Inflation is generally controlled by the Central Bank and/or the government. The main policy used is monetary policy (changing interest rates). However, in theory, there are a variety of tools to control inflation including:

- Monetary policy – Higher interest rates reduce demand in the economy, leading to lower economic growth and lower inflation.

- Control of money supply – Monetarists argue there is a close link between the money supply and inflation, therefore controlling money supply can control inflation.

- Supply-side policies – policies to increase the competitiveness and efficiency of the economy, putting downward pressure on long-term costs.

- Fiscal policy – a higher rate of income tax could reduce spending, demand and inflationary pressures.

- Wage/price controls – trying to control wages and prices could, in theory, help to reduce inflationary pressures. However, they are rarely used because they are not usually effective.

Video

Monetary Policy

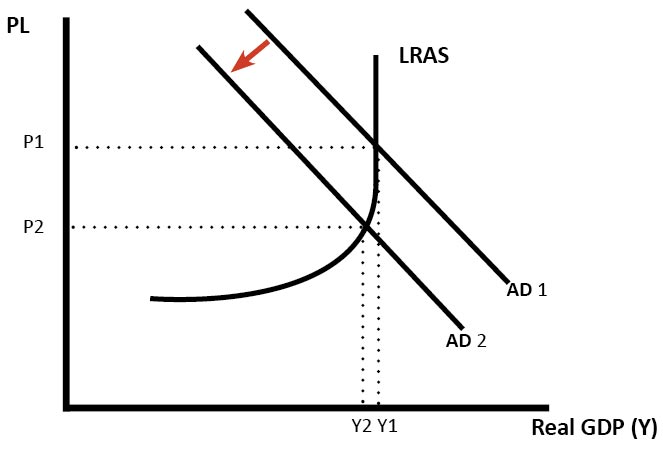

In a period of rapid economic growth, demand in the economy could be growing faster than its capacity to meet it. This leads to inflationary pressures as firms respond to shortages by putting up the price. We can term this demand-pull inflation.

In response to inflation, the Central bank could increase interest rates.

- Higher interest rates rates make borrowing more expensive and saving more attractive.

- Homeowners will have to pay increase mortgage payments, leading to less disposable income to spend.

- Therefore households will have less ability and incentive to spend

- Also firms will be detered from borrowing to fund investment, leading to lower business investment.

- Therefore, higher interest rates are quite effective in slowing down consumer spending and investment, leading to a lower rate of economic growth. And as economic growth slows down, so does inflation.

A higher interest rate should also lead to a higher exchange rate (higher interest rate attracts hot money flows) The appreciation in the exchange rate will also reduce inflationary pressure by:

- Making imports cheaper. (There will be lower price of imported goods, such as petrol and raw materials)

- Reducing demand for exports and therefore lower total demand in the economy.

- Because exports are less competitive, exporting firms will have an incentive to cut costs and improve competitiveness over time.

