The UK economy in 2016 is emerging from a long period of economic stagnation and the recession of 2008-12, and has some positive signals of growth, low inflation and falling unemployment.

However, the UK chancellor has been giving mixed signals. On the one hand he has pointed out that UK has one of the strongest rates of economic growth in the developed world. On the other hand, he is also keen to lower expectations pointing to the many potential pitfalls to future economic growth.

Summary of UK economy in 2016

- Positive economic growth for past couple of years, with low inflation (0.1%) and falling unemployment (5.3%)

- However, economic recovery is still fragile, with growth helped by low interest rates of 0.5%, and a fall in the savings ratio.

- UK economy has outperformed (marginally) some of our European neighbours, but this has contributed to current account deficit and fears weak growth in Europe may curtail the UK economic recovery.

- Although the budget deficit has fallen from crisis peak of 10% of GDP, the chancellor has indicated he still wishes to reduce deficit further. This will entail continued strictness in government spending.

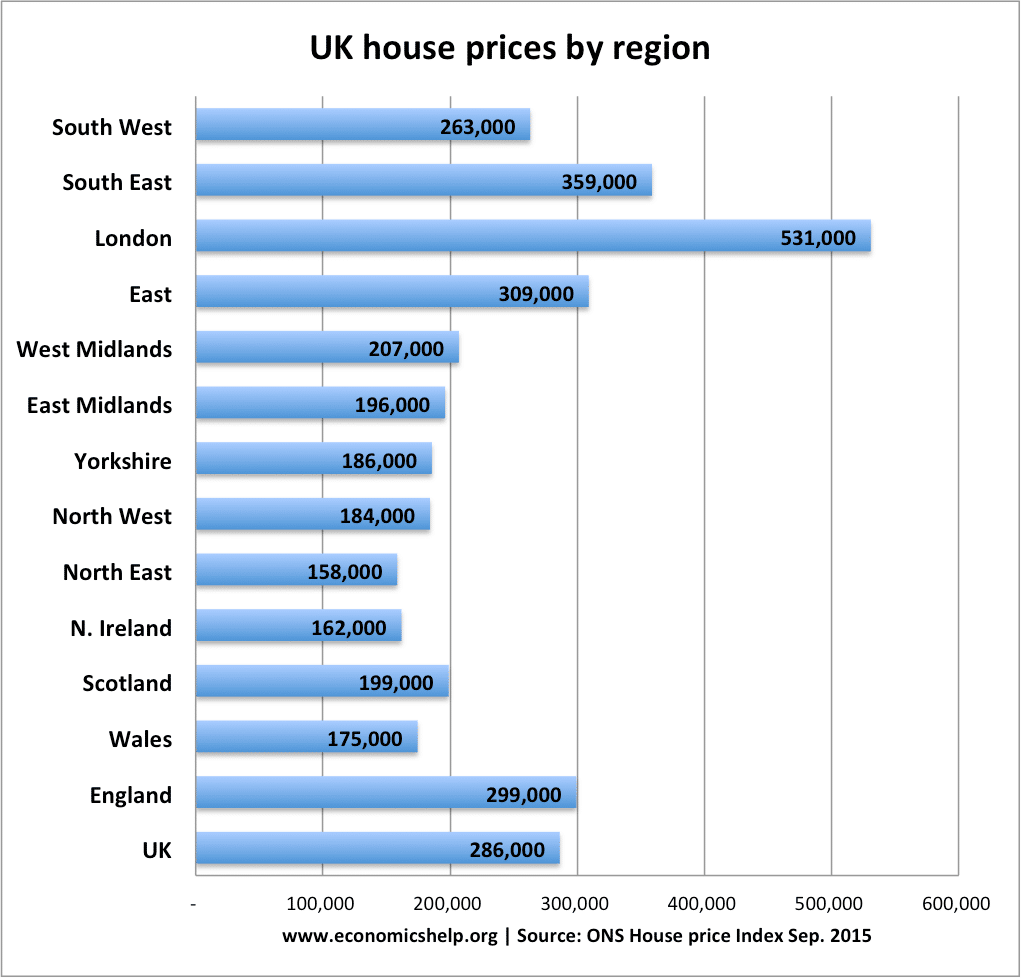

- There are signs the UK economy is unbalanced with rapid rises in house prices increasing wealth inequality and creating problems for those who cannot afford to buy.

Problems facing UK economy in 2016

- Weak growth in major trading partners – Europe and Asia, could lead to lower exports.

