Why Denmark is rich despite high taxes?

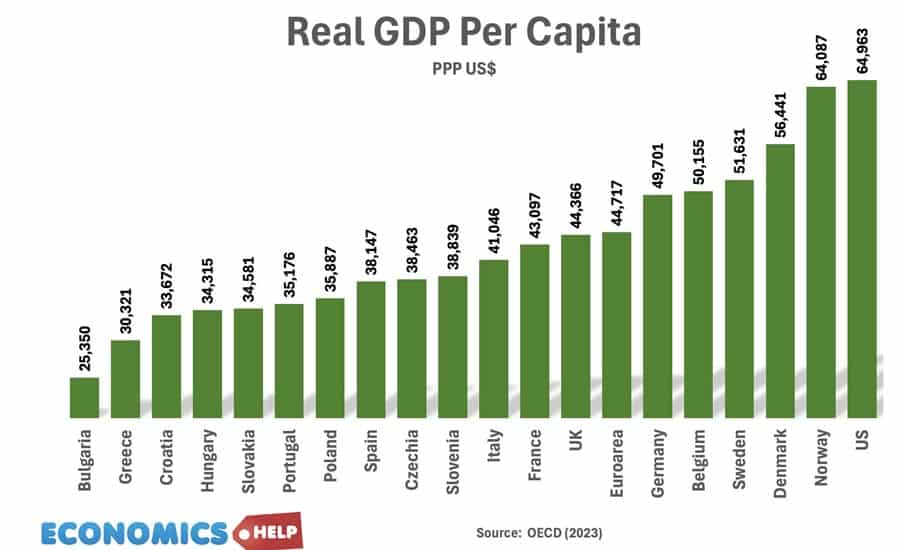

Denmark is an economic powerhouse with a GDP per capita higher than Germany, Netherlands and the UK. It is one of the richest countries in the world, but remarkably unlike Norway has no particular oil riches. Also, it has achieved its wealth despite having one of the highest tax rates in the world. What is …