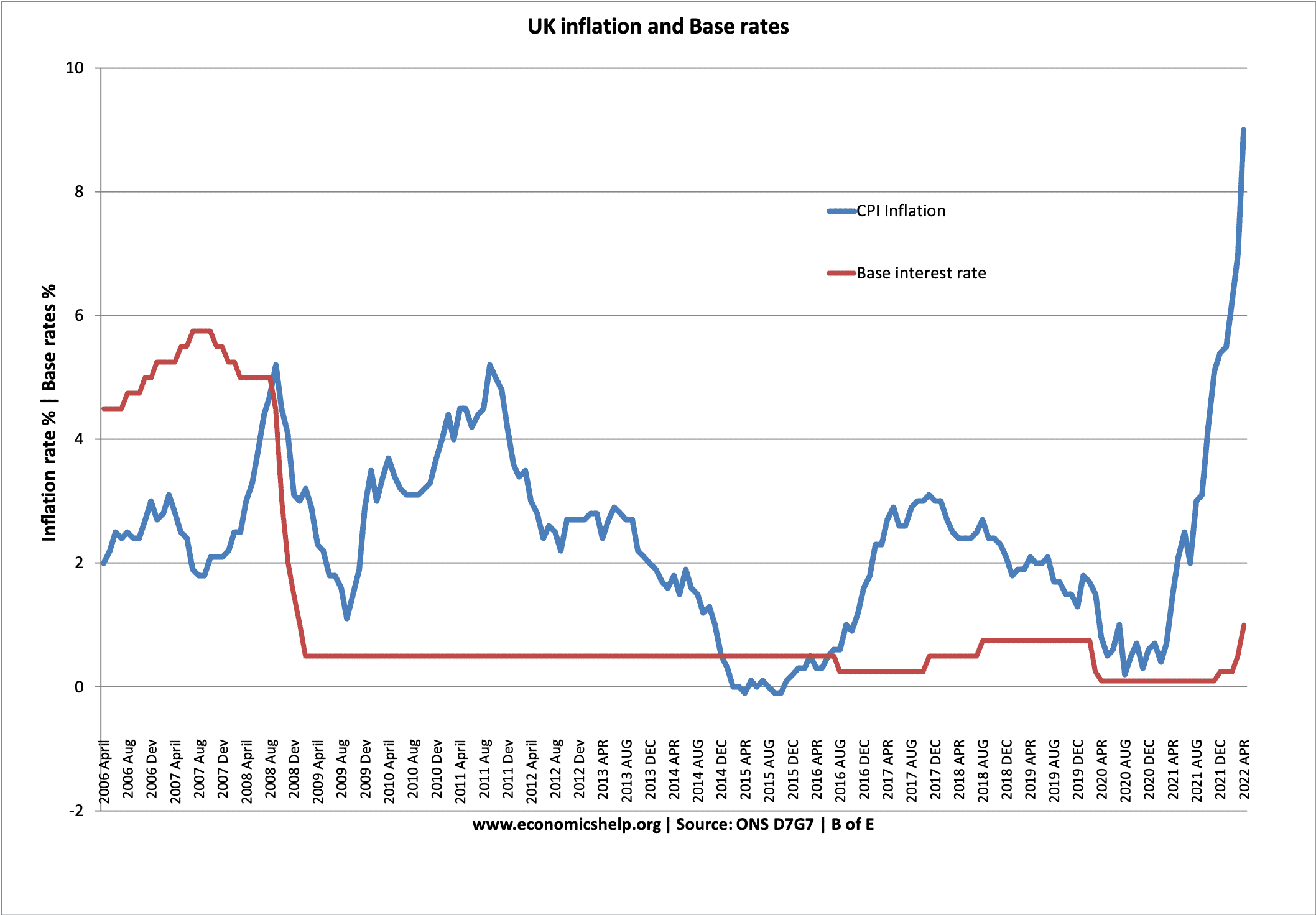

UK Inflation and interest rates

Interest rates were increased in 2022 to deal with the surge in inflation. However, the increase in interest rates is relatively low compared to the size of the inflation. This is because the Bank of England hope the inflation will prove temporary.

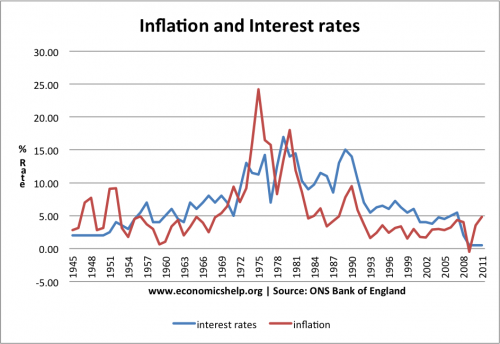

Inflation and interest rates post-war

If we look at inflation and interest rates in the post-war period, we can see interest rates rose to 15% in 1990 to deal with inflation of 10%.

If we look at inflation and interest rates in the post-war period, we can see interest rates rose to 15% in 1990 to deal with inflation of 10%.