- Years of negative real wage growth have led to higher personal debt levels and lower saving ratios.

- Continued squeeze in government spending as government seeks to reduce budget deficit.

- Fall in oil prices could cause problems for oil industry and banks who have lent credit for investment

- Headline inflation close to actual deflation, which could cause low growth.

- UK is still reliant on services and consumer spending. Growth in manufacturing, construction and export sector much weaker.

- Interest rate dilemma. Some would like to see interest rates rise, but it will have big impact on discretionary income of many homeowners and consumers.

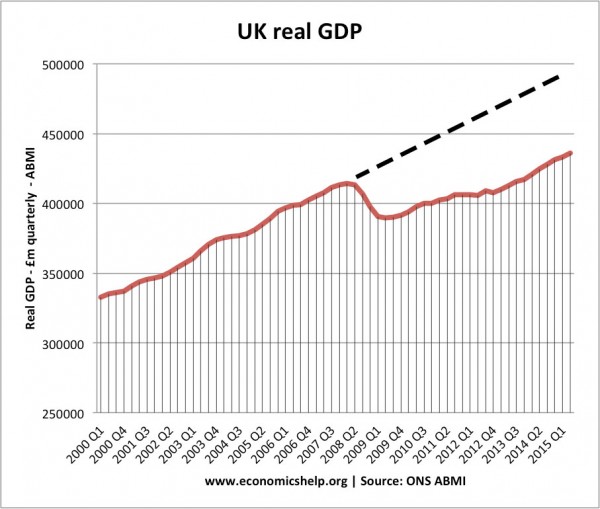

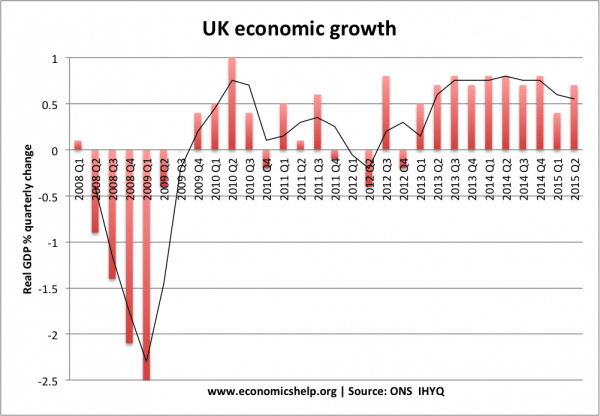

UK economic growth

Economic growth in 2015 Q3, 0.5%

- In recent quarters, economic growth has been fairly consistent at around 0.5-0.7%; this is close to the UK’s long run trend rate of economic growth, and usually would be a very good sign. However, the economy is still trying to catch up from the lost output during the great recession.

- The concern with economic growth is how sustainable it will be in 2016 and 2017? A slowdown in Europe and Asia could easily reduce confidence. Also, a rise in interest rates would hit consumers who have relatively high levels of debt and have become accustomed to low rates.

- Economic growth has been boosted by population growth; economic growth per capita is less impressive.

- Economic growth stats

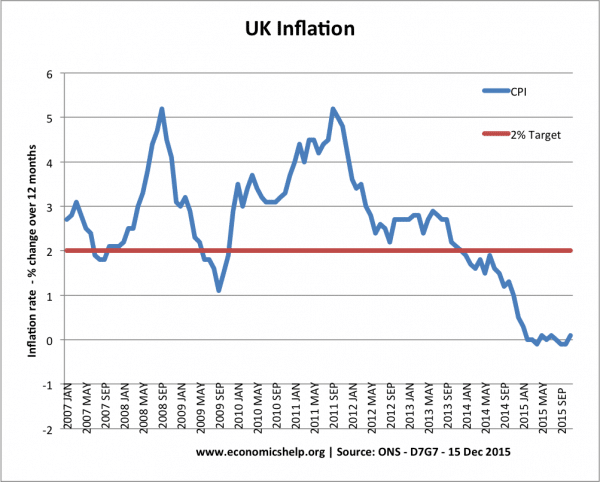

Inflation

A difficulty during the early parts of the great recession was that inflation well above the governments target of 2%. However, since 2014, headline CPI inflation has fallen below the government’s target and in recent months has been close to zero. This has been helped by falling oil prices and other commodities, but also is a reflection of the relatively weak demand and downward pressure on wages.

The recent rise in real wages may enable inflation to creep back towards the target. But, with inflation still perilously close to deflation, the Bank of England will be reluctant to raise interest rates – indicating how far from normality the UK economy still is.