep people employed on shorter working hour contracts.

This is illustrated by a rise in under-employment during the long recession. More people are reporting working fewer hours than they would like. However, flexible labour markets can also mean it’s easier to hire and fire workers. You would expect if labour markets were very flexible, firms would be quick to make redundancies, but this doesn’t seem to be occurring. (flexible labour markets)

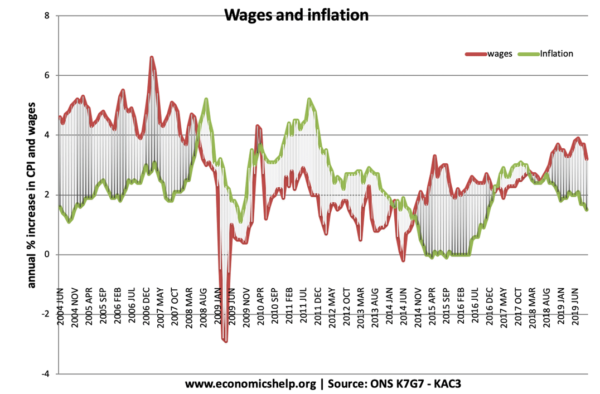

2. Flexible Pay. Related to flexible labour markets have been the recent trends in pay. We have seen ten years with real wages remaining stagnant. If unions were powerful, and workers could bargain for higher wages, it is likely that unemployment would be higher. The fact that wage growth has been stagnant has encouraged firms to keep holding onto workers. Firms are keeping low-paid workers rather than cut the number of workers. (UK wages)

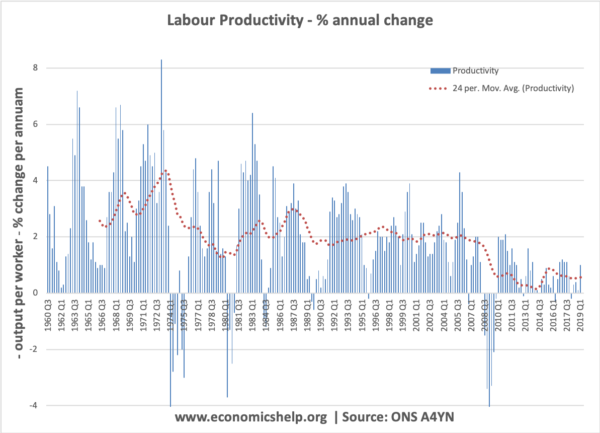

3. Falling Productivity

Source: ONS – labour productivity growth | data set: A4YN from ONS

Another feature of this recession has been a record fall in labour productivity . Usually, labour productivity increases by around 2.5% a year, but since 2008, labour productivity has been stagnant or growing very slowly.

With low productivity growth, firms need relatively more workers. If productivity growth was high, firms could produce the same output with fewer workers. Therefore, low productivity growth creates additional demand for workers.

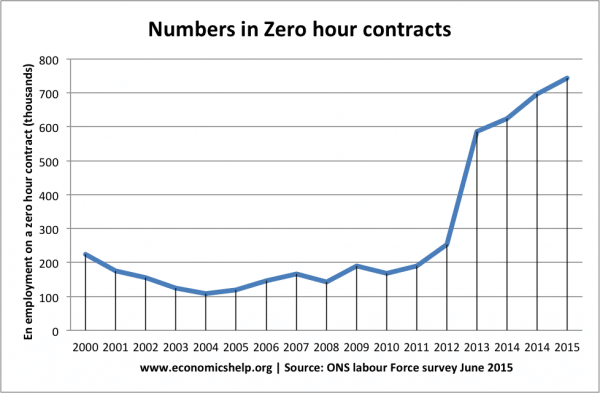

4. Growth in zero-hour contracts

The number of zero hour contracts have increased from 100,000 (2005) to 700,000 in (2015). This means workers have no guarantee of how many hours they will get paid for. It is a factor in explaining why there is more under-employment.

5. Growth in self-employment

In 2013, there are 367,000 more self-employed people than in 2008. More than 200,000, or 60% of these, became self-employed between 2011 and 2012. This suggests, that in response to deteriorating labour market conditions, more people are seeking to set up as self-employed. It also reflects the fact some firms are trying to promote self-employment.

6. More difficult to claim benefits

In recent years the government has tightened up the criteria for claiming benefits. If the unemployed wish to be counted as unemployed, they have to prove they are looking for work and willing to accept a job if it is offered. With real benefits falling behind wages, there is a strong incentive to take employment – even if it is fewer hours than workers would like or it doesn’t reflect their skills.

Conclusion

There are many reasons to be gloomy about the UK economy. Low productivity growth and poor real GDP per capita growth. However, the unemployment figures are relatively good. However, it has come at the cost of falling/stagnant real wages and poor labour productivity.

It appears the natural rate of unemployment is significantly lower in the UK in the 2020s, than it was in the 1980s.

Related