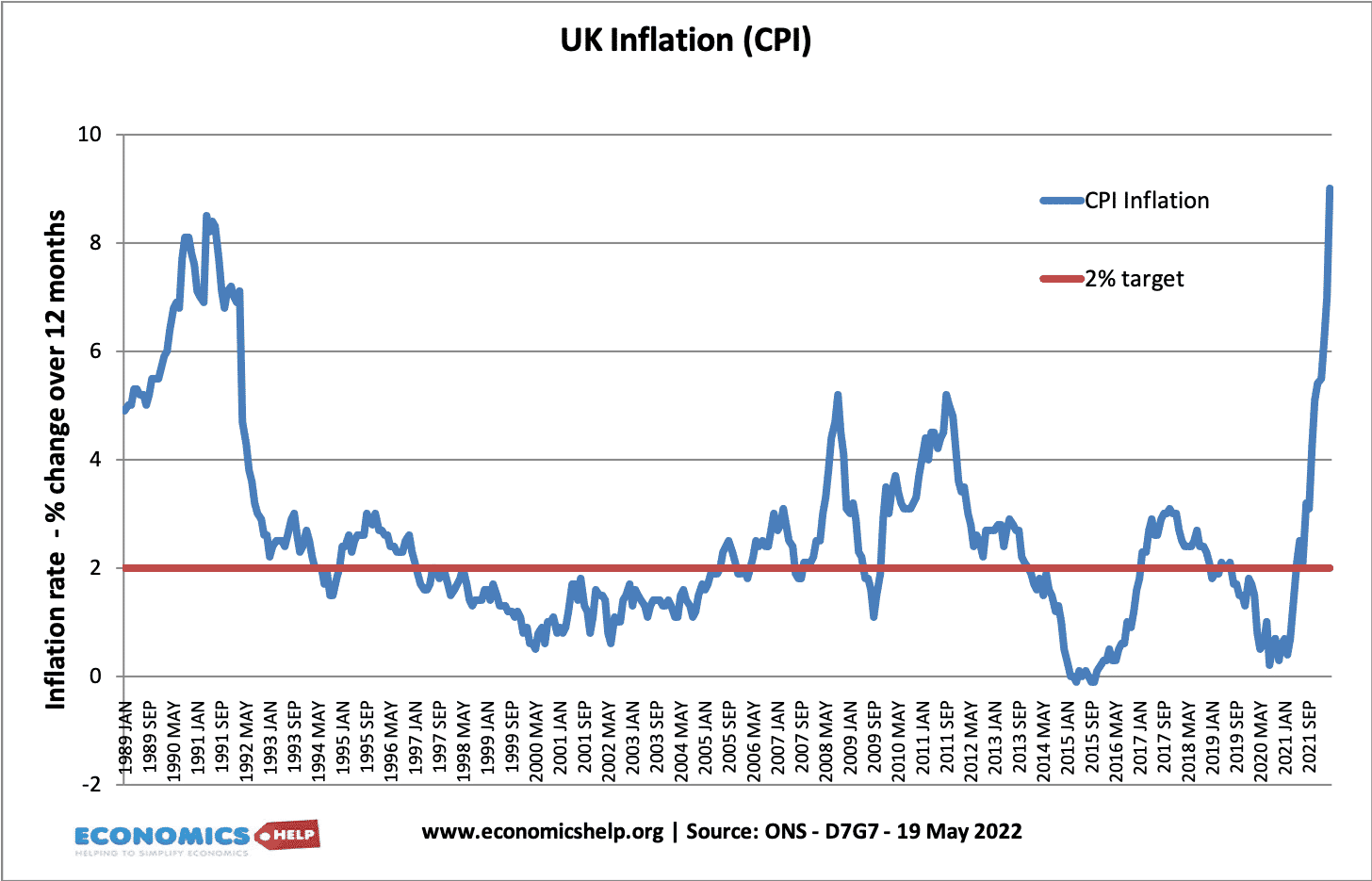

Inflation target

As part of monetary policy, many countries have an inflation target (e.g. UK inflation target of 2%, +/-1). The argument is that if people believe the inflation target is credible, then it will help to lower inflation expectations. If inflation expectations are low, it becomes easier to control inflation.

