A look at the future prospects for the Pound in the coming months of 2013.

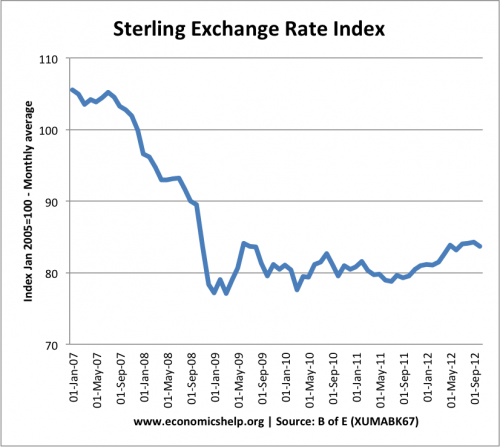

The Sterling index measures the value of the Pound Sterling against a basket of trade weighted currencies.

- In Dec 2011 the index was 80.4

- By Oct 2011, the exchange rate index has increased to 83.6

This modest appreciation in the Pound has occurred despite:

- Double dip recession in UK

- UK Inflation remaining above target

- Growing current account deficit

- Quantitative easing increasing money supply.

- One of largest budget deficits in OECD

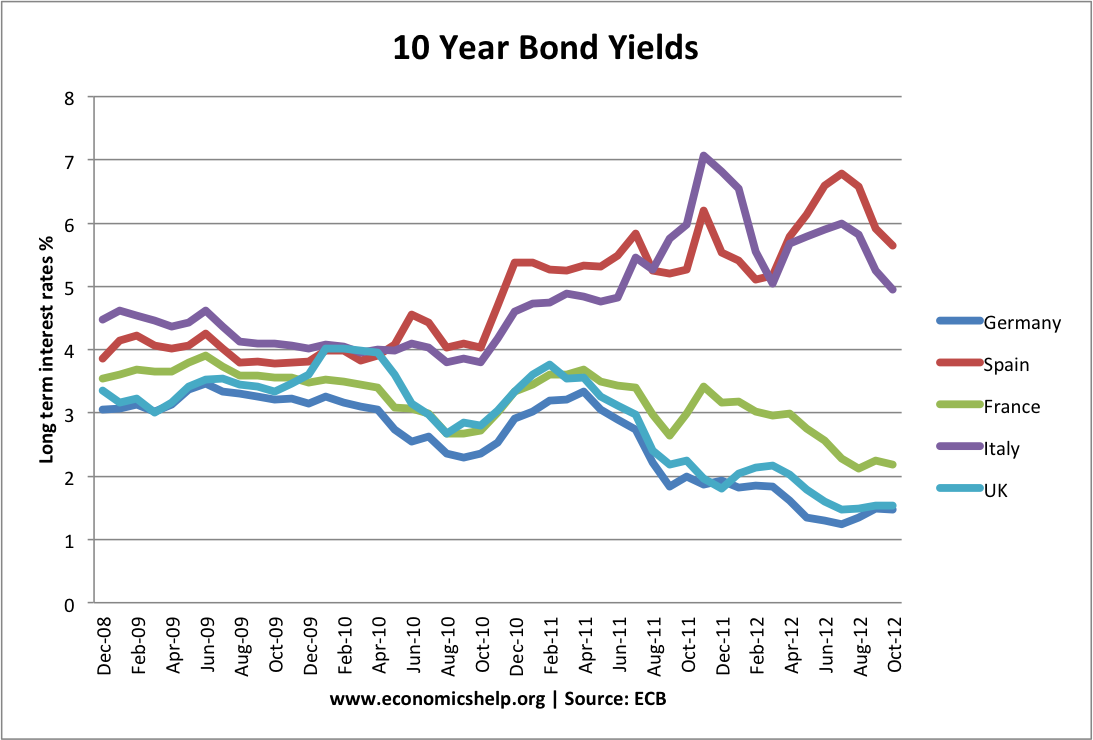

Therefore the appreciation in the Pound is not so much a reflection of the strength of the UK economy – but a reflection of market nervousness about other currencies. In particulary, given the Euro crisis and difficulties of Eurozone economies, the Pound offers a greater semblance of normality and confidence.

However, given the weak state of the UK economy, it is likely that the fortunes of the Pound could deteriorate in 2013 – especially against the dollar and currencies other than the Euro.

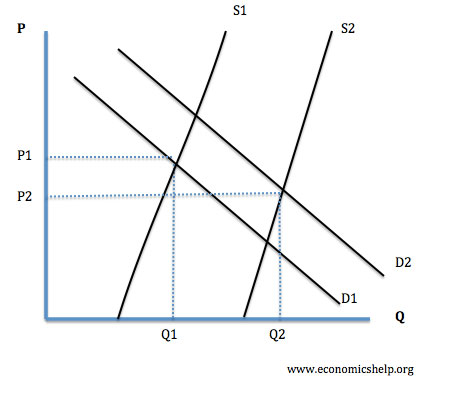

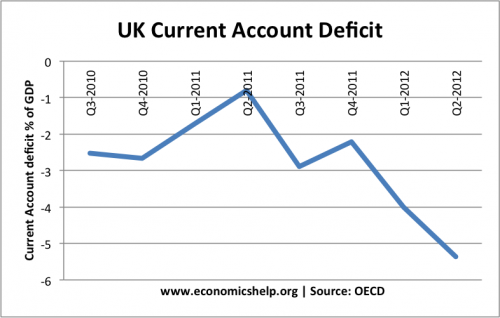

In particular, the growing UK current account deficit (now over 5% of GDP) suggests underlying lack of balance between imports and exports.

The UK has one of the largest current account deficits in the OECD. There are other reasons to explain the current account deficit, but the widening of the deficit to over 5% of GDP, suggests the Pound is becoming more uncompetitive against its main rivals. In a floating exchange rate, this is likely to lead to some depreciation in the future.