How to judge George Osborne’s and David Cameron’s economic record since May 2010?

They inherited an economy recovering from a deep recession, high unemployment and large budget deficit. It was a difficult economic circumstance, but at the same time you might expect a strong economic recovery as there was much unused capacity and potential for economic growth.

The chancellor and supporters will point to a stronger economic recovery than Europe, falling unemployment and a large reduction in the budget deficit.

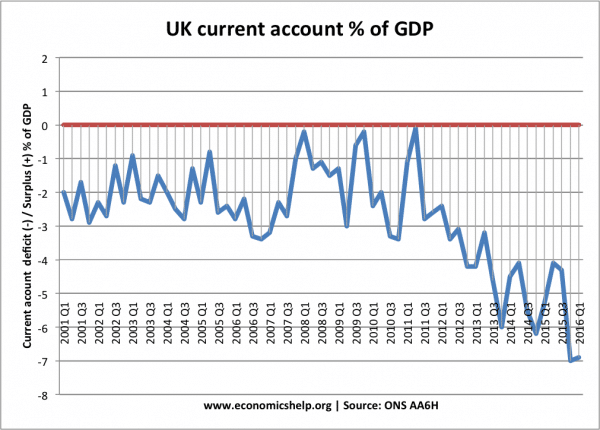

His critics will argue the austerity of 2010-12 was unnecessary – causing the slowest economic recovery on record and leading to a permanent loss in potential output. They will also criticise the unbalanced nature of the UK recovery – a record current account deficit, reliance on consumer spending and an economy fragile to the economic shock of Brexit.

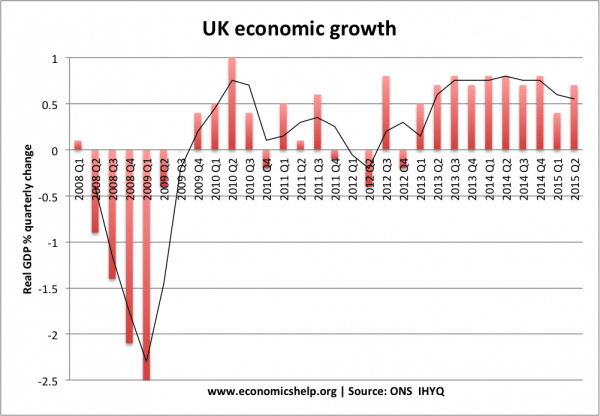

Economic growth

The most disappointing part of their record was the stalled economic recovery in the last half of 2010 until the start of 2013.

Arguably, this was for two main reasons:

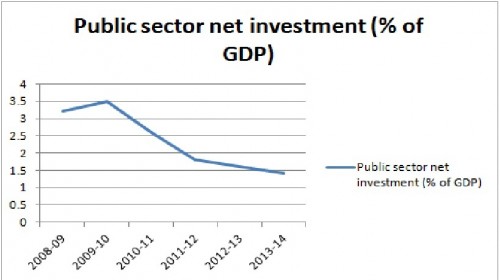

- Actual austerity – spending cuts and cutting public sector investment reduced aggregate demand and investment.

- Also the relentless focus on austerity and how bad shape the economy was in – hit consumer and business confidence.

In a recession, with high levels of savings, very low interest rates and weak growth, is the perfect time for the government to finance more public sector investment for both improving the demand and supply side of the economy, but this opportunity wasn’t taken.

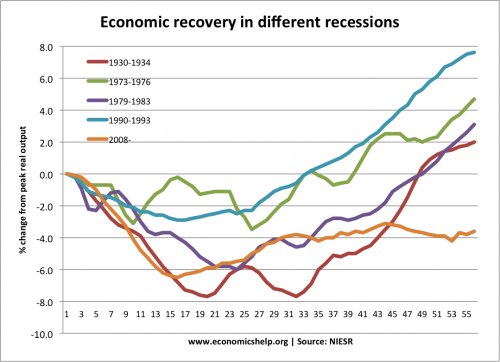

Slowest recovery on record

See: Comparing different recessions

This graph shows that the UK recovery from 2008 recession was the slowest on record. The chancellor could defend himself by saying:

- It was a uniquely deep recession, due to the financial crisis hitting the UK hard.

- The biggest falls in output occurred before they took office in May 2010.

- Eurozone recovery has been even worse in recent years (weighed down by austerity and Eurozone crisis). The UK is at least growing close to 2% a year.

