Interesting post by David Blanchflower about the best form of economic stimulus – Here’s a way to end the slump (Useful for any economic student wishing to understand marginal propensity to consume – mpc)

A fiscal stimulus could involve a tax cut or government spending increase. This should increase overall aggregate demand, and boost economic growth.

A monetary stimulus could involve interest rate cut or policy of quantitative easing.

But, if we decide to pursue fiscal stimulus – How do we make sure this has the biggest effect on increasing overall aggregate demand? Who is the best group of people to give it to?

For example, If you cut the higher rate of marginal income tax 50p to 40p for incomes over £100,000 – then this tax cuts is most likely to be saved. This is because people with salaries of over £100,000 are not in great need of buying essential items. They probably have most items they need. If they gain an extra increase in income, a large proportion will just be saved. They may buy one or two extra luxuries, but comparatively, they will have a low marginal propensity to consume. Therefore, the effect of the fiscal stimulus will be largely dissipated. You could argue that a low income tax may have a supply side incentive, but at 50%, it is debatable how significant this will be.

If you cut capital gains tax, it would benefit a relatively small percentage of wealthy firms and individuals. Again, you would expect a relatively low marginal propensity to consume. There may be some extra investment. But, in the current climate, you would expect business to be risk-averse. It’s hard to see businessmen rushing to invest because of lower capital gains tax.

Quantitative easing is a form of monetary policy which has given extra cash reserves to banks. Yet, this has had a very limited stimulus effect. Basically, banks have been saying thanks very much for the cash, we will use it to improve our bank reserves, but not to engage in a risky investment.

What about if we gave it to those on a very low income. For example, low paid workers, who have seen a 10% real pay decrease in the past few years? or increase unemployment benefits? Here, you would expect a higher marginal propensity to consume. The problem is that increasing benefits to the unemployed is not going to gain you too much political kudos.

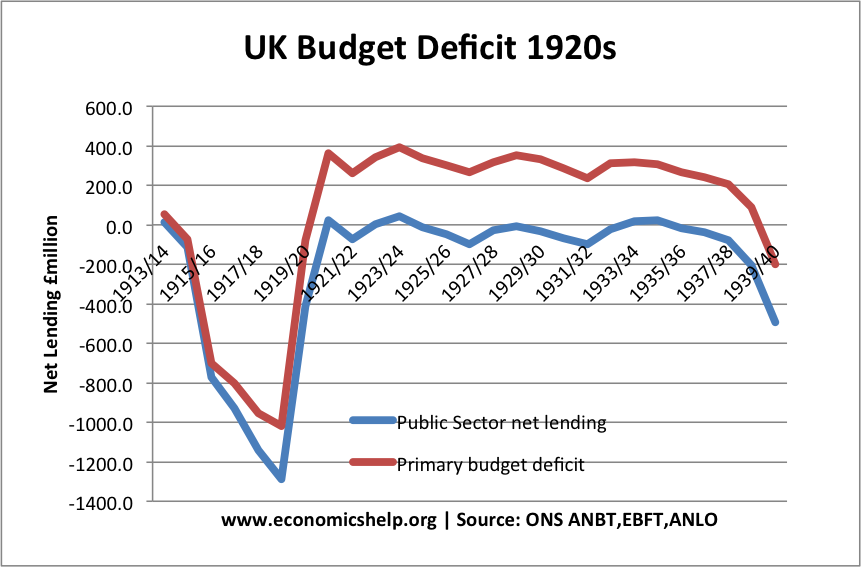

In 1936, the US government gave a stimulus to a group of low-income people – military veterans from the First World War. The US Congress authorised $1.8bn to 3.2 million war veterans (2.1% of GDP) = (to put stimulus into perspective – 2.1% of GDP is equal to £30bn in UK). The money was financed from a bigger government deficit.

Joshua Hausman from UC Berkeley argues that the bonus added 2.5 to 3 percentage points to 1936 GDP growth and lowered the unemployment rate by 1.3 to 1.5 percentage points. Contemporary newspaper accounts reported that veterans were keen to spend this extra money. Many used the $550 + payment to buy their first-ever car. Fortunately, the price of the cheapest Ford car was $500.