I’m off to New York on Wednesday, I’m tempted to stay until May 8th, so I can miss the UK General election campaigning, which so far has been quite depressing for the poor quality of economic debate.

This is just an outline of some issues for consideration. I may expand upon these in the coming weeks.

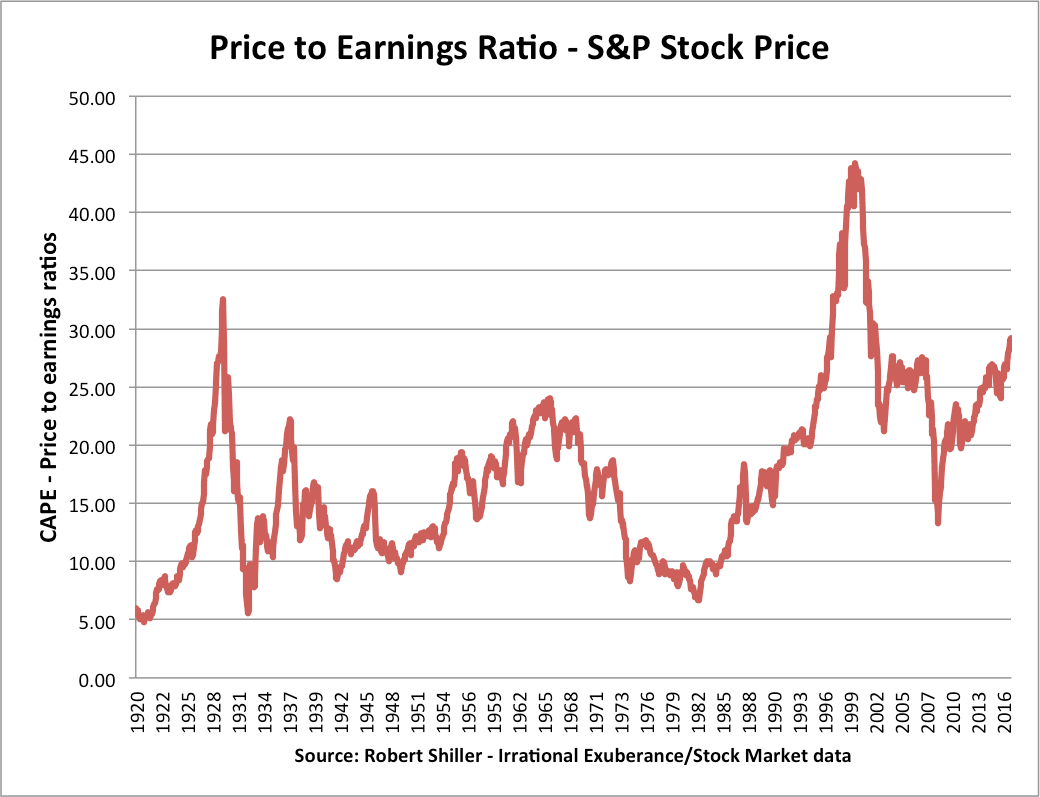

Whose fault was the 2008/09 economic crash? –

Essentially a global financial crisis, exacerbated by weak financial regulation. But, who was advocating much stricter regulation of the banks pre 2007?

See: who is to blame for great recession

Would the great recession have been worse?

Yes:

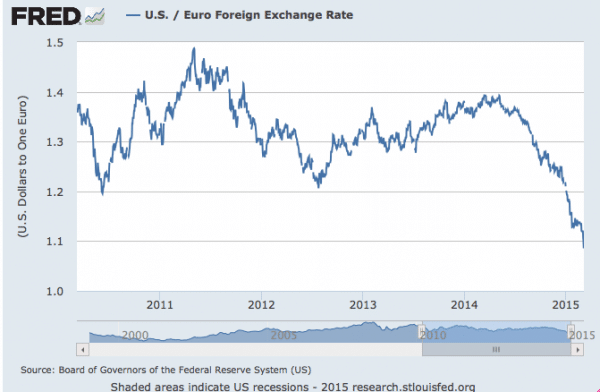

- if UK had been in EURO.

- If UK had not pursued expansionary fiscal policy in 2009

- If Bank of England had not pursued expansionary monetary policy

Was the great depression caused by reckless government borrowing under Labour?