However, in judging the economic record of 2010-16, the strength of the recovery was one of most important criteria, and the government’s fiscal policy was important for stalling the recovery.

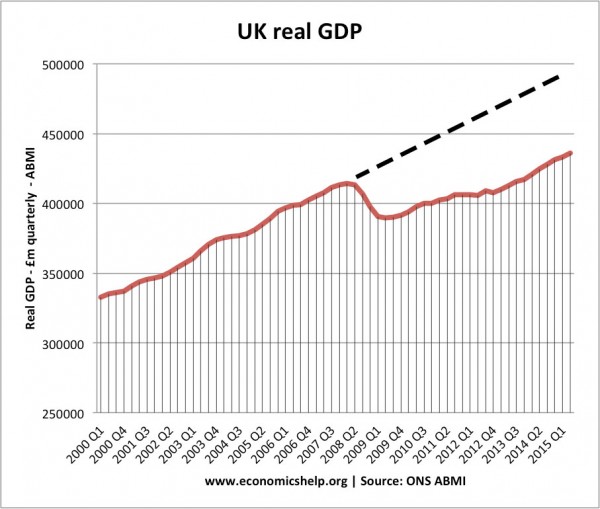

Real GDP

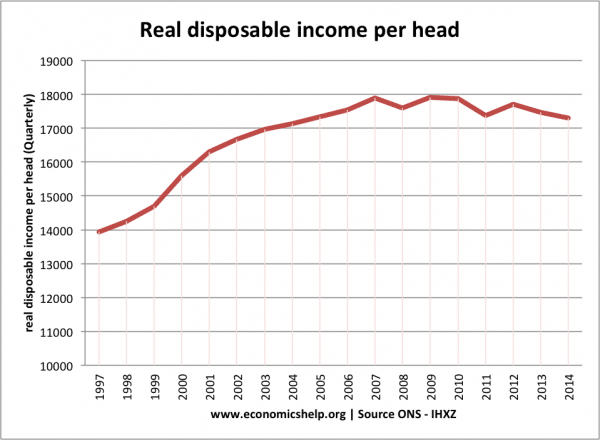

Real GDP per Capita

Source ONS – IHXZ

Real household incomes per capita fell from 2007 to 2014.

Economic growth record is even less impressive if you look at real GDP per capita. The irony is that (given hostility to migration in EU referendum) net migration levels have been very helpful for improving key economic statistics like real GDP growth and budget deficit.

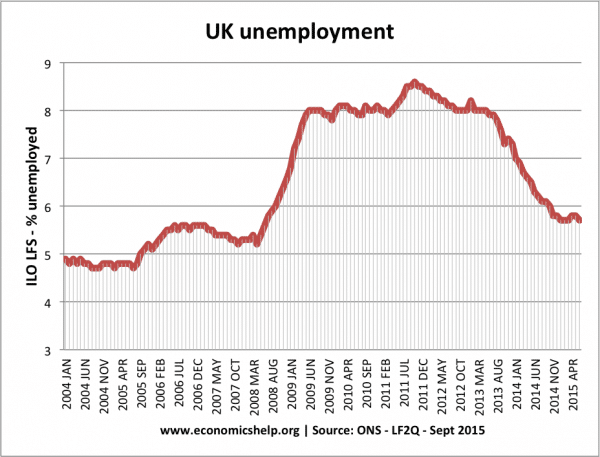

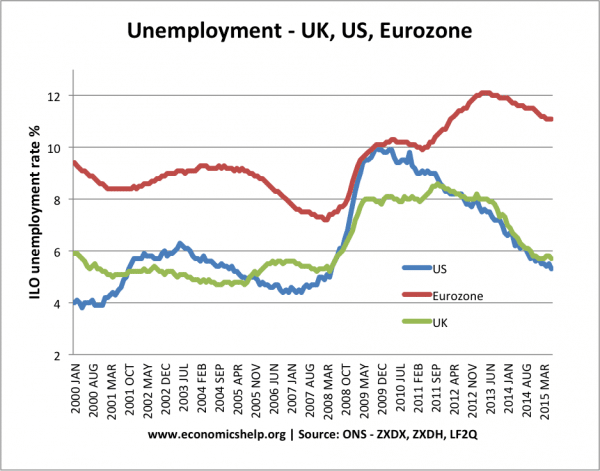

Unemployment

Unemployment is one of the major successes of the Osborne / Cameron years – falling to 5.5% – a much quicker fall in unemployment than previous recessions (e.g. 1980s, 1990s) This fall in unemployment occurred despite relatively weak economic growth; the credit for the fall in unemployment has often been attributed to more flexible labour markets – partly a result of government policy and partly due to changing working conditions.