Countries have also made Central Bank independent in setting monetary policy. The argument is that an independent Central Bank will be free from political pressures and avoid making mistakes like cutting interest rates before an election to curry favour with voters.

Fiscal Policy

To reduce inflation, the government can increase taxes (such as income tax and VAT) and cut spending. This improves the government’s budget situation and helps to reduce demand in the economy.

Both these policies reduce inflation by reducing the growth of aggregate demand. If economic growth is rapid, reducing the growth of AD can reduce inflationary pressures without causing a recession.

Also increasing taxes to reduce inflation is likely to be politically unpopular which is why fiscal policy is rarely used to reduce inflation.

Other Policies to Reduce Inflation

1. Reduce expectations

A key determinant of inflation over time is inflation expectations. If people expect inflation next year, firms will put up prices and workers will demand higher wages. This expectation tends to cause higher inflation. If the Central Bank and government can effectively reduce expectations by making credible threats to bring inflation under control, this will make their job easier.

2. Price controls

With inflation, we will see firms trying to increase prices as much as they can to maintain profitability and deal with rising costs. One way to try to avoid this ‘profit-push’ inflation is to introduce price controls. This is where the government sets limits on price increases.

For example, in 1971 President Nixon imposed a price freeze that he reintroduced in 1973 after winning the election. The price freezes were politically popular for a short time but basically failed. Firms restricted supply and when price freezes ended, suppressed inflation returned with a vengeance. However, it is worth noting that price controls during wartime were successful in reducing inflation. One study by Paul Evans found in WWII price controls were successful in keeping prices 30% lower than otherwise. (though this was with rationing and 7% lower output).

3. Wage Control

If inflation is caused by wage inflation (e.g. powerful unions bargaining for higher real wages), then limiting wage growth can help to moderate inflation. Lower wage growth will reduce the costs for firms and lead to less excess demand in the economy.

However, as the UK discovered in the 1970s, it can be difficult to control inflation through income policies, especially if the unions are powerful. Also, wage control requires widespread co-operation in the economy, but if firms are facing labour shortages they will be more concerned to get the workers, even if they have to exceed government wage controls.

4. Monetarism

Monetarism seeks to control inflation by controlling the money supply. Monetarists believe there is a strong link between the money supply and inflation. If you can control the growth of the money supply, then you should be able to bring inflation under control. Monetarists would stress policies such as:

- Higher interest rates (tightening monetary policy)

- Reducing budget deficit (deflationary fiscal policy)

- Control of money being created by the government

However, in practice, the link between money supply and inflation is less strong.

5. Supply-Side Policies

Often inflation is caused by persistent uncompetitiveness and rising costs. Supply-side policies may enable the economy to become more competitive and help to moderate inflationary pressures. For example, more flexible labour markets may help reduce inflationary pressure.

However, supply-side policies can take a long time, and cannot deal with inflation caused by rising demand.

6. Exchange rate policy

A country may seek to keep inflation low by joining a fixed exchange rate mechanism. The argument is that if the value of a currency is fixed (or semi-fixed) then this creates a discipline to keep inflation low. If inflation rises, the currency would become uncompetitive and start to fall. In the late 1980s, the UK joined the European Exchange Rate Mechanism (ERM) partly to bring inflation under control. However, targetting inflation through the exchange rate can is difficult and the UK was forced to leave the ERM in 1992.

6. Ways to Reduce Hyperinflation – change currency

In a period of hyperinflation, conventional policies may be unsuitable. Expectations of future inflation may be hard to change. When people have lost confidence in a currency, it may be necessary to introduce a new currency or use another like the dollar (e.g. Zimbabwe hyperinflation).