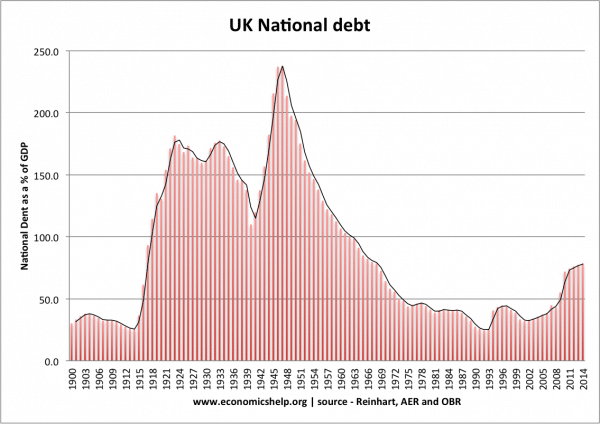

In 2007/08, UK public sector debt was close to the lowest level achieved since before the First World War in 1914.

See also: Government debt under Labour

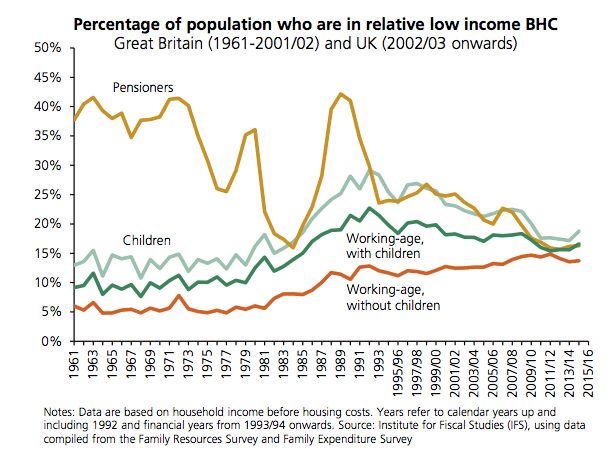

Note debt levels in 1945, when Labour introduced NHS, welfare state and nationalised key industries!

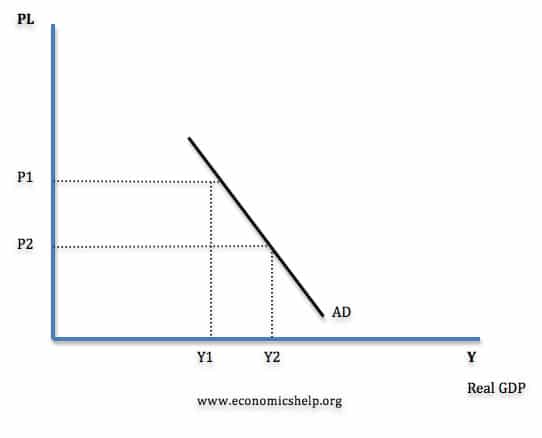

Is reducing the budget deficit an important economic objective – when the economy is recovering from recession?

Reducing debt may be an important political objective. But, ironically, many economists feel that reducing deficits (through austerity) can be counter-productive.

Why is austerity so politically popular, when so many economists state it is damaging?

What is the economic impact on immigration on the UK economy?

Many benefits for tax revenue, labour supply, economic growth and reducing debt to GDP. Though it does add to the added pressure on housing market, congestion and transport.

See: Economic effects of immigration

Economic record of the coalition

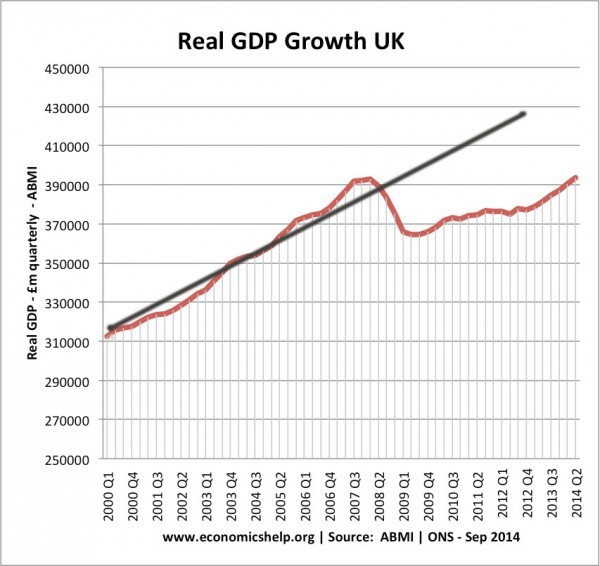

1. Economic growth

Economic recovery – better than Europe.

Recovery came, but did period of austerity in 2011 unnecessarily delay the recovery? Should the recovery have been much stronger? Have we permanently lost output? Austerity pros and cons