The only downside to the fall in unemployment is that:

- Without double-dip recession, the fall could have been stronger and quicker.

- The fall in unemployment has been achieved through low wage growth and a rise in zero hour contract types of employment. However, although job insecurity has increased. The increase in the national minimum wage to a living wage level is an achievement of the chancellor.

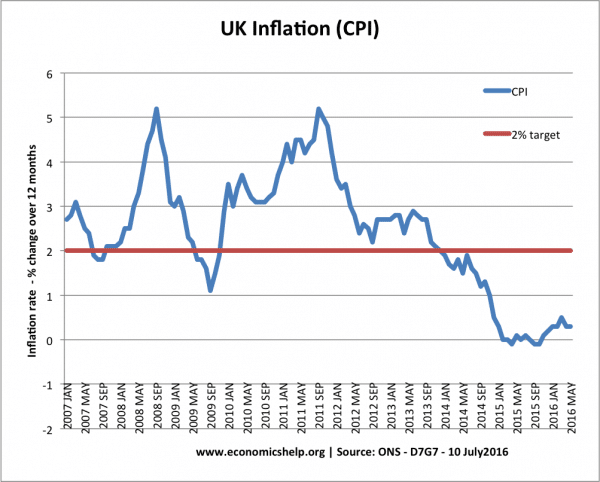

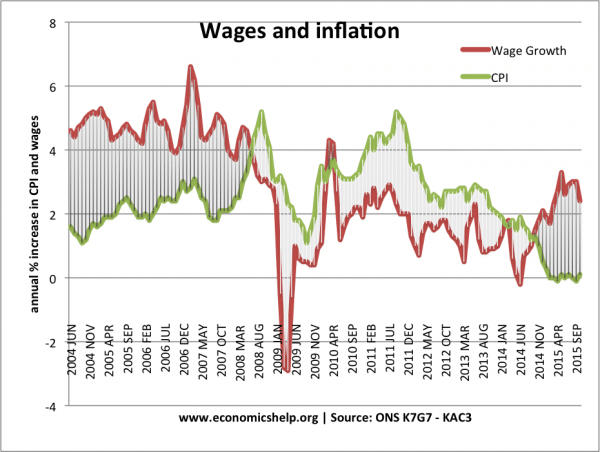

Inflation

Inflation has mostly been benign, apart from the cost-push inflation of 2011 – due to higher taxes, impact of devaluation and external factors. This cost-push inflation was mostly out of the control of government policy, but it did lead to a decline in real wages.

In fact, the main criticism of inflation in the 2010-16 years was the fact that inflation was too low – hitting 0% for much of 2015. An indication that economic growth that was too weak.

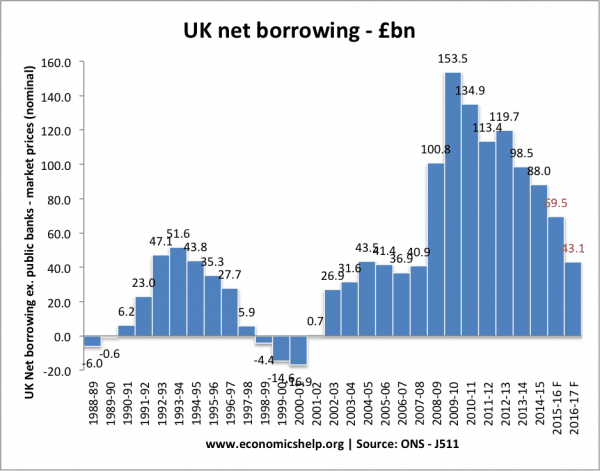

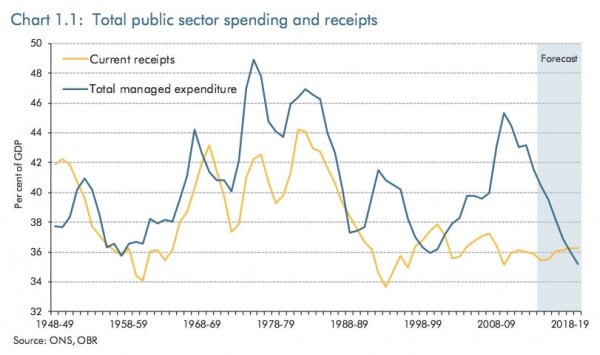

Budget deficit

For a chancellor who placed so much store on the budget deficit, he will take a reduction in the deficit as a major achievement. However, his own fiscal rules were regularly broken and the pace of deficit reduction was slower than he promised. This was partly due to the fact that lower growth (as a result of austerity) hit expected tax revenues. His fiscal rules for balancing the budget were widely condemned for lacking any economic logic, and they are likely to be ignored by the future Conservative chancellor.