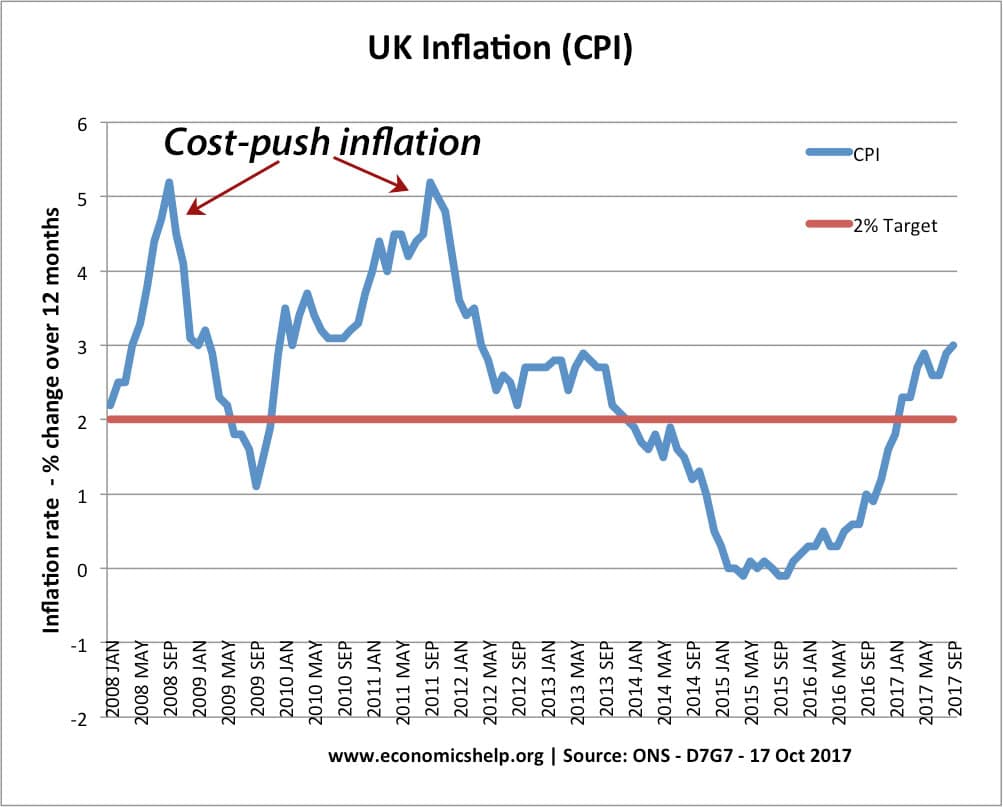

Ways to reduce Cost-Push Inflation

Cost-push inflation (e.g. due to rising oil prices) can lead to inflation and lower growth. This is the worst of both worlds and is more difficult to control without leading to lower growth. In 2022 the world saw a rise in cost-push inflation due to rising energy prices and the end of Covid lockdown causing supply shortages.

Cost-push inflation is more difficult to reduce because it is fundamentally caused by supply problems. Raising interest rates is a blunt tool and likely to cause unacceptably lower growth. This is why Central Banks tend to tolerate a higher rate of cost-push inflation and hope it is short-lived. In the long-term we can try and tackle the supply issues, such as more flexible labour markets, stock-piling oil reserves to deal with crises and policies to increase competitiveness.

Further reading

It is very helpful. Keep it up thank you very much

grtly explaind thanks kp up the gd work

i am doing a national diploma in human resources management and i have found this information to be very useful. please send me more information on my email

thank you

very helpfull please send me any more information about how to reduce inflation

thank you.

i do really appreaciate ur effort. i have just been able to do my assignment from here. pls keep it up.

Thanx for ur very useful materials. I done my assignment well. KEEP IT UP!!

This was really helpful I wouldn’t mind more

that is very useful info.

Thankyou man very helpful indeed.

this iz good learning mateerial , greatly appreciated

Helpful done my assignment well but nid mo info

this is very helpful thanks a lot!!!

Thanx for giving me the information about controlling measures. It is really helpful. However, kindly suggest me that which of measure is most important in all of these.

there are two ways to reduce inflation which are fiscal policy and monetary policy …monetary policy is done by the govenor e.g in zimbabwe it is done by the govenor of the reserve bank of zimbabwe , whilst on the other hand fiscal policy is implemrnted by the government…..thats what i have for you guyz

The government can stop inflation by reducing the consumer expenditure component of GDP by increasing taxes or by reducing transfer payments