In 2010, it was claimed that unless borrowing was brought under control, the UK would face rising interest rates or worse. Yet, just days after Brexit, UK yields fell into negative territory. A reminder that the UK was not in danger of default or any of the worse predictions.

For me the focus on the budget deficit was misplaced – at least in the tentative quarters of recovering from the deepest recession on record. It would have been better economic policy to focus on a strong economic recovery and medium term stabilisation of debt to GDP ratio.

EU Referendum

Both George Osborne and David Cameron made the economic benefits of the EU as a central part of their strategy to stay in the EU. This analysis was supported by the vast majority of economists who agreed leaving EU would have both short-term and long-term costs. Yet, Osborne’s message didn’t always resonate with the voters. Perhaps because it was made in the wrong way.

For example, leaving EU will adversely affect the UK’s budget deficit – especially in the long-run. But, Osborne’s rather shrill threat to launch a ‘punishment budget’ after leaving the EU (a budget of tax rises and spending cuts) was seen as a low point of the Remain campaign, rather than help people understand the costs of leaving. This threat was seen as an over-reaction and largely dismissed. (See: Can you talk yourself into recession?)

It was also a reminder of how Osborne’s grasp of economics has always been uncertain. After the EU referendum, Osborne did a u-turn saying there would be no austerity budget after all, and came up with a proposed corporation tax cut, but by then it was too late and his reputation was damaged – even with his own party

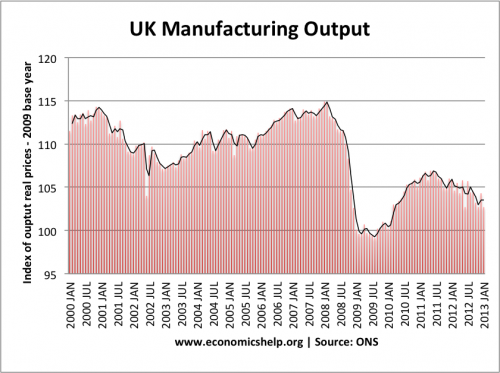

Balanced economy?

The economy is still unbalanced. This is shown by record current account deficit, low productivity growth and still a reliance on consumer spending.

Manufacturing output

Real wages

Only in the past year have we started to see real wage growth with nominal wages exceeding inflation. On the positive side, the rise in income tax threshold to over £10,000 is good news for those on low income earners. Also rise in minimum wage combined with falling unemployment is helpful.

But, on the other hand, the past decade has seen a rise in income and wealth inequality – fuelled by a more flexible labour market, rising house prices and weak wage growth for low income earners.

A smaller state?

Evaluation

To evaluate the economic record, we have to take into account difficult economic circumstances. In particular, did the government pursue the best policies given the current economic situation?

In this regard, economists will consider the 2010-16 as a missed opportunity. The chancellor appeared to place political rhetoric over understanding of economics on frequent occasions. The politics of balancing the budget, undoubtedly helped the Conservatives to win the 2010 election, but from an economic perspective the austerity of 2010-12 derailed the recovery and unnecessarily led to lost output.

However, on the positive side, the chancellor’s concern over public opinion did see him moderate his own austerity policies post 2012, and we saw some reversal in policy. There was a belated effort to increase public investment, and real public spending did rise. This enabled a modest economic recovery and fall in unemployment, but to many economists it left the feeling – we should and could have done better.

You could also argue, the UK economy could have been a lot worse. For example, if we look over the channel to the Eurozone, where unemployment is nearly double. But, doing better than the deflationary bias of the Eurozone is – damning with feint praise.

Other quick points

- Creation of OBR – widely regarded as a good achievement.

- Sugar tax – a good economic policy for dealing with the externalities of excess sugar consumption. A rare sign of innovation.

- Environment – very little positive change, e.g. freezing fuel duty was politically popular but a missed opportunity to help congestion and environmental issues.

Related